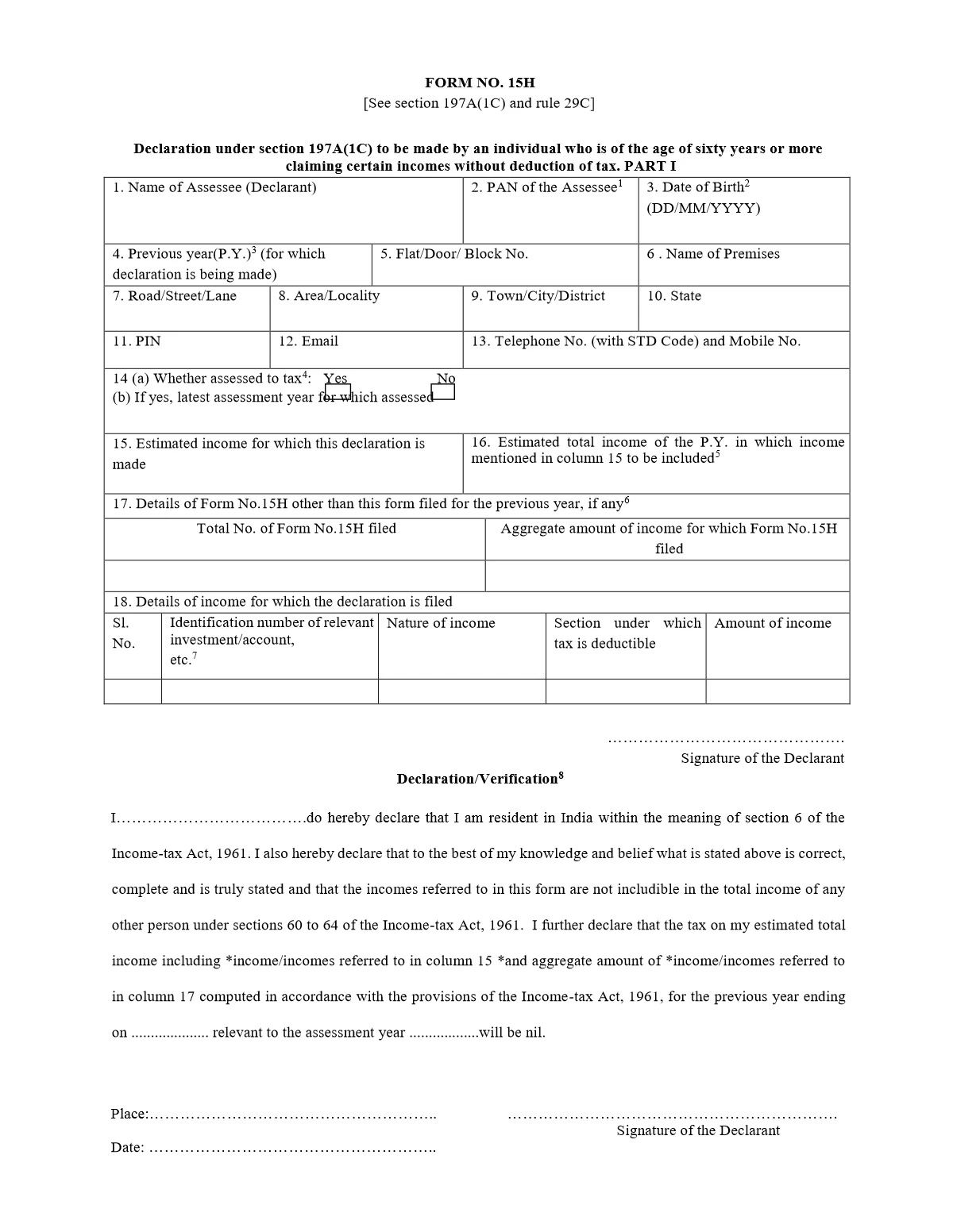

Post Office Form 15H

Form 15H is a self-declaration form used by individuals to declare that their total income for the financial year is below the taxable limit, and hence, they are not liable to pay tax on that income.

Individuals who are 60 years or older can submit Form 15H to the bank or financial institution from which they receive income to declare that they are not liable to pay tax on the interest earned on fixed deposits, recurring deposits, or any other interest-bearing accounts.

Post Office Form 15H Benefits

- Form 15H is primarily used to claim exemption from Tax Deducted at Source (TDS) on interest income if the total income for the financial year is below the taxable limit.

- Form 15H simplifies the process for senior citizens and individuals with low income to claim exemption from TDS on interest income without having to claim a refund later.

Also Check – Post Office Form 15G