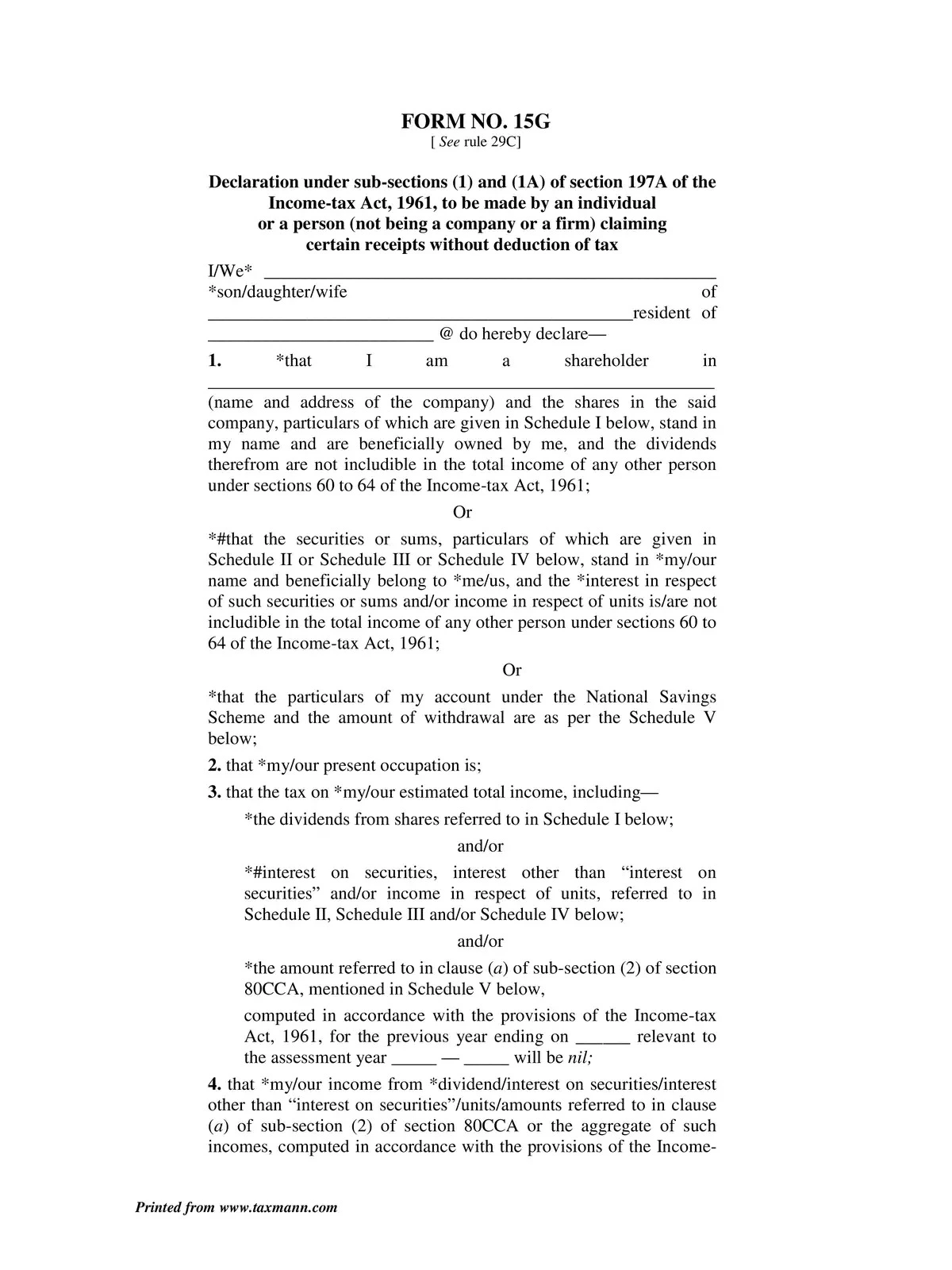

Form 15G for Fixed Deposit

Form 15G is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and HUF) to ensure that no TDS (tax deduction at source) is deducted from their interest income for the fiscal.

Form No. 15G or 15H are self-declaration forms that can be furnished by individuals to state that their income is below the taxable limit and hence no TDS should be deducted. Provident fund withdrawal before five years of completion of service attracts tax deducted at source (TDS) at 10 percent from Jun 1, 2015.

Form 15G for Fixed Deposit – Overview

| File Name | Form 15G |

| File Type | |

| Language | English |

| Beneficiary | Bank Customer |

| Purpose | For Tax Rebate Purpose |

| Form 15G PDF | [pdflink] |

When can Form 15G be submitted?

Declaration in Form 15G can be submitted for reduction of TDS burden in the following cases:

- TDS on interest income from Bank Deposits: Banks are supposed to deduct TDS if the interest amount on fixed deposit or recurring is more than Rs. 10,000 in a year (As of FY 2019-20, this threshold has been increased to Rs. 40,000 annually). An important point to note here is that banks deduct TDS based on the provisional interest not on the basis of the actual interest payout. Hence, even if the tenure of a fixed deposit is more than one year, you need to submit Form 15G to avoid a deduction of TDS.

- TDS on Employee’s Provident Fund Withdrawal: If the employee’s provident fund is withdrawn prior to completing a service tenure of 5 years with the current organization, TDS is applicable on the proceeds. But even in that case, if your total taxable income including the provident fund withdrawal balance is zero, then you can submit Form 15G for non-deduction of TDS.

- TDS on interest from post office deposits: If you fulfill all the conditions to submit Form 15G, the post office which provides deposit service also accepts Form 15G declarations for your post office deposits and national savings schemes.

- TDS on income from corporate bonds and debentures: Income from corporate bonds exceeding Rs. 5000 for a financial year is subjected to tax deducted at source. In such cases, if you are eligible to submit Form 15G, you can do so and request the issuer of bonds to not deduct TDS.

- TDS on Proceeds from Life Insurance Policy: Under the provision of Section 194DA of the Income Tax Act, 1961, if the maturity proceeds from a life insurance policy exceeds Rs. 1 lakh, such proceeds are subjected to tax deductions at source. However, if all conditions mentioned in Form 15G declarations are satisfied, the taxpayer can submit Form 15G to a life insurance company to prevent a TDS deduction.

- TDS on Rental income: If your rental income for the financial year exceeds Rs. 8 lakh, such income is subject to tax deductions at source. However, if the taxable income is lower than the basic exemption limit, then you can submit Form 15G for non-deduction of TDS.

You can download the Form 15G PDF format using the link given below.