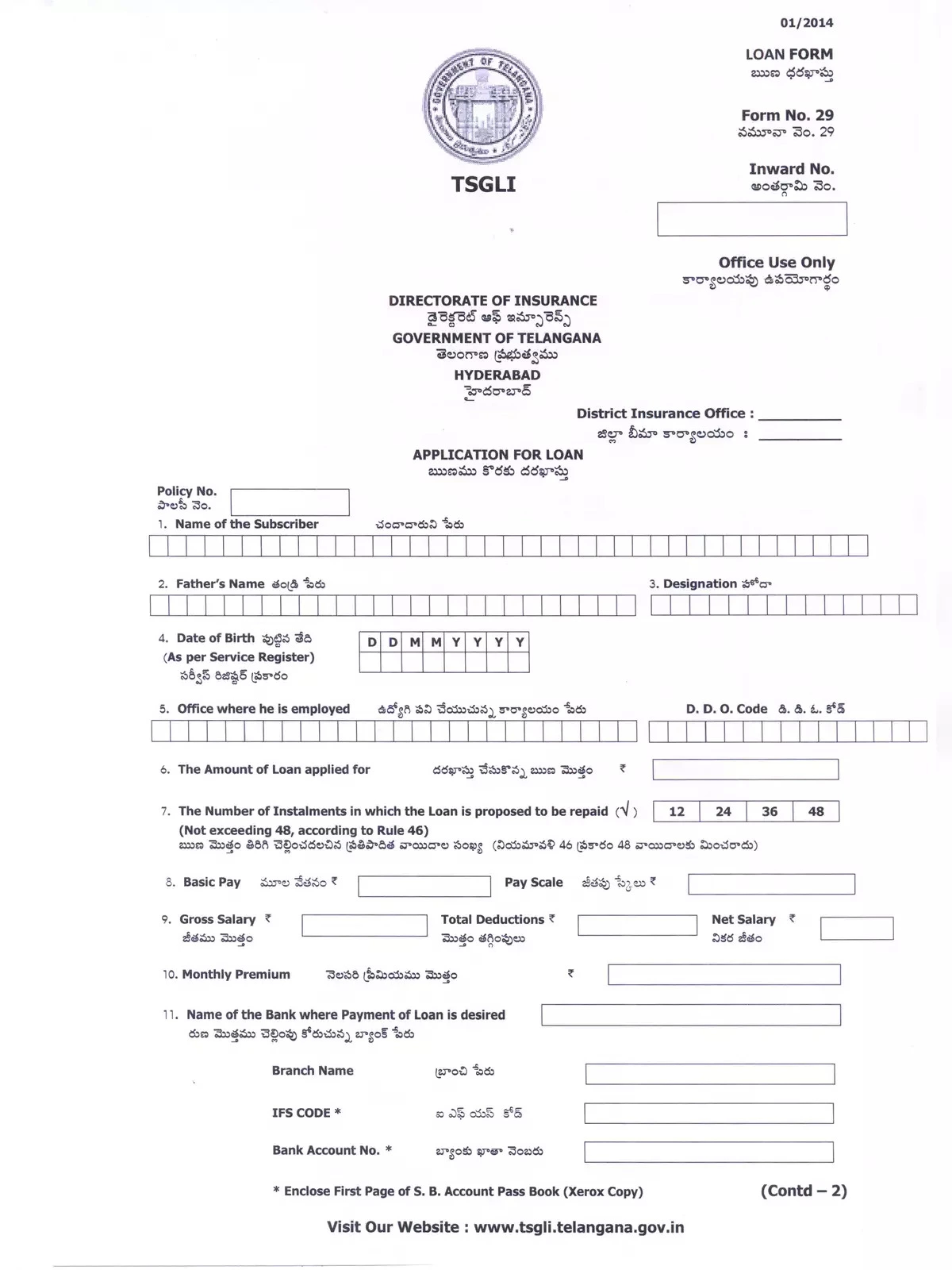

TSGLI Loan Application Form

Salient Features of TSGLI

- The Government employees aged between 21 and 53 years can apply for TSGLI Policies.

- TSGLI Department exclusively provides Endowment Policies that mature one day before the policyholder turns 58 years old.

- TSGLI policies are designed not to lapse.

- Premium rates for TSGLI are kept low for affordability.

- TSGLI Premium payments enjoy exemption from income tax under section 80C, along with attractive bonus rates.

- The current bonus rate is Rs 100 for every Rs 1000 Sum Assured per annum.

- Loans can be sanctioned up to 90% of the Surrender Value of the policy.

- A simple interest rate of 9% per annum is applicable on loans granted.

- Upon maturity of the policy, the entire Sum Assured and accrued Bonus till the Date of Maturity are paid to the policyholder.

- If the Policy Holder stops being a Government servant and opts to surrender the policy by halting premium payments, they will receive the Surrender Value along with any eligible Bonus.

- In the unfortunate event of the policyholder’s death before maturity, the complete Sum Assured along with Bonus until the date of death will be paid to the legal beneficiary.

How to Download the TSGLI Loan Application Form

You can easily download the TSGLI Loan Application Form Telangana in PDF format using the link provided below. This is a simple process that ensures you have all the necessary information in a convenient format.

Benefits of TSGLI Loan Application

The TSGLI Loan Application not only helps you secure a loan but also enhances your financial planning as a government employee. It’s an excellent way to manage your savings and take advantage of government benefits.

Download the TSGLI Loan Application Form Telangana in PDF format using the link given below.