Form 19 PF Final Settlement

This content provides all the important information you need about the Form 19 PF Final Settlement for PF withdrawal. This is essential for employees who wish to withdraw their PF amount during the final settlement. You can download the Form 19 PDF directly from the official EPFO website at www.epfindia.gov.in, or you can also download it through the convenient link given below.

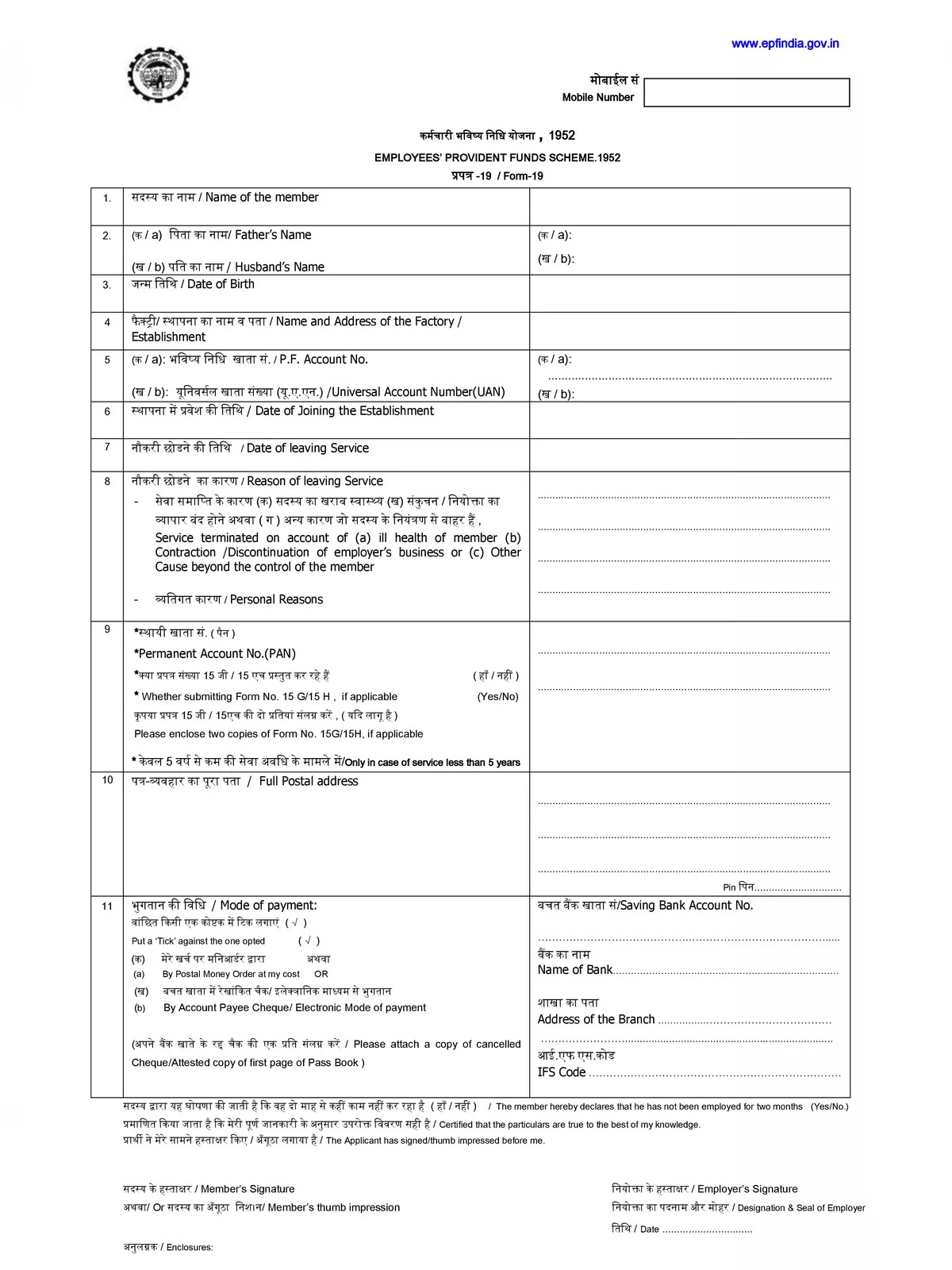

Understanding Form 19 PF Final Settlement

PF Form 19 must be filled out by members wanting to settle their PF accounts completely. This form is specifically for those employees who do not have a Universal Account Number (UAN). You can submit PF Form 19 without a UAN, but you must provide your PF account number. This form serves the purpose of claiming a final settlement of your PF account or obtaining pension withdrawal benefits.

Details to be Mentioned in Form 19 PF Final Settlement

- Name of the member and personal details

- PF Account No.

- Universal Account Number (UAN)

- Date of leaving Service

- Reason for leaving Service

- PAN Number

- Full Postal Address

- Mode of Payment

Form 19 Online Apply Procedure

- Login to the EPFO website with your Universal Account Number (UAN), password, and captcha.

- Once you have logged in, click on the ‘Online Services’ tab and select “Claim (Form – 31, 19 & 10C)”.

- Next, enter the last four digits of the bank account number linked with your PF account and click on ‘Verify’.

- Click on ‘Yes’ for the ‘Certificate of Undertaking’ pop-up.

- Next, select ‘Only PF Withdrawal (Form – 19)’ from the drop-down menu under the ‘I want to apply for’ option.

- Once the disclaimer page appears, read it and click on the ‘Get Aadhaar OTP’ option.

- The OTP will be sent to your registered mobile number. Enter it to verify.

- Upon successful submission, you will receive a reference number to track your process completion.

After your employer approves the request, the PF amount will be deposited into your bank account.

Download the Form 19 PF Final Settlement in PDF format using the link given below.