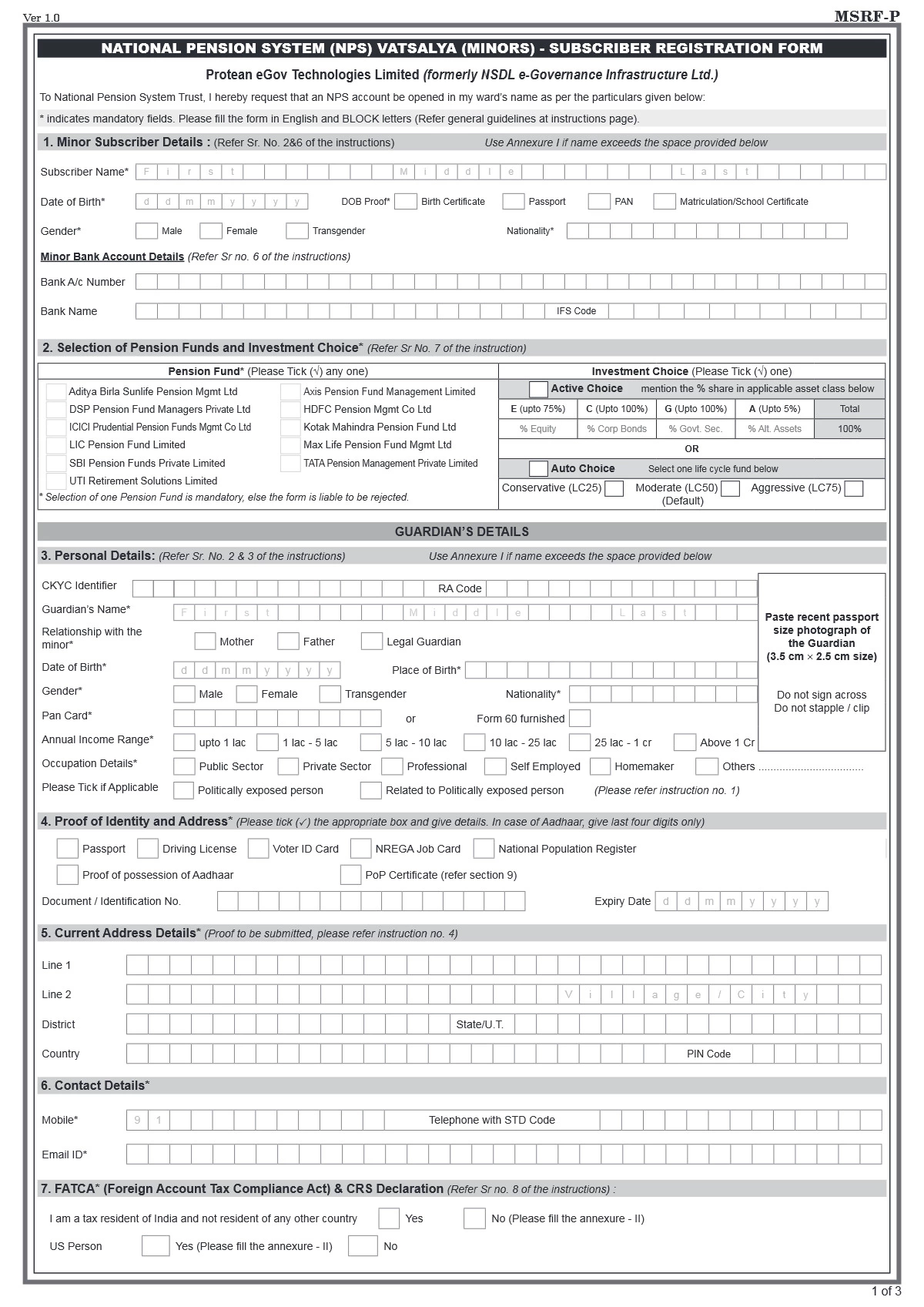

NPS Vatsalya Form

The NPS Vatsalya is the central government’s new pension scheme for children where parents can invest in their child’s future financial security, ensuring that their children have a stable and secure future ahead.

NPS Vatsalaya Scheme Benefits

- Early Savings: Parents can start saving for their child’s retirement from infancy, instilling financial discipline and responsibility early on.

- Compounding Growth: The scheme leverages the power of compounding, allowing investments to grow significantly over time, which can lead to a substantial corpus by the time the child turns 18.

- Flexible Contributions: The minimum annual contribution is just ₹1,000, with no upper limit, making it accessible for families across different economic backgrounds. Contributions can be as low as ₹500 per month.

- Diverse Investment Options: Parents can choose from various investment strategies, including default, auto, and active choices, allowing them to tailor the investment approach according to their risk appetite.

- Partial Withdrawals: After three years, parents can withdraw up to 25% of the corpus for specific needs like education or medical expenses, providing financial flexibility when needed.

- Seamless Transition: Upon reaching adulthood at 18 years, the NPS Vatsalya account converts into a regular NPS account, ensuring continued growth and availability of funds for future needs.

- Security for Guardians: In case of the guardian’s demise, the entire corpus is returned to the registered nominee, ensuring financial security for the child

How to open NPS Vatsalya’s online platform (eNPS)?

To open an NPS Vatsalya account online, follow these steps:

- Visit the eNPS Portal: Go to the official eNPS website, which will host the NPS Vatsalya scheme.

- Select the NPS Vatsalya Option: Look for the option to apply for the NPS Vatsalya scheme specifically designed for minors.

- Complete Registration: Fill out the necessary details, including the minor’s information and guardian’s KYC details.

- Upload Documents: Provide required documents such as proof of identity and address for the guardian and proof of age for the minor.

- Make Initial Contribution: Ensure a minimum annual contribution of ₹1,000 is made during registration.

- Receive PRAN Card: After successful registration, a Permanent Retirement Account Number (PRAN) card will be issued for the minor subscriber.

Required Documents for NPS Vatsalya Scheme

- Proof of Identity for Guardian: This can include an Aadhaar Card, PAN Card, Passport, or Driving Licence.

- Proof of Address for Guardian: Any official document that verifies the current address.

- Proof of Age for Minor: A Birth Certificate or any government-issued document that confirms the date of birth of the child.

- Identity Proof for Minor: An Aadhaar Card is recommended if available.

- Contact Information: A valid mobile number and email ID for registration and communication.

- Photographs: Recent passport-size photographs of the guardian.