Mandate Form for Individuals

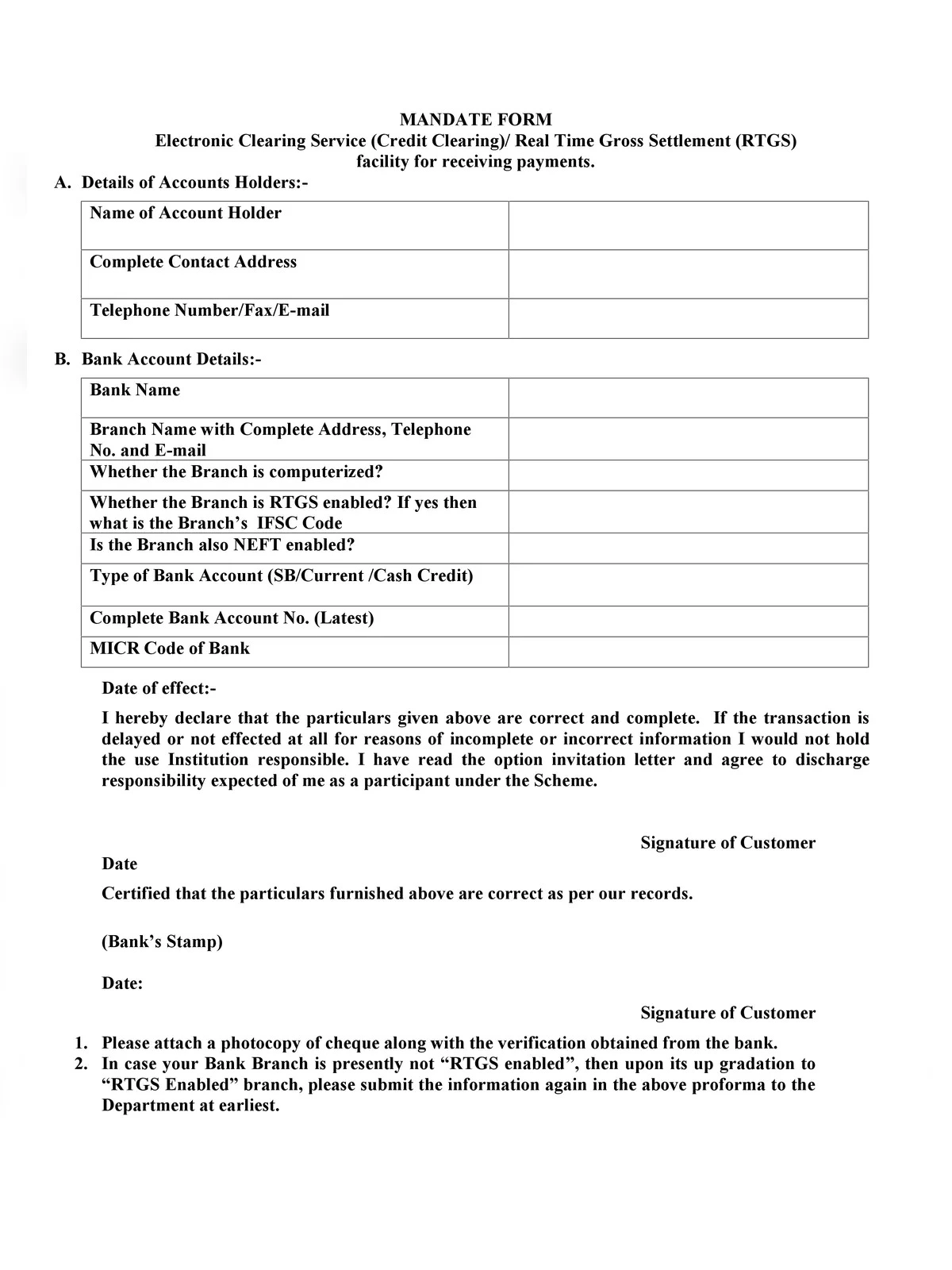

Mandate Form PDF is essential for using the Electronic Clearing Service (Credit Clearing)/RTGS facility to receive payments smoothly. Under the Systematic Investment Plan (SIP) arrangement, a specific amount is regularly invested in mutual fund schemes on set due dates. To ensure that this investment is automatically deducted from your linked savings account, you must authorize your bank. Thus, issuing a bank mandate becomes necessary to enable your bank to start the SIP payments.

Understanding the Mandate Form

A bank mandate allows a third party to debit a specific amount from your bank account at regular intervals. By submitting a mandate form, you give permission to your bank to conduct an auto-debit transaction. This process draws a certain amount from your savings account on predetermined dates. The withdrawn funds are then invested through SIPs into your selected mutual fund schemes. Therefore, bank mandates make investing easy, paperless, and super convenient!

Mandate Form – Details to be Mentioned

- Account Holder Details

- Complete Address

- Mobile Number and Email ID

- Bank Account Details

- Branch Name and Address

- Bank Account Number

- IFSC Code

- Type of Accounts

- And any other details

Documents Required for Mandate Form

- Mandate Application Form

- Account Information Form

- Canceled Cheque

- And any other documents

You can download the Mandate Form in PDF format using the link given below. 📥