NPS Form for Central Government Employees

The National Pension System (NPS) is based on a unique Permanent Retirement Account Number (PRAN) which is allotted to every subscriber. To encourage savings, the Government of India has made the scheme reassuring from a security point of view and has offered some attractive benefits. The scheme is portable across jobs and locations, with tax benefits under Section 80C and Section 80CCD.

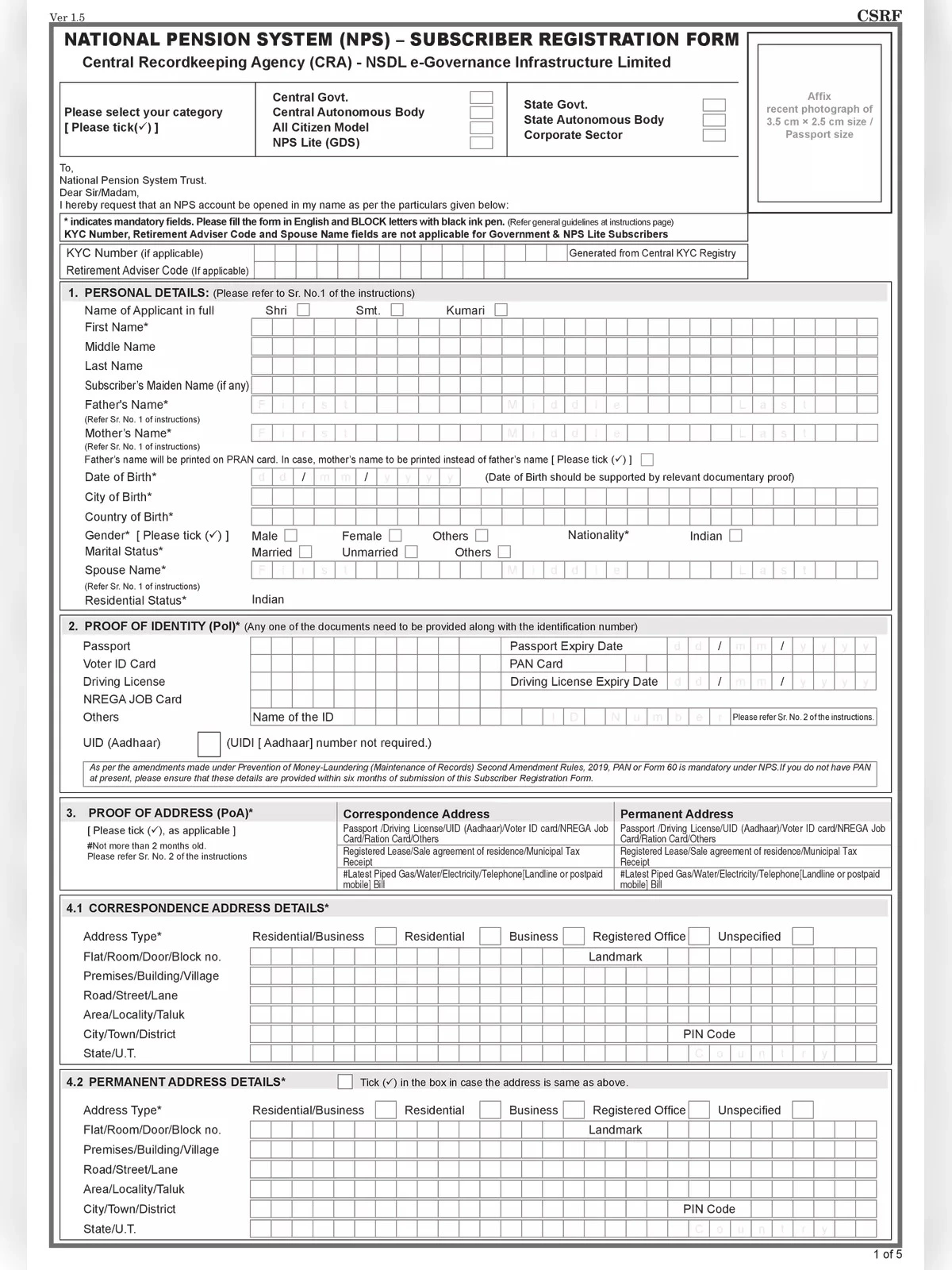

How to Fill NPS Form Online

- You can enroll for NPS by clicking on the ‘Apply Now’ option under NPS (National Pension System)

- You can choose any one CRA to open the account (K-Fin Technologies Private Limited or NSDL e-governance infrastructure LTD.).

- You will get the online form, which needs to be filled with mandatory fields.

- An acknowledgment ID for your registration (account opening) will be generated.

- Modes of KYC verification

- Pan-based – The Bank will verify KYC based on details maintained in your account with Bank.

- Offline Aadhaar .XML KYC – KYC details will be taken from the database of UIDAI.

- You need to share details like Bank details, scheme details, nominee details etc.

- You need to upload a photograph, specimen signature, cancelled cheque/bank statement / passbook copy and PAN copy as per file size permissible.

- You need to make initial contribution of min Rs. 500.

- You will be directed to online payment platform wherein you will complete the payment through HDFC Bank NetBanking or payment gateway.

- On successful payment, 12-digit PRAN will be allotted to you and PDF form will be generated based on the data given.

- PRAN will be communicated to you via registered email and SMS.

- E-Sign/OTP – You will have to complete an online e-sign or OTP-based confirmation once the registration process is completed. This is to avoid physical submission of the registration form.

Required Documents for NPS Form

- Application Form

- ID Proof

- Address Proof

- Passport Size Photograph

- And any other documents

NPS Accounts Types

The two primary account types under the NPS are tier I and tier II. The former is the default account while the latter is a voluntary addition. The table below explains the two account types in detail.

| Particulars | NPS Tier-I Account | NPS Tier-II Account |

| Status | Default | Voluntary |

| Withdrawals | Not Permitted | Permitted |

| Tax exemption | Up to Rs 2 lakh p.a.(Under 80C and 80CCD) | 1.5 lakh for government employees Other employees-None |

| Minimum NPS contribution | Rs 500 or Rs 500 or Rs 1,000 p.a. | Rs 250 |

| Maximum NPS contribution | No limit | No limit |

NPS Withdrawal Rules After 60

Contrary to common belief, you cannot withdraw the entire corpus of the NPS scheme after your retirement. You are compulsorily required to keep aside at least 40% of the corpus to receive a regular pension from a PFRDA-registered insurance firm. The remaining 60% is tax-free now.