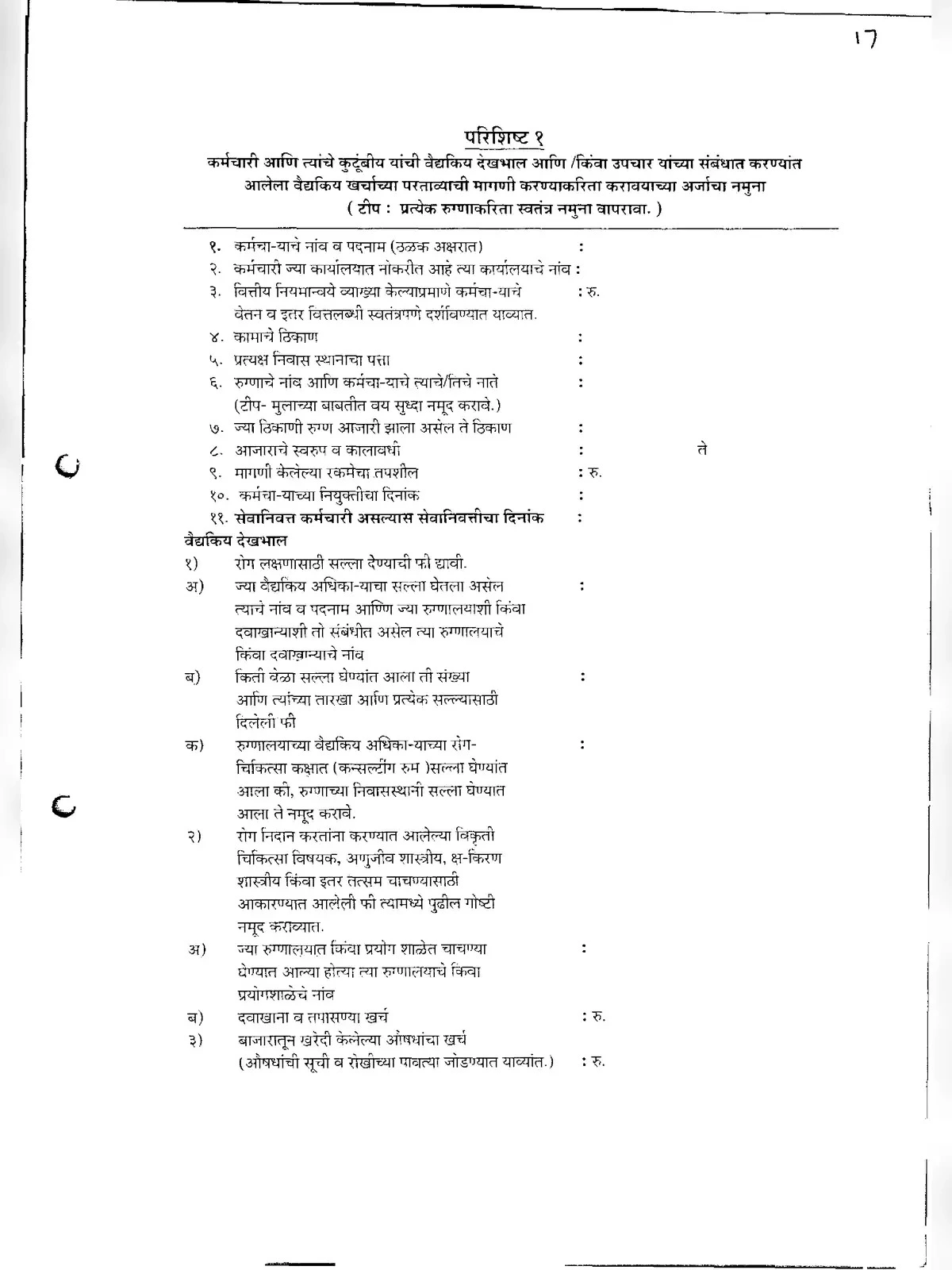

Medical Reimbursement Form for Maharashtra Government Employees

Medical Reimbursement is a crucial benefit that allows Maharashtra Government Employees to get back a part of their medical expenses. The Income Tax Act permits a tax exemption of up to INR 15,000 on medical reimbursements provided by employers.

Understanding Medical Reimbursement Forms

It is certified that the case did not require hospitalization but is of a prolonged nature, needing medical attention at the outpatient department for more than 10 days. You can easily download the PDF of the Medical Reimbursement Form for Maharashtra Government Employees from the link below.

Documents Required for Medical Reimbursement Form Submission

To ensure a smooth processing of your claim, please include the following documents:

- Annexure – II (with amount, signature of the applicant, and attestation)

- Emergency certificate (with signature and stamp of the hospital/treated doctor)

- Essentiality certificate (with signature and stamp of the hospital/treated doctor; the amount in the Essentiality Certificate should match the amount in Annexure-II)

- Discharge Summary (with signature and stamp of the hospital/treated doctor)

- Out Patient Card if treatment was taken as an Out Patient.

- Dependent and Non-drawal certificates (with attestation from the forwarding authority and signature of the applicant).

- For every follow-up treatment for post-operative cases requiring lifelong treatments, revalidation of prescriptions must be obtained every six months from the specialist Government doctor.

- In cases of accidents or treatments taken in unrecognized hospitals under emergencies, an FIR should be submitted.

- A Legal Heir certificate must be provided in the event of the teacher’s death.

You can easily download the Medical Reimbursement Form for Maharashtra Government Employees in PDF format online from the link provided below. 📄