Post Office 15G Form Fill Up

How to Fill Up Post Office Form 15G

- You can get Form 15H from your local post office or download it from the Indian Post Office website or the Income Tax Department’s website.

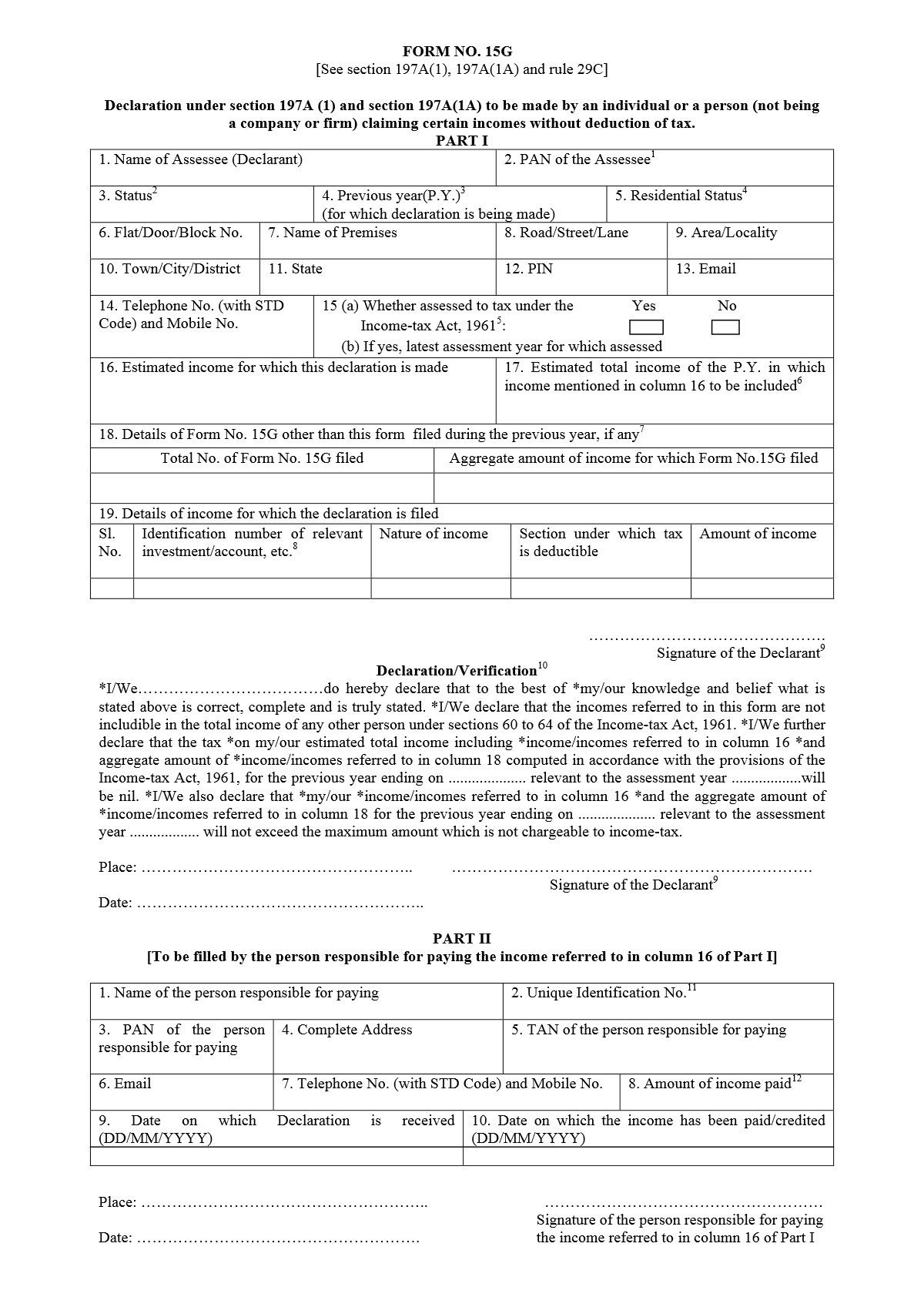

- Fill in Personal Details:

- Name of Assessee (Declarant): Write your full name as per your PAN card.

- PAN of the Assessee: Enter your Permanent Account Number (PAN).

- Status: Select your status (Individual/Senior Citizen).

- Previous Year: Mention the financial year for which the declaration is being made.

- Residential Status: Select your residential status (Resident).

- Declaration:

- Part I: Provide details like address, email, and phone number.

- Estimated Income for which declaration is made: Enter the estimated income for the financial year.

- Details of Form 15G other than this form filed during the previous year, if any: If you have submitted Form 15G elsewhere, mention those details here.

- Verification: Sign the form at the bottom, declaring that the information provided is true and correct to the best of your knowledge.

- Submit the Form: Submit the filled and signed Form 15H at your local post office.

Also Check – Post Office Form 15H

Documents Required for Form 15g in Post Office

- Duly Filled Form 15G: Ensure that the form is accurately filled out and signed.

- Copy of PAN Card: A self-attested copy of your Permanent Account Number (PAN) card is mandatory.

- Identification Proof: A self-attested copy of any of the following documents as proof of identity:

- Aadhaar Card

- Voter ID Card

- Passport

- Driving License

- Address Proof: A self-attested copy of any of the following documents as proof of address (if different from the identification proof provided):

- Aadhaar Card

- Utility bills (electricity, water, gas)

- Passport

- Voter ID Card