SBI KYC Form

The KYC (Know Your Customer) form used by the State Bank of India (SBI) is a document that helps the bank verify the identity and address of its customers. It is a standard procedure to prevent identity theft, fraud, money laundering, and other illegal activities.

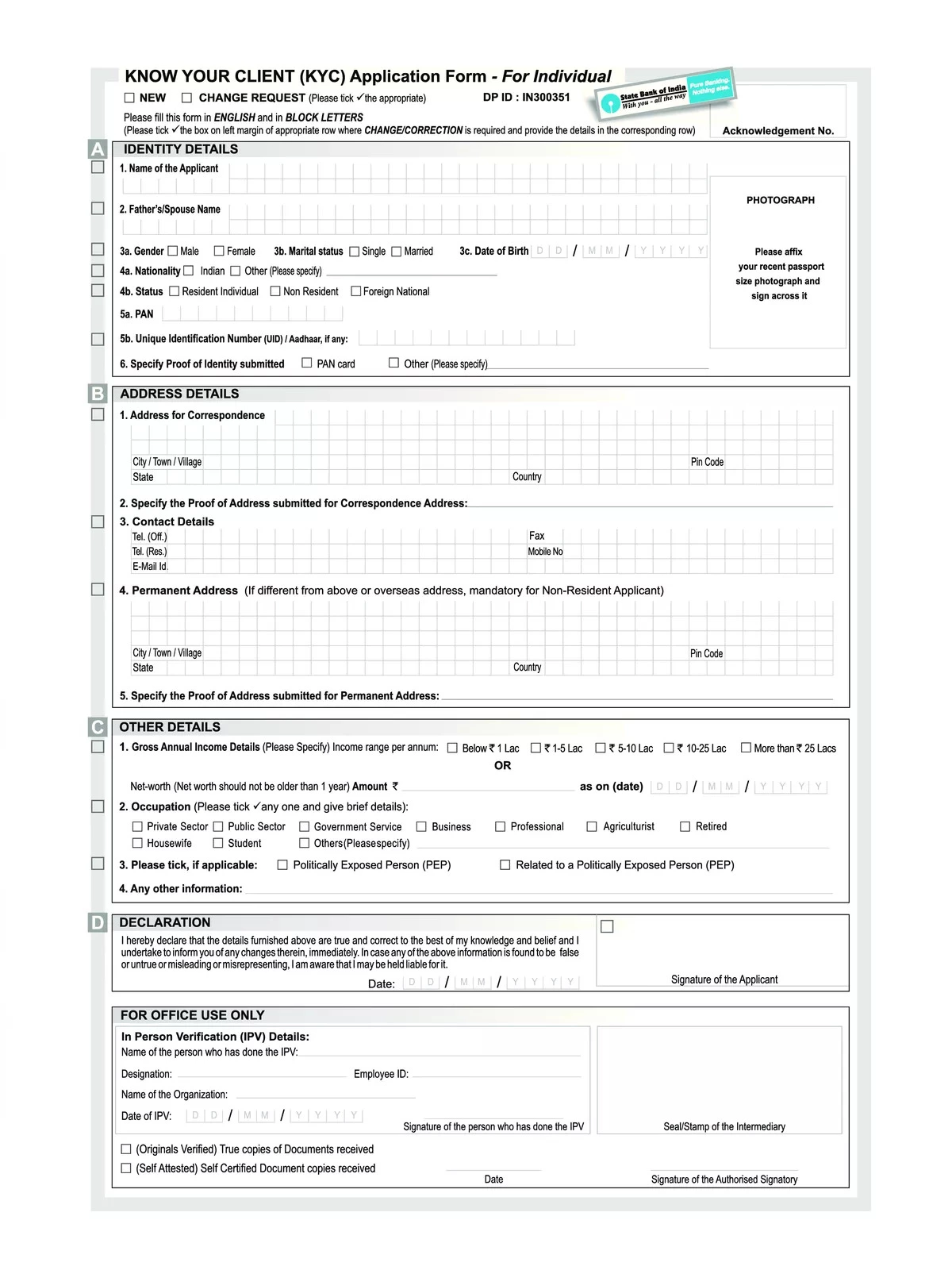

How to Fill Out the SBI KYC Form

- Personal Information: This section collects basic personal details such as name, date of birth, gender, and nationality.

- Contact Information: Customers are required to provide their current address, along with any previous addresses if applicable. This helps the bank confirm the residential details of the customer.

- Identification Details: Customers need to submit proof of identity documents such as an Aadhaar card, PAN card, passport, voter ID card, etc. They may also be required to provide proof of address documents such as utility bills, rental agreements, or aadhaar card if it contains the address.

- Declaration: The form typically includes a declaration section where the customer confirms the accuracy of the information provided and agrees to comply with the bank’s KYC policies.

- Signature and Date: Finally, customers are required to sign and date the form to certify that they have provided the information truthfully.

Required Documents for SBI KYC Form

- Passport.

- Voter’s Identity Card.

- Driving Licence.

- Aadhaar Letter/Card.

- NREGA Card.

- Letter issued by the National Population Register containing details of name and address.

- Any one document towards proof of identity and proof of address (either permanent or current )

SBI KYC Form for Minors

To complete KYC for a minor with the State Bank of India (SBI), you’ll need to provide the following documents:

- ID proof for the account operator: If the minor is under 10 years old, you’ll need to provide ID proof for the person who will operate the account.

- Proof of the minor’s date of birth: You’ll need to provide proof of the minor’s date of birth.

- KYC for the parent: You’ll need to provide the KYC of the parent.

- Additional documents for opening an account with a mutual fund or depository participant: If you’re opening an account for a minor with a mutual fund or depository participant, you’ll need to provide a photocopy of the minor’s passport, birth certificate, or school leaving certificate or mark sheet.