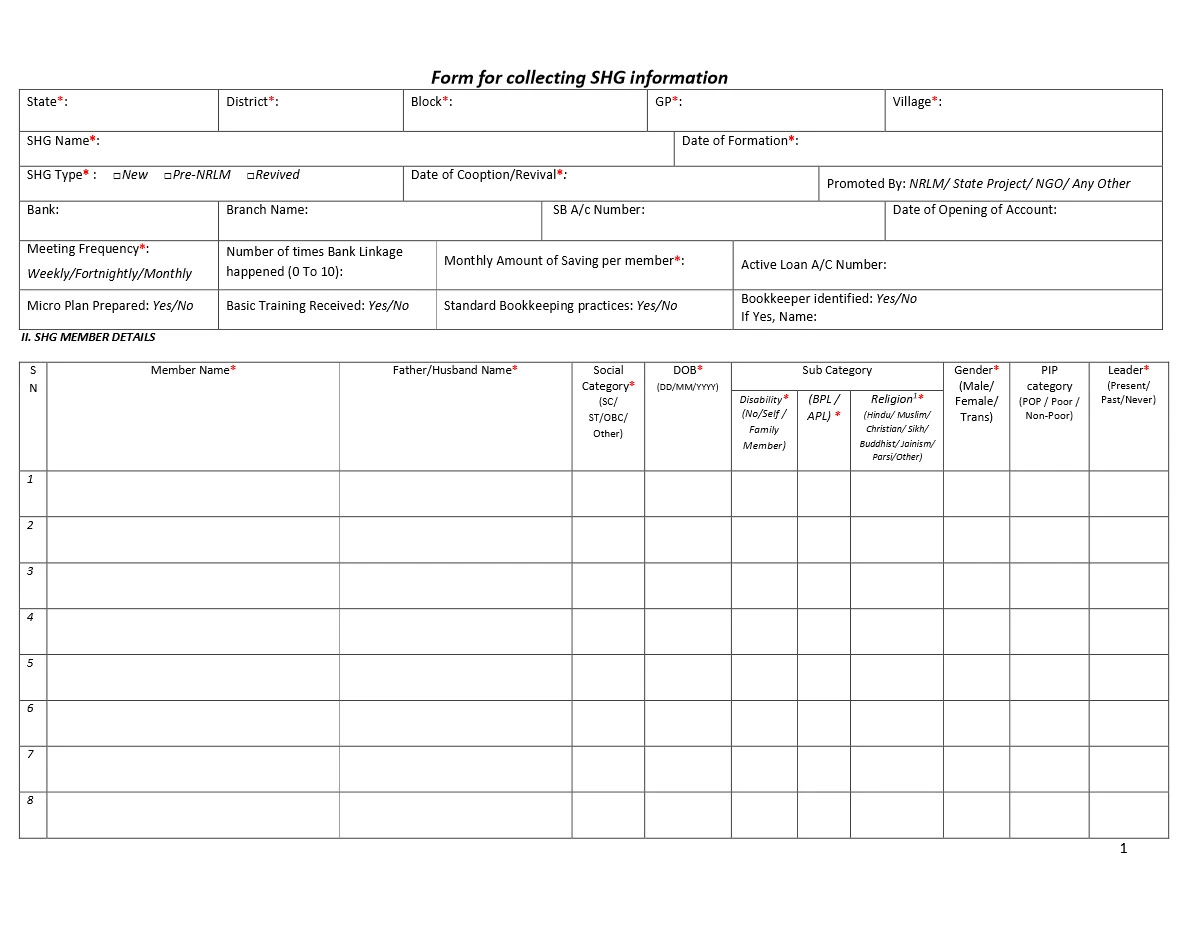

SHG Business Plan Form

The Assam government has launched a program to train about 40 lakh women members of Self-Help Groups (SHGs) as Rural Micro Entrepreneurs or Lakhpati Baideos, or sisters, and guarantees an annual income of 1 lakh per member. A population and female child education standard will be developed by the program.

The objective of the programme is to provide microfinance to the poor in rural, semi-urban and urban areas for enabling them to improve their living standard by generating income through employment of very small fund in different services and productive activities.

SHG Business Plan Form – Eligibility

- Women from the general and other backward caste (OBC) categories (except from the Moran, Muttock and tea-tribe communities) will need to have not more than three children.

- Women from Moran Muttock and tea-tribe communities will be eligible if they have four or lesser number of children.

- For women from Scheduled Tribe (ST) and Scheduled Caste (SC) categories they will not qualify for the scheme if they have more than four children.

- Sarma said that the limit has been kept to ensure that those children who get the grant are able (have adequate time) to devote to the new business.

Document Required for Assam SHG Business Plan

- Aadhar Card of all the members

- One photo of all the members

- Inter-se Agreement (either registered or unregistered) executed by all members of the SHG communicating their decision to open a Savings Account with the bank and identifying two or three members to jointly operate the account

- Copy of passbook of existing account with a bank

- In case of SHGs, who do not have an existing bank account, a letter of introduction from the Village Sarpanch / Village Administrative Office (VAO) in rural locations would be accepted

- Identify Proof & Address Proofs of Authorised Signatories

- Voter ID card of members

- Bank pass book (bearing photograph of client) issued by Banks where account has been opened at least 3 months prior, along with an account opening cheque drawn on the same account.

- Documents required other than KYC

- SHPI Recommendation Letter

- Repayment track record if the SHG has credit linkage with any other bank or financial institution

- Sanction letter and repayment statement (Statement of Account) of active loans