NPS Withdrawal Form

The National Pension System (NPS) withdrawal process and its associated forms can vary slightly depending on whether you are withdrawing from Tier 1 or Tier 2 account. Here’s a general overview:

NPS Tier 1 Withdrawal:

- Eligibility:

- NPS Tier 1 account has restrictions on withdrawal before retirement age except under specific circumstances like critical illness, higher education, or house purchase.

- You must have completed a minimum of 10 years of contributions to be eligible for partial withdrawal for specific purposes.

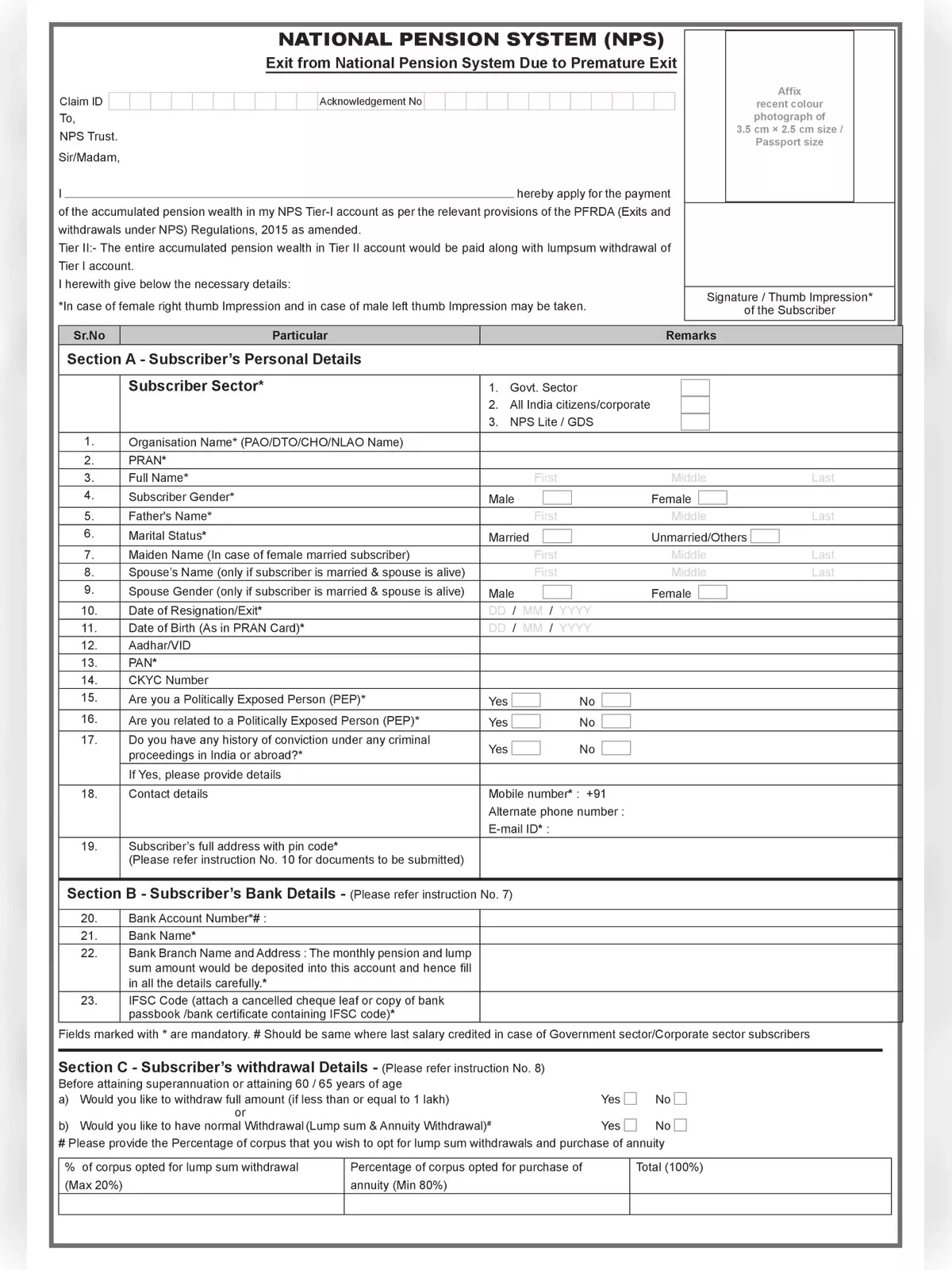

- Forms:

- You need to fill out the “Composite Withdrawal Form” (UOS-S12), which is available on the official website of the NPS or through your respective NPS Point of Presence (PoP).

- Limits:

- The limit for partial withdrawal varies depending on the purpose, and the maximum limit is usually 25% of your contributions. Specific limits apply to each purpose.

- Process:

- Fill out the Composite Withdrawal Form with accurate details.

- Attach necessary documents as per the purpose of withdrawal (e.g., medical certificates for critical illness).

- Submit the form and documents to your nearest NPS PoP or the designated authority.

NPS Tier 2 Withdrawal:

- Eligibility:

- NPS Tier 2 account allows for anytime withdrawals without any restrictions on the number of withdrawals.

- There is no minimum contribution period required for withdrawal from the Tier 2 account.

- Forms:

- For Tier 2 withdrawals, you need to fill out the withdrawal form specific to your NPS PoP or online through the NPS website.

- Limits:

- There are no specific limits on the amount you can withdraw from your Tier 2 account.

- Process:

- Fill out the withdrawal form with necessary details.

- Submit the form either physically at the NPS PoP or online through the NPS website.

- Ensure all details are accurate and complete to avoid processing delays.

Tax Benefits for NPS Tier 1 Account:

- Employee Contribution (under Section 80CCD(1)):

- Employee contributions up to 10% of Salary (Basic + Dearness Allowance) within the overall ceiling of ₹1.5 lakh under Section 80CCD(1) of the Income Tax Act are eligible for tax deduction.

- For self-employed individuals, contributions up to 10% of Gross Total Income (as per Section 80CCD(1)) within the overall ceiling of ₹1.5 lakh are eligible for tax deduction.

Tax Benefits for NPS Tier 2 Account:

- No Tax Deductions on Contributions:

- Contributions to the NPS Tier 2 account do not qualify for any tax deductions under Section 80C or any other section of the Income Tax Act.