Form 15G For PF Withdrawal 2026

Form 15G PF Withdrawal PDF is crucial for individuals claiming specific incomes without tax deductions while withdrawing from their Provident Fund (PF). This applies when the amount exceeds Rs. 10,000 within a financial year. The recent launch of the EPFO Unified portal has introduced a hassle-free way for EPF members to submit EPF Form 15G online for PF withdrawals.

Understanding Form 15G for PF Withdrawal

Form 15G serves as a declaration that allows individuals (aged below 60 and Hindu Undivided Families or HUFs) to ensure that no Tax Deduction at Source (TDS) is applied to their interest income during the year. According to income tax rules, banks are required to deduct TDS on interest earned on fixed deposits and recurring deposits.

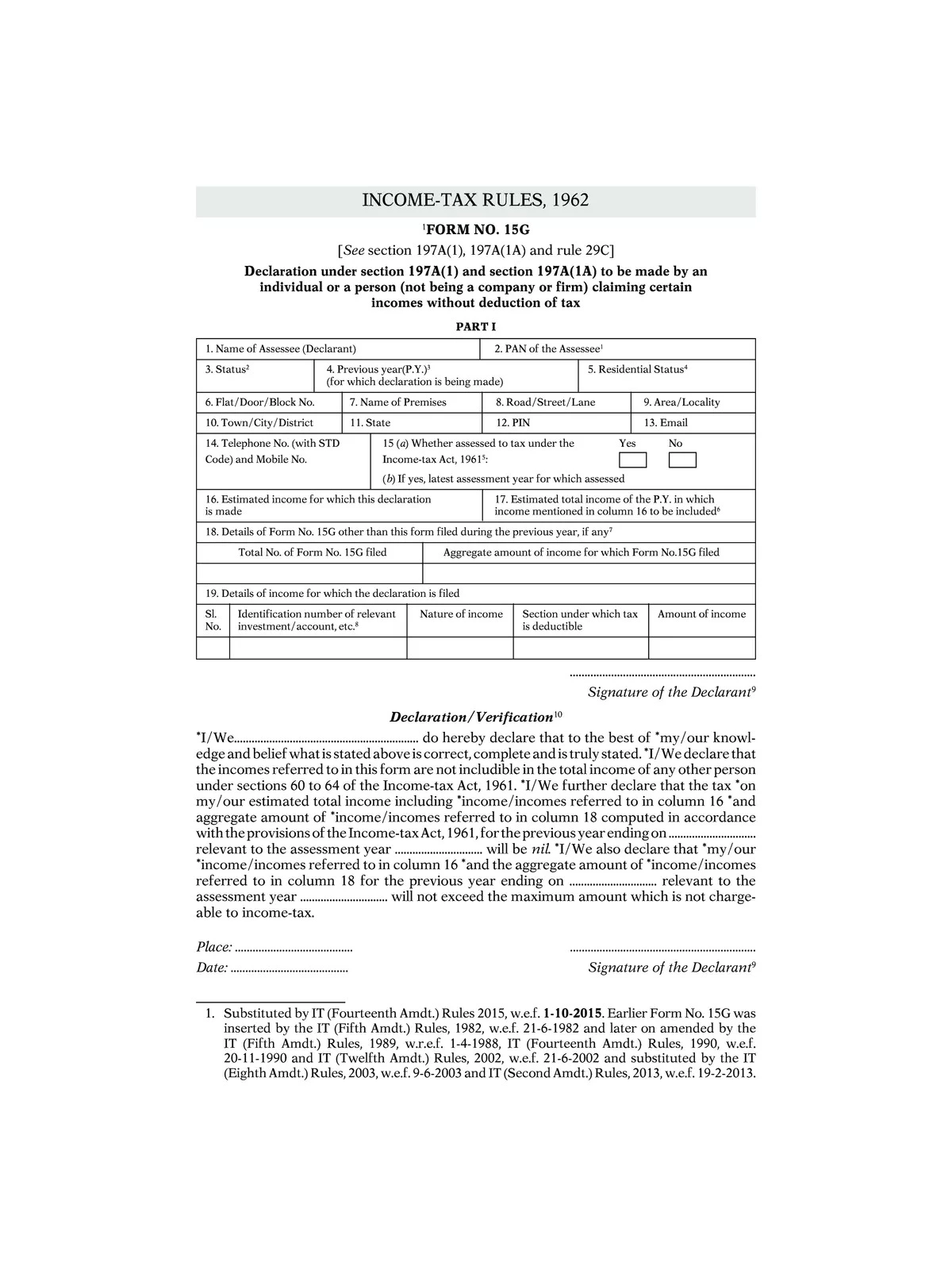

Form 15G For PF Withdrawal – Details to Mention

This form consists of two sections. The first part is designated for individuals who wish to claim no tax deduction on specific incomes. Below are the fields to fill out in the first segment of Form 15G:

- Field (1) Name of the Assessee (Declarant): Enter the name as it appears on your PAN Card.

- Field (2) PAN of the Assessee: A valid PAN card is needed to file Form 15G. If no valid PAN is provided, the declaration will be deemed invalid. Individuals can submit this form, but firms or companies cannot.

- Field (3) Status: Indicate your income tax status (Individual/Hindu Undivided Family (HUF)/AOP) depending on what applies to you.

- Field (4) Previous Year: Select the financial year for which you are requesting non-deduction of TDS.

- Field (5) Residential Status: Specify your status as a resident individual because Non-Resident Indians (NRIs) cannot submit Form 15G.

- Fields (6-12) Address: Provide your communication address accurately, including the PIN code.

- Fields (13-14) Email ID and Phone Number: Enter a valid email ID and contact number for future communications.

- Field 15 (a) Whether assessed to tax under the Income-tax Act, 1961: Tick ‘Yes’ if you were assessed for any previous assessment years.

- (b) If yes, the latest assessment year for which assessed: Provide the latest assessment year related to the returns assessed.

- Field (16) Estimated income for which this declaration is made: Mention the estimated income relevant to this declaration.

- Field (17) Estimated total income of the P.Y. in which income mentioned in column 16 is to be included: State the total estimated income for the financial year (including all incomes).

- Field (18) Details of Form No. 15G other than this form filed during the previous year, if any: If you previously filed Form 15G in the financial year, include those details and the aggregate income amount.

- Field (19) Details of income for which the declaration is filed: Fill in the investment account number (such as term deposit, life insurance policy number, employee code, etc.) for the declaration. Ensure you review all fields thoroughly to avoid errors.

Form 15G EPFO Withdrawal – Online Procedure

- Log in to the EPFO UAN Unified Portal for members at epfindia.gov.in.

- Click on the ONLINE SERVICES option and select Claim (Form 31, 19, 10C).

- Verify the last 4 digits of your bank account.

- In the ‘I want to apply for’ option, click on Upload form 15G as shown in the image.

Form 15G for PF Withdrawal Rules

- The tax exemption limit for interest on Provident Fund (PF) contributions has increased to Rs. 5 lakh per annum.

- This applies only if the contributions up to Rs. 5 lakh exclude the employer’s contribution, currently limited to 12% of the basic pay, meaning no employer contributions.

- This update became effective from 1 April 2021.

FAQs on Form 15G for PF Withdrawal

Is Form 15G mandatory for PF withdrawal of less than Rs. 50,000?

No.

How much PF interest is tax-free?

Interest on EPF contributions up to Rs. 2.5 lakh per year is tax-free.

When is TDS applicable on EPF withdrawal?

TDS rules apply when an employee applies to withdraw an EPF amount of Rs. 50,000 or more and has worked for less than 5 years:

- If the employee submits their PAN card but does not provide Form 15G/15H, TDS is deducted at a rate of 10%.

- If the employee does not provide their PAN card and fails to submit Form 15G/15H, TDS will be deducted at a higher rate of 30%.

What is the use of Form 15G?

Form 15G helps individuals avoid TDS on their interest income in a specific assessment year.

Download Form 15G For PF Withdrawal in PDF format using the link given below.