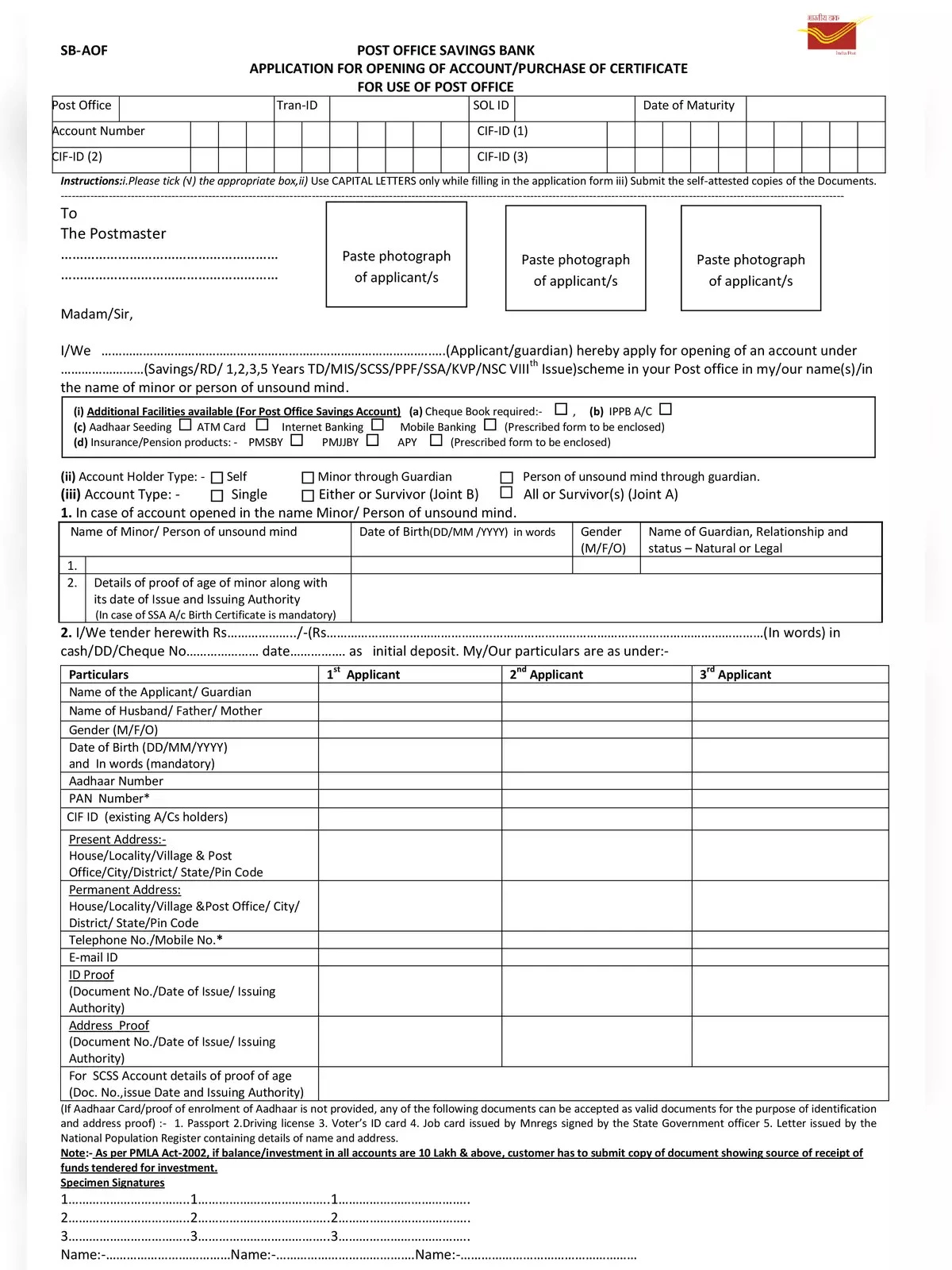

Post Office Saving Account Form

Post Office Saving Account Application Form

One of the most accessible and widely used savings accounts in India is the Post Office Savings Account. This account serves as an ideal financial tool for individuals looking to secure their savings while earning a decent interest rate. To open a Post Office Savings Account, the minimum amount required is Rs.500, and the highest balance that can be maintained is also Rs.500. Currently, the interest rate available for this account is an attractive 4.00 percent per annum. Notably, even a minor above the age of ten can open this account in their name. However, it is important to note that individuals are only permitted to hold one account.

In a Post Office Savings Account, there is no upper limit on the amount that can be deposited. Furthermore, this account is eligible for tax benefits under the Income Tax Act Section 80TTA for interest earned up to Rs.10,000 in a financial year, when combined with all other savings accounts.

Eligibility Criteria

- Minors who are above ten years of age.

- A person of unsound mind can act as a guardian on behalf of a minor.

- A joint account can be opened by two or three individuals.

- Accounts such as Group Accounts, Institutional Accounts, Security Deposit Accounts, and Official Capacity Accounts are not permitted.

Interest Rate on Post Office Saving Account

The interest rate on Post Office Savings Accounts is determined by the Central Government on a regular basis, typically ranging from 3% to 4%. Interest is calculated monthly and is credited annually, providing account holders with a steady return on their savings.

For those who are interested, you can explore further details and access the Post Office Saving Account application form through the provided resources. 📄💰

If you are looking for an easy and effective way to save, consider opening a Post Office Savings Account today! 🌟