New Income Tax Bill 2025

Income Tax Bill 2025: Key Highlights & PDF Download

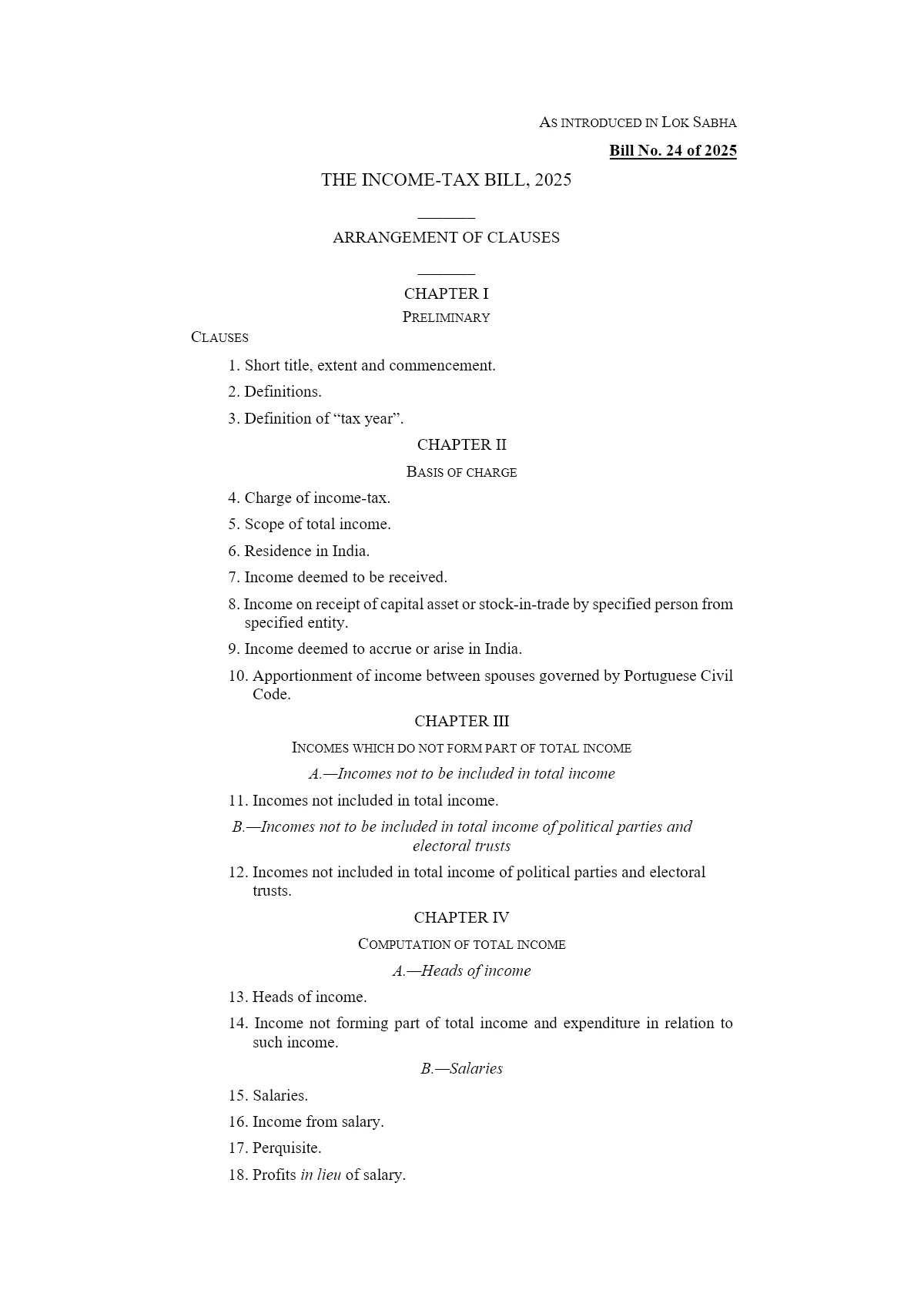

Income Tax Bill 2025, introduced by Finance Minister Nirmala Sitharaman in the Lok Sabha, aims to replace the existing Income Tax Act, 1961, by simplifying the tax laws and improving clarity for taxpayers. The bill seeks to modernize and rationalize tax provisions by removing redundant clauses, simplifying legal jargon, and consolidating provisions.

Income Tax Bill 2025 PDF Download

You can download the full text of the Income Tax Bill 2025 from the official Lok Sabha website from here or using the direct download link below.

Key Highlights of the Income Tax Bill 2025

1. Complete Overhaul of Tax Law

- The new bill replaces the Income Tax Act, 1961, which has been in force for over 60 years.

- The existing law has 298 sections & 14 schedules, whereas the new law will have 536 sections, 23 chapters, and 16 schedules.

- The total length of the act has been reduced to 622 pages, almost half of the old law.

2. Introduction of “Tax Year”

- The bill introduces the concept of “Tax Year”, replacing the terms “Assessment Year” and “Previous Year”.

- The Tax Year will be the 12-month period starting from April 1 each year.

3. Removal of Complex & Redundant Clauses

- The Fringe Benefit Tax (which was abolished earlier) and other outdated provisions have been removed.

- The terms “notwithstanding” have been replaced with “irrespective” for better clarity.

4. Enhanced Readability & Simplicity

- Shorter sentences and reader-friendly language.

- Use of tables & formulas to clarify provisions related to TDS, presumptive taxation, salary, deductions, etc.

5. Introduction of “Taxpayer’s Charter”

- A new Taxpayer’s Charter is introduced, which defines the rights and obligations of taxpayers.

6. Clearer Rules for ESOPs & Employee Benefits

- The bill simplifies taxation rules for Employee Stock Ownership Plans (ESOPs).

- This is aimed at reducing tax disputes and providing better clarity for employees.

7. Relocation of Exempt Incomes

- Incomes that are not taxable (like agricultural income) have now been moved to schedules.

- This will help in simplifying the main tax law.

8. Incorporation of Judicial Pronouncements

- The bill includes important court rulings from the past 60 years to bring more clarity to taxation laws.

Why is the Income Tax Bill 2025 Important?

✅ Simplifies tax compliance for businesses & individuals.

✅ Reduces legal complexity by modernizing outdated laws.

✅ Brings uniformity in tax regulations & definitions.

✅ Improves transparency with clear guidelines for taxpayers.

✅ Introduces structured schedules for better readability.

Conclusion

The Income Tax Bill 2025 is a significant step towards making India’s tax laws simpler, more transparent, and modern. The removal of redundant sections and the introduction of a new Tax Year are expected to ease compliance and reduce tax disputes.