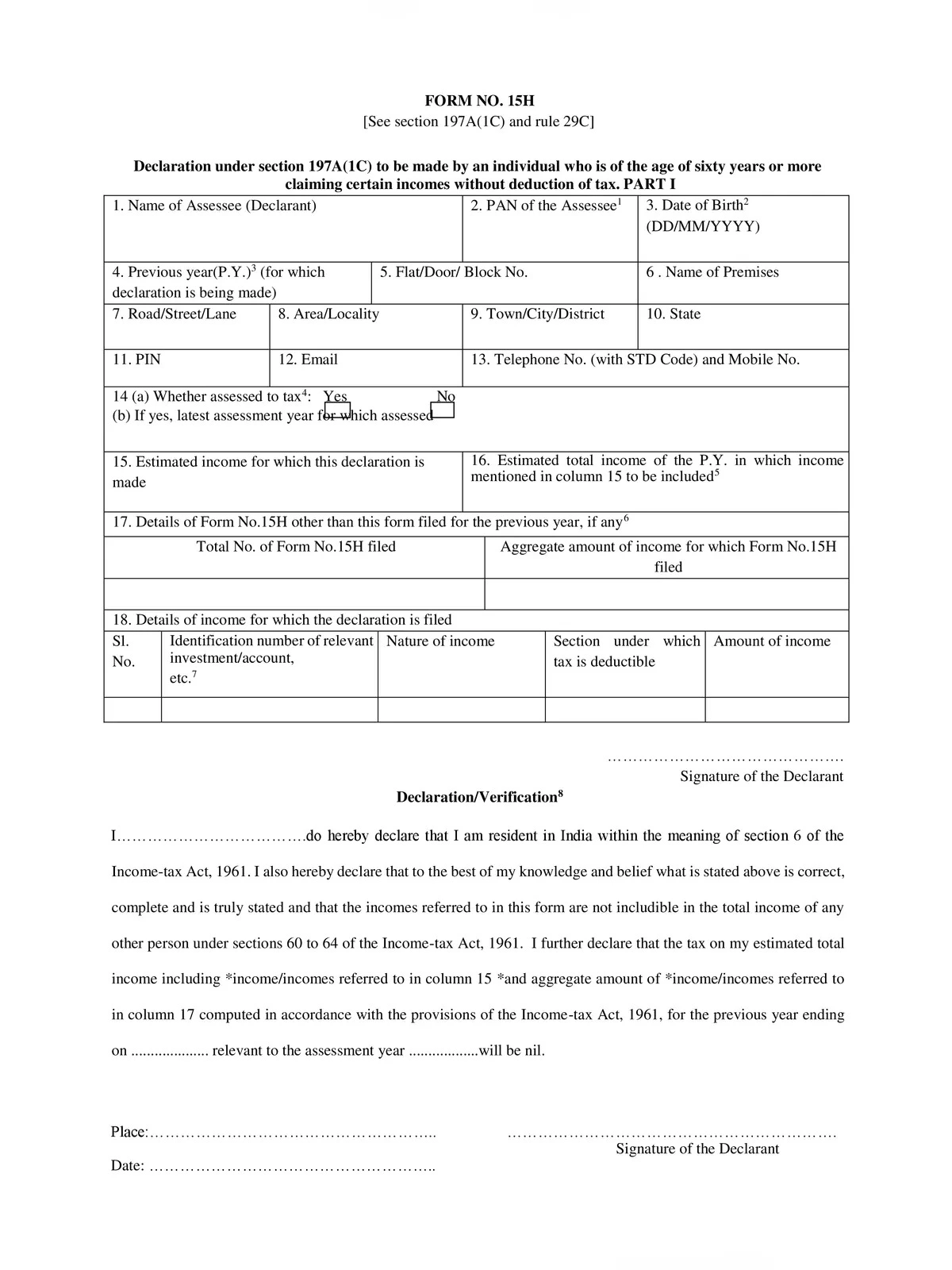

Form 15H For PF Withdrawal

Form 15H is a declaration form used in India for individuals above a certain age (usually 60 years) to declare that they have no taxable income and hence no tax should be deducted at source (TDS) on their interest income. This form is typically used for various financial transactions where TDS is applicable, including PF (Provident Fund) withdrawals.

How to Apply Form 15H For PF Withdrawal

- Obtain the Form: You can usually download Form 15H from the website of the Income Tax Department of India or obtain it from the bank or financial institution where you have your PF account.

- Fill out the Form: Provide all the required details accurately in the Form 15H. This includes your details such as name, address, PAN (Permanent Account Number), and declaration regarding your eligibility for submitting Form 15H.

- Attach Necessary Documents: You may need to attach supporting documents such as identity proof, address proof, and PAN card copy along with Form 15H. The exact documents required may vary depending on the policies of the institution handling your PF withdrawal.

- Submit the Form: Once you have filled out the form and attached the necessary documents, submit it to the concerned authority. In the case of PF withdrawal, this could be your employer (if they manage your PF account) or the Provident Fund office or financial institution where your PF account is maintained.

- Verification and Processing: The submitted Form 15H will be verified by the concerned authority. If everything is in order and you meet the eligibility criteria, they will process your PF withdrawal without deducting any TDS.

- Receive Payment: Once the withdrawal request is processed, you will receive the PF withdrawal amount in your designated bank account.

Documents Required for Form 15G for PF Withdrawal

- Form 15G: This is the main declaration form that you need to fill out and submit to declare that you are eligible for non-deduction of TDS on your PF withdrawal.

- Identity Proof: You will need to provide a copy of a valid identity proof such as Aadhaar Card, Passport, Voter ID, Driving License, etc.

- PAN Card Copy: You must submit a copy of your Permanent Account Number (PAN) card along with Form 15G.

- PF Withdrawal Form: Apart from Form 15G, you’ll also need to fill out the PF withdrawal form provided by your employer, the Provident Fund office, or the financial institution managing your PF account.

- Bank Account Details: You will need to provide details of your bank account where you want the PF withdrawal amount to be credited. This typically includes your bank account number, IFSC code, and the name of the bank branch.

- Address Proof: Some institutions may require a copy of your address proof such as Aadhaar Card, Passport, Utility Bill (electricity bill, telephone bill, etc.), or Rent Agreement.

- Passport Size Photograph: Some institutions may require passport size photographs along with the withdrawal application.