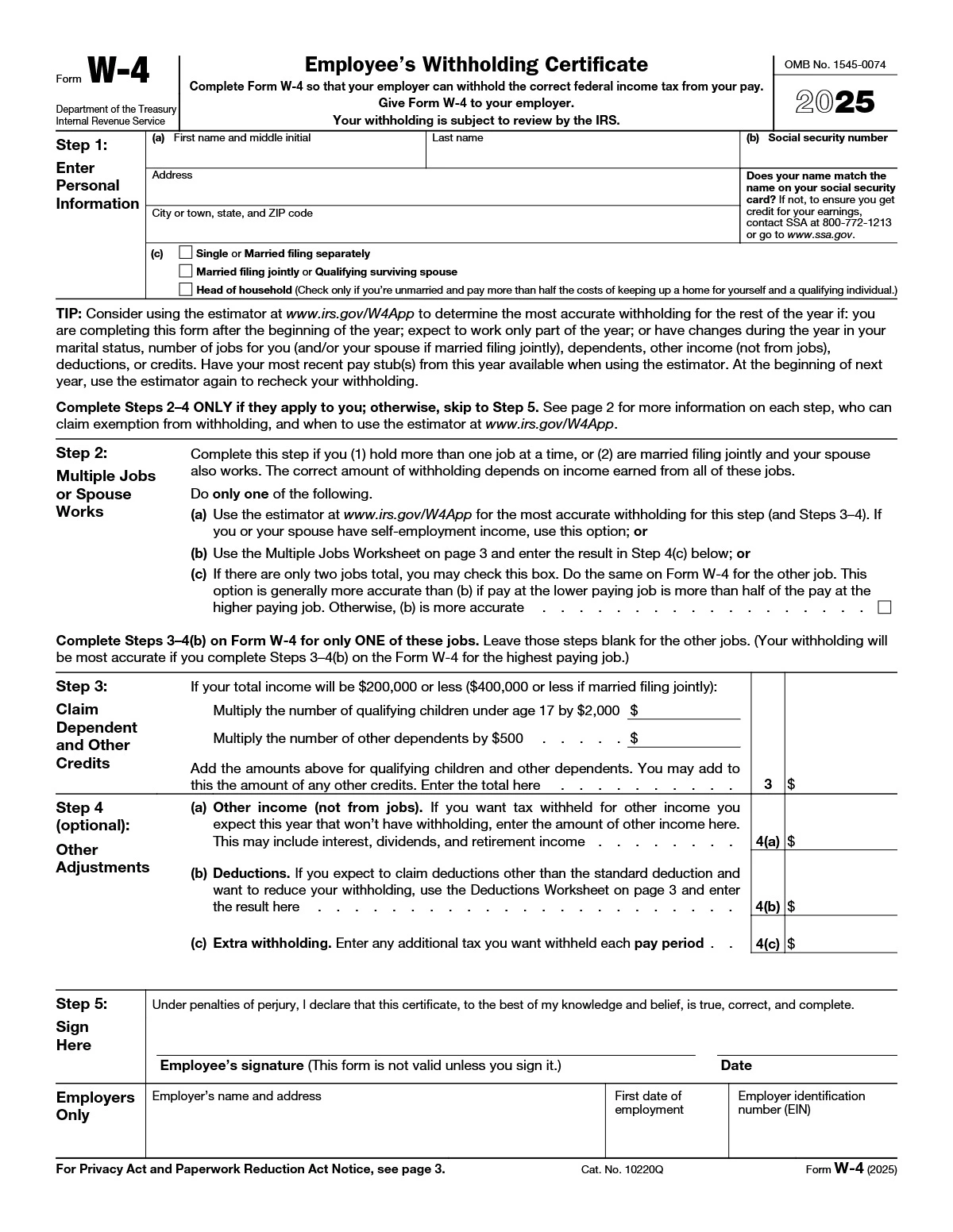

2025 W 4 Form Printable

W 4 form to filled by the all new empoyee’s Certificate once they are hired. A W-4 should be filled out by all employees when they are hired, or whenever their life or financial situation changes. If an employer does not receive a completed Form W-4 from an employee, they are authorized to withhold federal income tax at the Single – No Deductions rate.

W 4 Form Purpose

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund. Complete a new Form W-4 when changes to your personal or financial situation would change the entries on the form. For more information on withholding and when you must furnish a new Form W-4, see Pub. 505, Tax Withholding and Estimated Tax.

W 4 Form 2025 Instructions

- Step 1(c). Check your anticipated filing status. This will determine the standard deduction and tax rates used to compute your withholding.

- Step 2. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. Submit a separate Form W-4 for each job. Option (a) most accurately calculates the additional tax you need to have withheld, while option (b) does so with a little less accuracy.

- Step 3. This step provides instructions for determining the amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return. To qualify for the child tax credit, the child must be under age 17 as of December 31, must be your dependent who generally lives with you for more than half the year, and must have the required social security number.