HRA Form for Salaried Employees

“HRA” typically refers to “House Rent Allowance,” which is a component of salary provided by employers to employees to meet their rental expenses. It is governed by specific rules and regulations set forth by tax authorities in different countries. While I can provide a general guideline on how to fill up an HRA form, please note that specific instructions may vary depending on your location and the form provided by your employer or tax authorities.

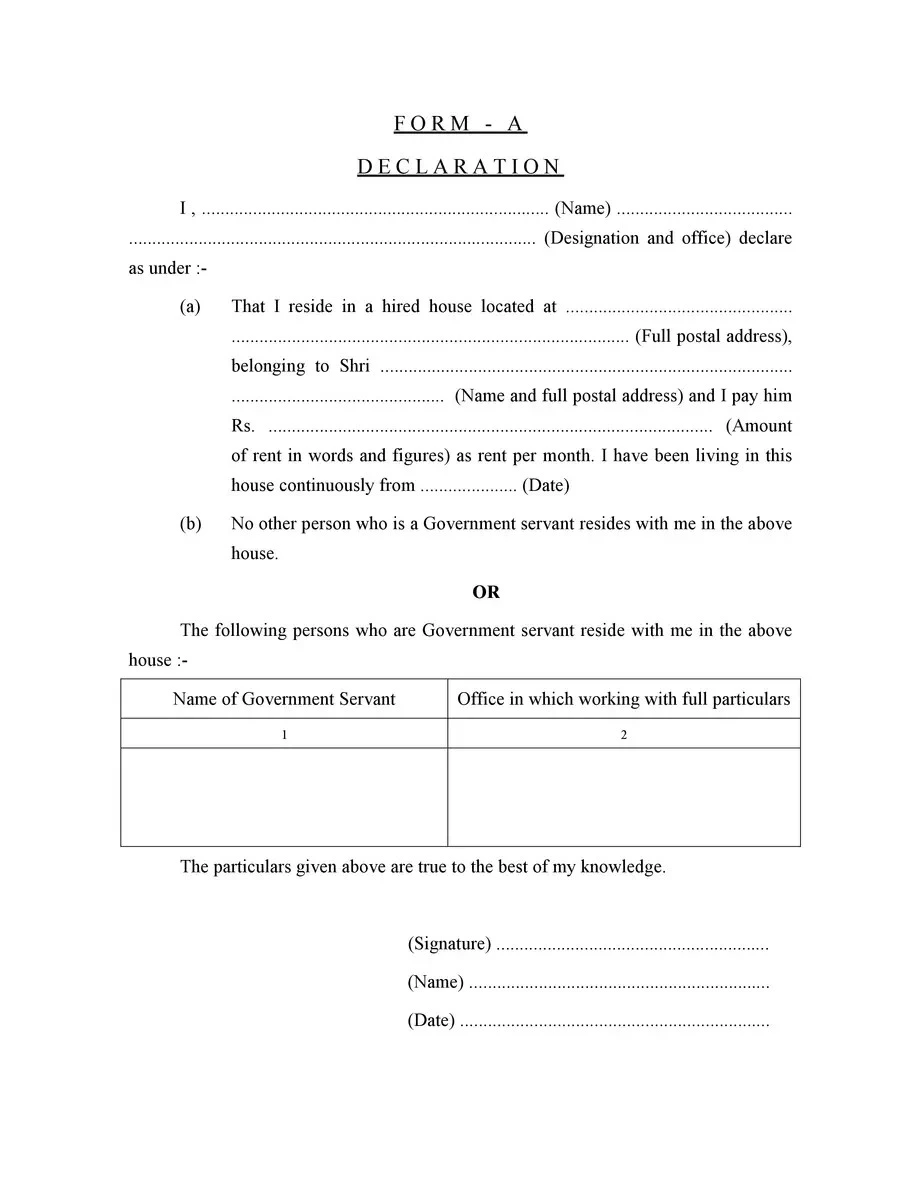

How to Fill UP HRA Declaration Form

- Personal Information: Start by filling in your personal information, including your name, address, employee ID, and other relevant details as required.

- Employment Details: Provide details about your employment, such as your designation, department, joining date, etc.

- HRA Component: Indicate the amount of House Rent Allowance you’re entitled to receive as per your employment contract or as specified by your employer.

- Rental Details: If required, you may need to provide details about your rental accommodation. This may include the address of your rented property, the monthly rent amount, the landlord’s name, and their contact information.

- Declaration and Signature: Read through the declaration carefully and sign the form where indicated. This is usually to certify that the information provided is accurate and complete to the best of your knowledge.

- Attach Supporting Documents: Depending on the requirements, you may need to attach supporting documents such as a rent agreement, rent receipts, or any other documents requested by your employer or tax authorities.

- Submission: Once you’ve completed the form and attached the necessary documents, submit it to the relevant department in your organization or to the designated authority as per the instructions provided.

HRA Exemption Rule in India

Exemption under Section 10(13A): In some countries like India, there are specific provisions under the tax laws (such as Section 10(13A) of the Income Tax Act) that provide for exemption of a portion of the HRA received from tax. The exemption is usually the least of the following:

- Actual HRA received from the employer.

- 50% of salary (basic salary + dearness allowance if applicable) for employees residing in metro cities or 40% of salary for those residing in non-metro cities.

- Actual rent paid minus 10% of salary.