अटल पेंशन योजना चार्ट (APY Contribution Chart 2026)

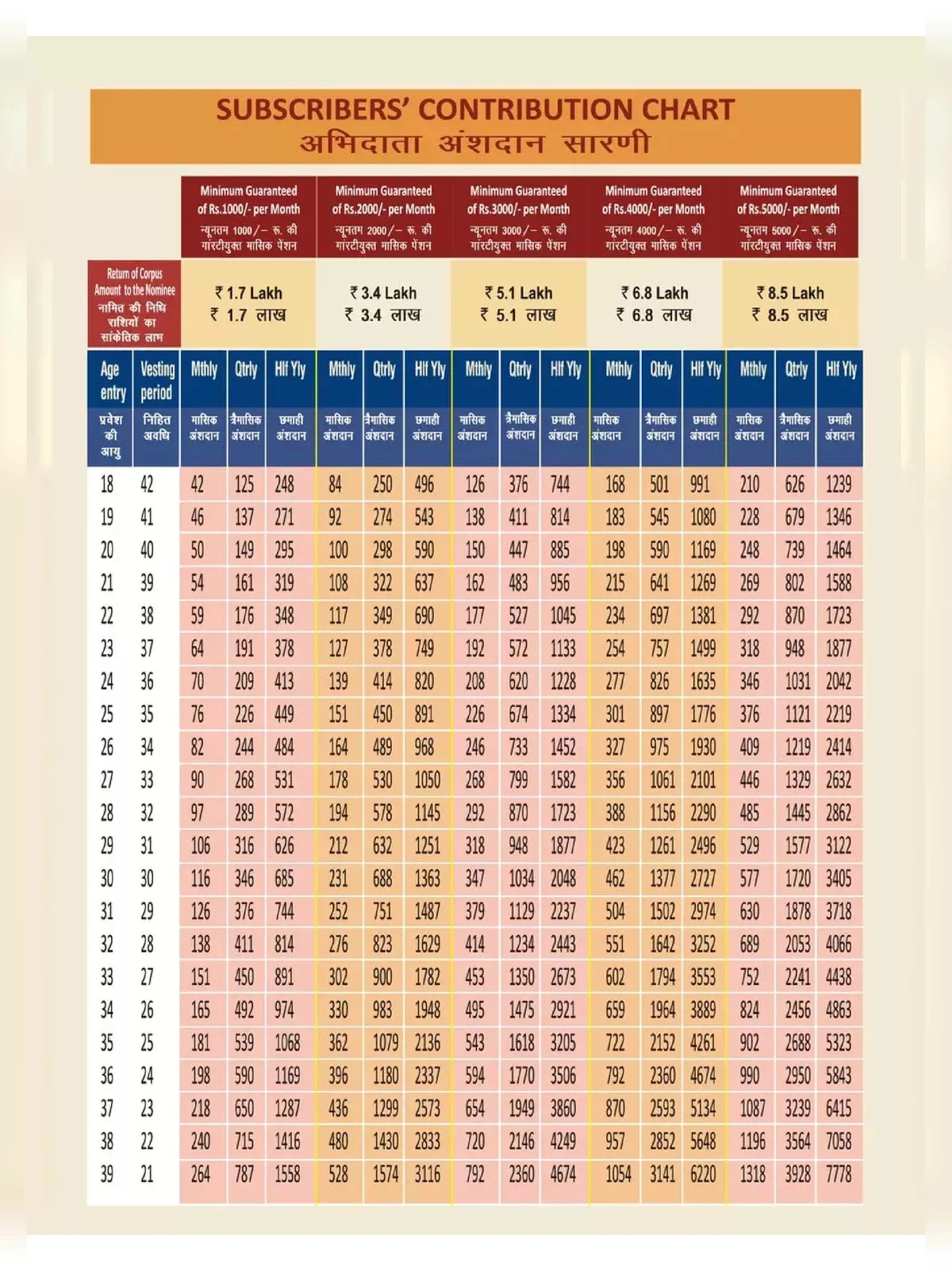

Atal Pension Yojana (APY), a pension scheme for citizens of India, is focused on the unorganized sector workers. Under the APY, guaranteed minimum pension of Rs. 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given at the age of 60 years depending on the contributions by the subscribers.

The scheme is administered by the Pension Fund Regulatory & Development Authority (PFRDA) and the Institutional Architecture of NPS is utilized to enroll subscribers under APY.

Eligibility For Atal Pension Yojana (APY)

Any Citizen of India can join the APY scheme. The following are the eligibility criteria: –

- The age of the subscriber should be between 18 – 40 years.

- He / She should have a savings bank account/ post office savings bank account.

- The prospective applicant may provide Aadhaar and mobile number to the bank during registration to

facilitate receipt of periodic updates on the APY account. Aadhaar needs to be provided at the time of

enrolment.

Mode of contribution to the APY (अटल पेंशन योजना) account

The contributions can be made at monthly/quarterly/half-yearly intervals through the auto-debit facility from a savings bank account of the subscriber.

अटल पेंशन योजना प्रीमियम चार्ट 2026–

SBI Bank Atal Pension Yojana Chart PDF 2026

PNB Bank Atal Pension Yojana Chart PDF

https://www.npscra.nsdl.co.in/nsdl/scheme-details/APY_Subscribers_Contribution_Chart_1.pdf

How do the contributions are invested in APY?

The contributions under APY are invested as per the investment guidelines prescribed by PFRDA for Central Government / State Government / NPS-Lite / Swavalamban Scheme / APY. The contributions thus collected are invested and the funds are managed by namely SBI Pension Fund Pvt. Ltd, LIC Pension Fund Ltd, UTI Retirement Solution Ltd.

Benefits under APY Scheme on attaining 60 years

Central Government guaranteed minimum pension amount: Each subscriber under APY shall receive a Central Government guaranteed minimum pension of Rs. 1000 per month or Rs. 2000 per month or Rs. 3000 per month or Rs. 4000 per month or Rs. 5000 per month, after the age of 60 years until death.

Central Government guaranteed minimum pension amount to the spouse: After the subscriber’s demise, the spouse of the subscriber shall be entitled to receive the same pension amount as that of the subscriber until the death of the spouse.

Return of the pension wealth to the nominee of the subscriber: After the demise of both the subscriber and the spouse, the nominee of the subscriber shall be entitled to receive the pension wealth, as accumulated till age 60 of the subscriber.

Download (अटल पेंशन योजना प्रीमियम चार्ट) APY Contribution Chart PDF using the link given below.