Tax Audit Due Date Extension Notification 2024

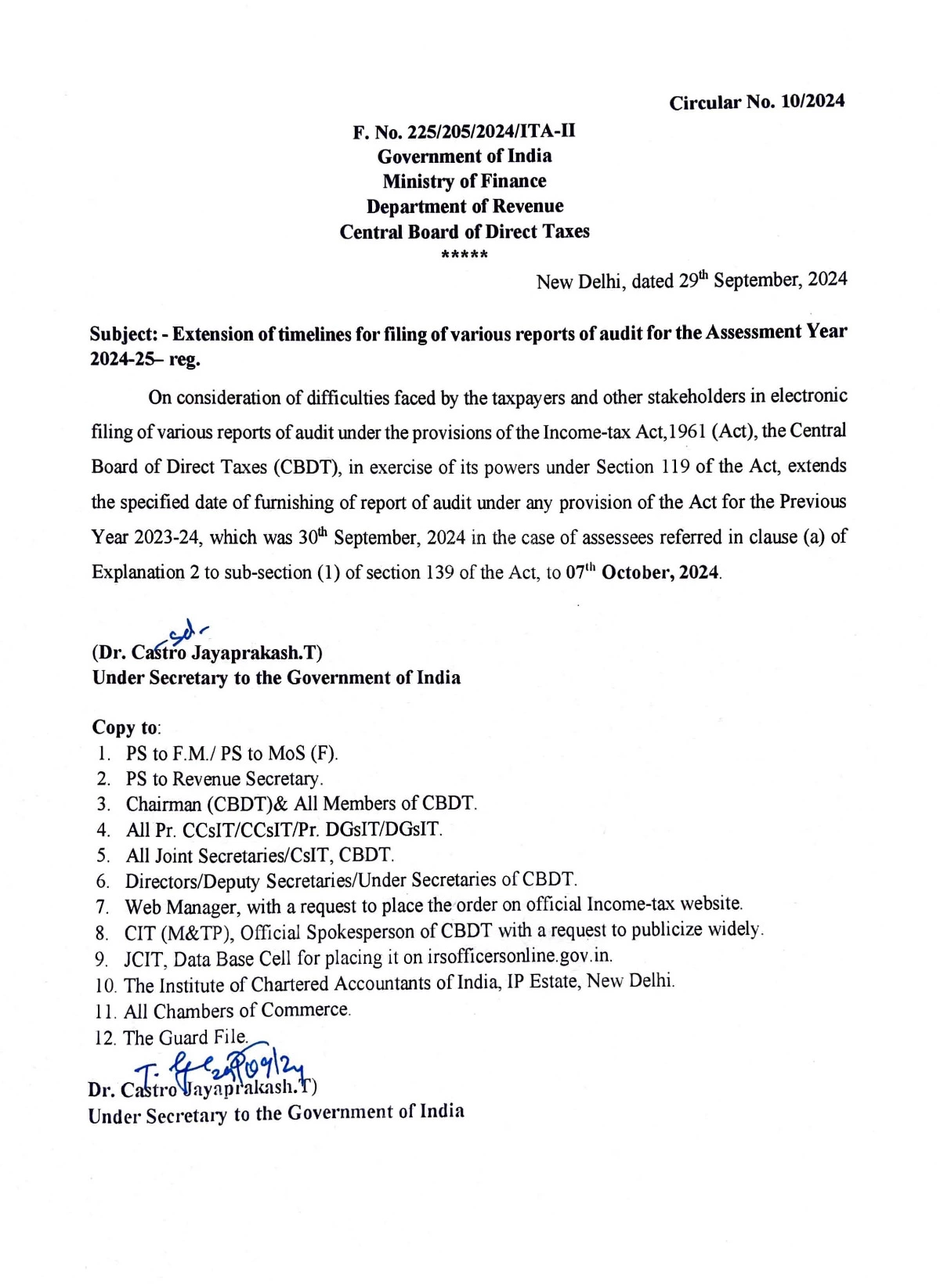

The Central Board of Direct Taxes (CBDT) has extended the due date for filing various reports of audit including Tax Audit for the Previous Year 2023-24. The last date for filling the audit report was September 30.

The government has officially extended the Tax Audit Due Date for the financial year 2023-24, providing much-needed relief for taxpayers and businesses. If you’ve been struggling to complete your tax audit process, this extension will give you more time to ensure accuracy and compliance.

📝 New Due Date for Tax Audit:

- Original Due Date: September 30, 2024

- Extended Due Date: [October 7th, 2024]

⚠️ Who Does This Apply To?:

- Businesses and professionals whose total turnover exceeds the prescribed limit under the Income Tax Act.

- Individuals and companies required to get their accounts audited under Section 44AB.

🔑 Key Reasons for Extension:

- Pandemic recovery and business disruptions

- Compliance issues raised by taxpayers and auditors

- System upgrades and technical difficulties on government portals

🛠️ What Should You Do Now?:

- Take Advantage of the Extra Time: Complete the audit and filing process accurately without rushing.

- Consult Your Auditor: Stay in close touch with your tax auditor or consultant to ensure all paperwork is in order.

- File Early to Avoid Last-Minute Glitches: Though the deadline is extended, it’s advisable to file well in advance to avoid system overload or technical issues.