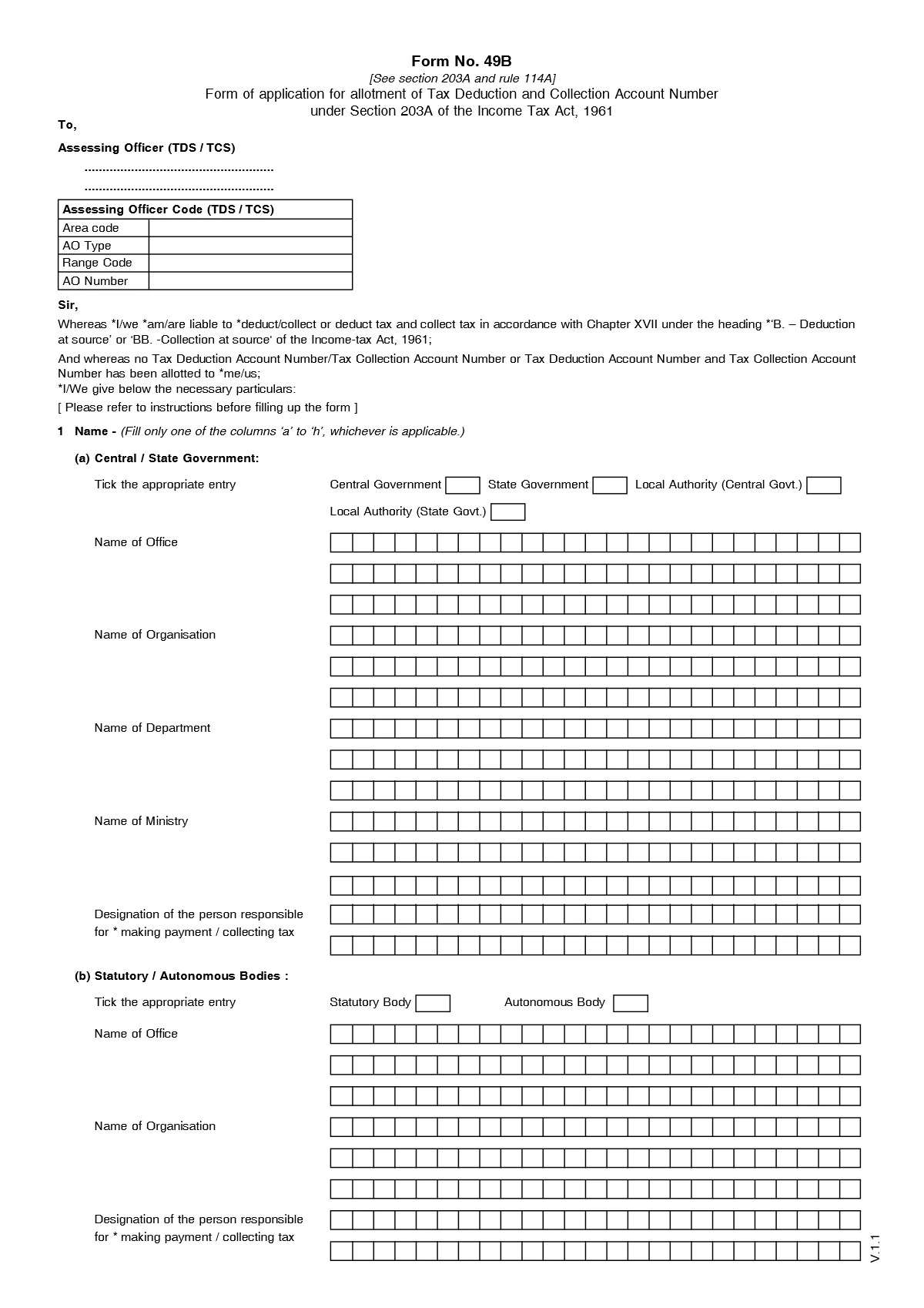

TAN Application Form

Form 49B is used for applying for a new TAN or changes or corrections in an existing TAN. It is filed with the Income Tax Department of India. TAN is a 10-digit alphanumeric number required to be obtained by all persons who are responsible for deducting or collecting tax.

If applying for a new TAN, the applicant needs to specify whether the application is for fresh allotment or changes or corrections in an existing TAN. For changes or corrections, details such as the existing TAN, name of the deductor/collector, and details of the correction required are needed.

How to Fill TAN Application Form (Form 49B)?

- Provide all necessary details in block letters to make the entries legible.

- You need to furnish details about the Assessing officer. You can access the information from the Income Tax Office.

- Enter one letter in every required box to make it more visibly clear.

- Provide accurate details regarding the area code, district, tax circle, etc. You can avail of this information from TIN Facilitation Center or the income tax office.

- For left thumb impression, ensure to get it attested by the gazetted officer or a magistrate. This is only applicable to individuals applying for TAN through offline mode. If you are applying under the ‘Other category of deductors’, it is essential to sign the acknowledgment slip.

- It is necessary to fill in all details. No blank space in this Form 49B will be taken into consideration.

- It is crucial to mention your designation, and the address provided must belong to India.

Form 49B Apply Online Procedure

- Enter all necessary information, including entity address, block no, post office, AO type, range code, AO number, etc.

- Review all information and click the ‘Confirm’ option to submit the form.

- An acknowledgement page will appear on the screen, confirming the submission of Form 49B to the Income Tax Department.

- On that screen, you will see important information such as the 14-digit acknowledgement number, applicant’s status, applicant’s name, payment details, signature space, and contact details.

- Now, download this acknowledgement slip and sign it.

- Finally, send the printout of the acknowledgement slip along with the required documents to NSDL’s office.

Address: NSDL e-Governance Infrastructure Limited 5th Floor, Mantri Sterling, Plot No.341, Survey No.997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016

On the other hand, if you are unable to submit Form 49B through online mode, you can also apply offline. Take a look at the offline process:

- On the NSDL portal, download Form 49B.

- Enter all the personal and mandatory details.

- Tick the declaration confirming that the information provided is correct.

- Specify the date and place and add your left thumb impression or signature.

- Ensure to attest the left thumb impression by a gazetted officer or magistrate.

- Review all the details and submit the form with all necessary documents to the nearest UTIITSL or NSDL office.

Documents Required for TAN Application

- Applicant’s PAN

- Deductor’s personal information such as address, name, contact information, etc.

- Responsible person of company’s digital signature certificate

- Incorporation certificate of company

- Responsible person’s details