Revenue Law Book Kannada

Revenue Law Book refers to a concise summary or analysis of a legal textbook or case law. The process of creating a brief involves extracting key information, arguments, and principles from the original text.

The Karnataka Law Book Kannada

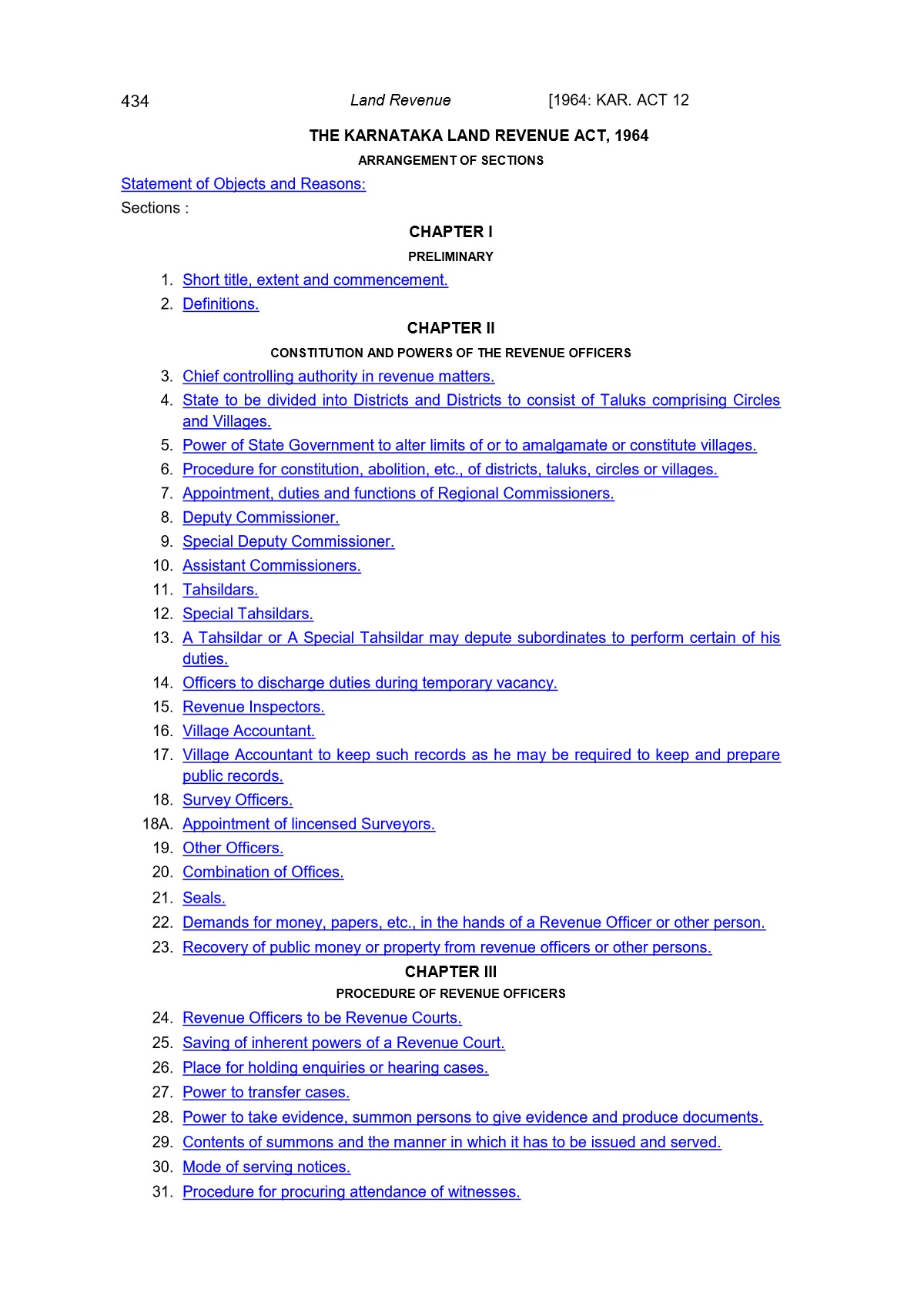

CHAPTER I

PRELIMINARY

1. Short title, extent and commencement.

2. Definitions.

CHAPTER II

CONSTITUTION AND POWERS OF THE REVENUE OFFICERS

3. Chief controlling authority in revenue matters.

4. State to be divided into Districts and Districts to consist of Taluks comprising Circles and Villages.

5. Power of State Government to alter limits of or to amalgamate or constitute villages.

6. Procedure for constitution, abolition, etc., of districts, taluks, circles or villages.

7. Appointment, duties and functions of Regional Commissioners.

8. Deputy Commissioner.

9. Special Deputy Commissioner.

10. Assistant Commissioners.

11. Tahsildars.

12. Special Tahsildars.

13. A Tahsildar or A Special Tahsildar may depute subordinates to perform certain of his duties.

14. Officers to discharge duties during temporary vacancy.

15. Revenue Inspectors.

16. Village Accountant.

17. Village Accountant to keep such records as he may be required to keep and prepare public records.

18. Survey Officers.

18A. Appointment of lincensed Surveyors.

19. Other Officers.

20. Combination of Offices.

21. Seals.

22. Demands for money, papers, etc., in the hands of a Revenue Officer or other person.

23. Recovery of public money or property from revenue officers or other persons.

CHAPTER III

PROCEDURE OF REVENUE OFFICERS

24. Revenue Officers to be Revenue Courts.

25. Saving of inherent powers of a Revenue Court.

26. Place for holding enquiries or hearing cases.

27. Power to transfer cases.

28. Power to take evidence, summon persons to give evidence and produce documents.

29. Contents of summons and the manner in which it has to be issued and served.

30. Mode of serving notices.

31. Procedure for procuring attendance of witnesses.

32. Compelling attendance of witnesses and examination of witnesses on commission.

33. Formal inquiry.

34. Summary inquiry.

35. Formal and summary inquiry to be deemed judicial proceedings.

36. Hearing and decisions to be in public and after notice.

37. Inquiries other than formal or summary.

38. Power to enter upon any lands or premises for the purposes of measurements, etc.

39. Manner of evicting any person wrongfully in possession of land.

CHAPTER IV

CONSTITUTION AND POWERS OF THE KARNATAKA REVENUE APPELLATE TRIBUNAL

40. Constitution of the Revenue Appellate Tribunal.

41. Conduct of business of the Tribunal.

42. Sittings of the Tribunal.

43. Powers of the Tribunal.

44. Powers of review.

45. Finality of the orders of the Tribunal.

46. Powers of the Tribunal to call for returns, etc.

47. Proceedings of Tribunal to be judicial proceedings.

48. Power to make regulations.

CHAPTER V

APPEAL AND REVISION

49. Appeals from original orders.

50. Second Appeal.

51. Limitation of Appeals.

52. Application of the Limitation Act.

53. Copy of the order to accompany petition of appeal.

54. Powers of appellate authority.

55. Stay of execution of orders.

56. Power of Revision.

57. Orders expressly made final under the act.

58. Amendment of orders.

59. Orders not reversible by reason of error or irregularity not occasioning failure of justice.

CHAPTER VI.

REVENUE JURISDICTION.

60. Definitions.

61. Exclusive Jurisdiction of Revenue Courts and bar of Jurisdiction of Civil Courts.

62. Savings of certain suits.

63. Plaintiff to exhaust his right of appeal before instituting a suit or other proceeding against Government.

64. Power of Tribunal to refer questions for decision of High Court.

65. Power of Civil Court to refer questions of jurisdiction to High Court.

66. Composition of Bench.

CHAPTER VII.

LAND AND LAND REVENUE.

Land.

67. Public roads, etc., and all lands which are not the property of others belong to the Government.

68. Extinction of rights of public and individuals in or over any public road, street, lane or path not required for use of public.

69. Disposal of lands or other property belonging to State Government under section 67.

69A. Disposal of lands or other property belonging to the Sate Government.

70. Right to mines and mineral products to vest in Government.

71. Lands may be assigned for special purposes and when assigned, shall not be otherwise used without sanction of the Deputy Commissioner.

72. Regulation of use of pasturage.

73. Recovery of value of natural product unauthorisedly removed from certain lands.

74. Right to trees in villages to which survey settlement has not been introduced.

75. Right to trees in villages, to which survey settlement has been introduced.

76. Trees and forests vesting in the Government.

77. Road-side trees.

78. Recovery of value of trees, etc., unauthorisedly appropriated.

79. Regulation of supply of firewood and timber for domestic or other purposes.

Land Revenue.

80. All land liable to pay land revenue, unless specially exempted.

81. Alluvial land and its liability to land revenue.

82. Remission of assessment in cases of diluvion.

83. Manner of assessment, commutation of non-agricultural assessment and prohibition of use of land for certain purposes.

84. Assessment by whom to be fixed.

85. Register of alienated lands.

86. Settlement of assessment with whom to be made.

87. Land Revenue to be a paramount charge on the land.

88. Forfeited holdings may be taken possession of and otherwise disposed.

89. Receipts.

90. Penalty for failure to grant receipts.

CHAPTER VIIA

CONSTRUCTION OF WATER THROUGH LAND OF ANOTHER

90A. Construction of water course through land belonging to other persons.

90B. Failure to pay rent and to keep water course in good repair.

90C. Removal or discontinuance of water course.

CHAPTER VIII

GRANT, USE AND RELINQUISHMENT OF UNALIENATED LAND.

91. Unoccupied land may be granted on conditions.

92. Grant of alluvial land vested in Government.

93. Permission for taking up unoccupied land.

94. Penalties for unauthorized occupation of land.

94A. Regularisation of certain cases of unauthorized occupation by constituting the committee, etc.

94B. Grant of land in certain cases.

94C. Grant of land in case of construction of dwelling house in occupied land.

94CC. Grant of Land in case of construction of dwelling house in occupied land in an urban area

94-D. Regularization and grant of land of dwelling house along with site thereof and land immediately appurtenant thereto built on Government land in unrecorded habitations

95. Uses of agricultural land and the procedure for use of agricultural land for another purpose.

96. Penalty for using agricultural land for another purpose without permission.

97. Diversion of non-agricultural land held for a specific purpose.

98. Permission may be granted on terms.

99. Rights of occupants.

100. Occupancy not transferable without the sanction of prescribed authority nor liable to process of a Civil Court.

101. Occupancy right transferable and heritable.

102. Relinquishment.

103. Right of way to relinquished or forfeit land or to land used for purpose of agriculture.

104. Summary eviction of person unauthorisedly occupying land.

105. To prevent forfeiture of occupancy certain persons other than occupant may pay land revenue.