YES Bank RTGS Form 2026

YES Bank RTGS Form offers to Transfer money to any bank branch within India through RTGS during stipulated business hours or through NEFT and IMPS anytime. RTGS is used for payments of over Rs 2 lakh, while payments below this amount can be made using NEFT. Besides, loan and credit card repayments to the bank can also be done through IMPS from other bank accounts.

YES Bank RTGS Form – Highlights

| Type of Form | RTGS/NEFT Form |

| Name of Bank | YES Bank |

| Official Website | https://v1.hdfcbank.com/ |

| Language | English |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | 2 Lacs |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

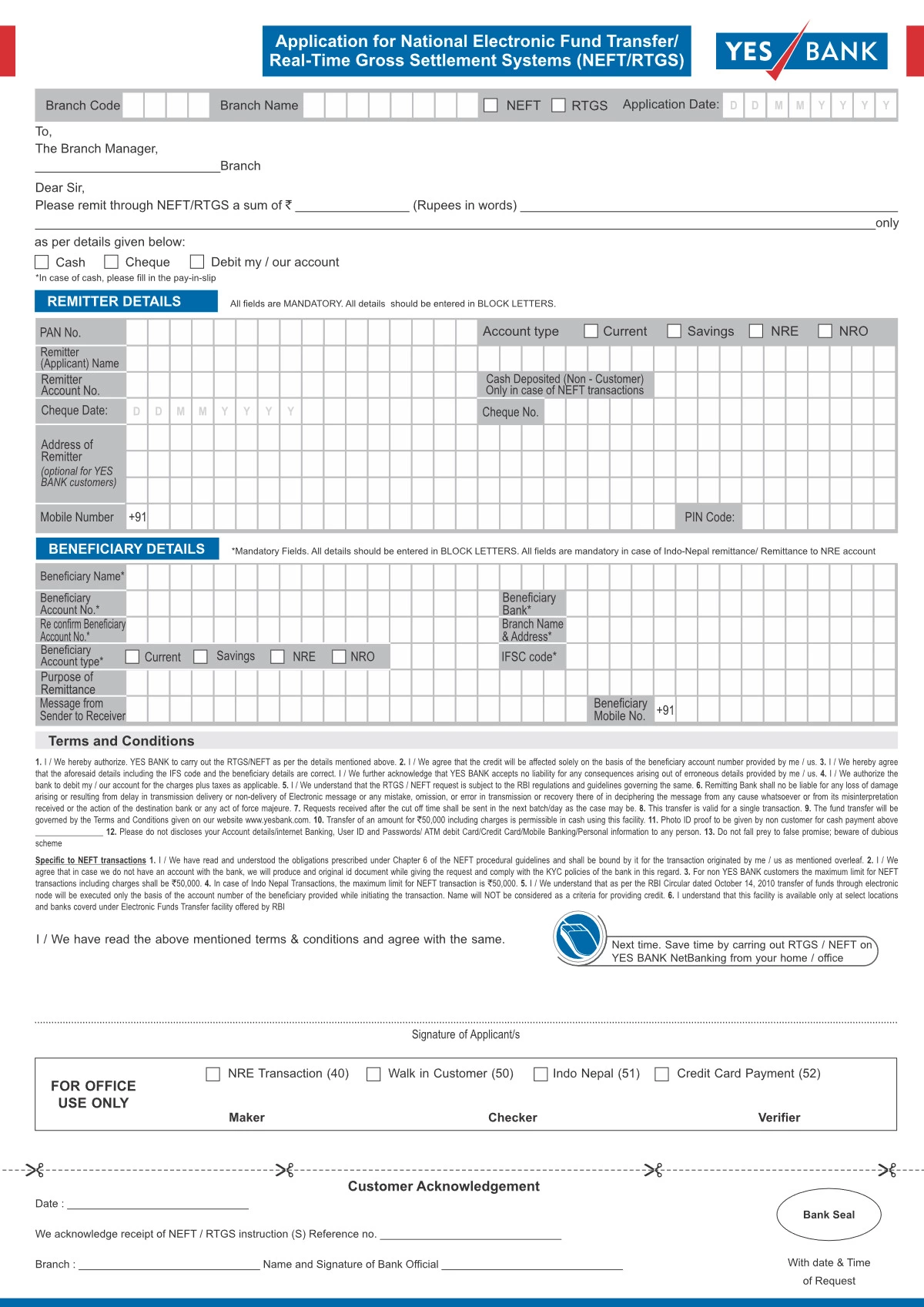

YES Bank RTGS Form – Details to be Mentioned

- Sender Details: This section requires you to fill in your personal details such as your name, address, contact number, and account number from which the funds will be debited.

- Recipient Details: Here, you’ll provide details about the recipient, including their name, address, contact number, and account number to which the funds will be credited. You’ll also need to provide the IFSC (Indian Financial System Code) of the recipient’s bank branch.

- Amount to be Transferred: Specify the amount you wish to transfer in figures and words.

- Purpose of Remittance: You might be asked to mention the reason for the transfer, such as payment for goods/services, loan repayment, etc.

- Date of Transfer: You’ll indicate the date on which you want the transfer to take place. For RTGS transactions, funds are transferred in real-time, so the date specified is usually the current date.

- Charges: RTGS transactions typically involve charges, which could be borne either by the sender, the recipient, or shared. This section clarifies who will bear the charges.

- Authorization: Signatures of the sender are usually required to authorize the transaction.

- Declaration: You may need to declare that the information provided is accurate and that you understand the terms and conditions of the RTGS transaction.