List of Exempted Goods and Services Under GST

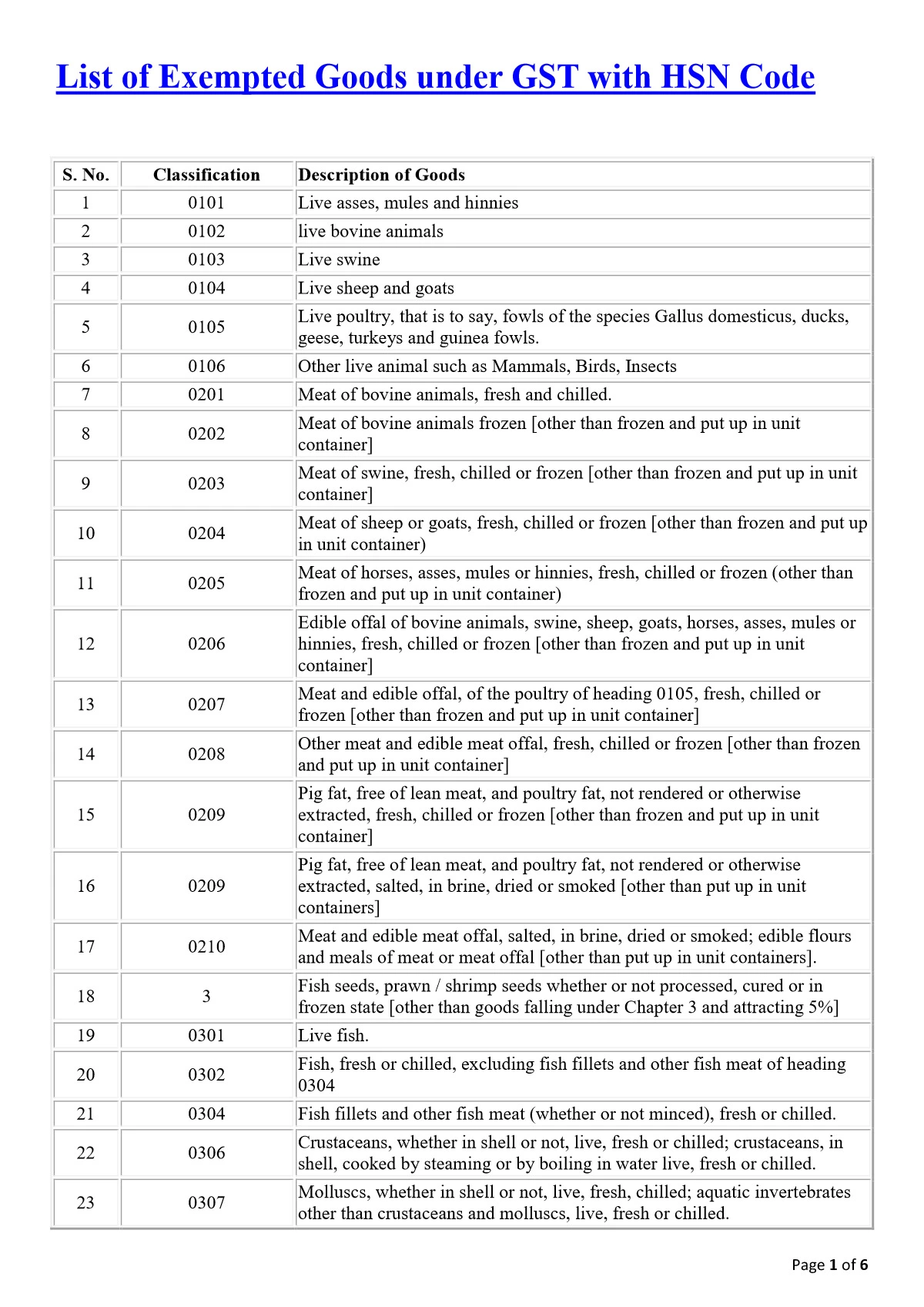

List of GST Exemption on Goods

Businesses and individuals who are supplying goods can claim GST exemption if their aggregate turnover is less than INR 40 lakhs in a financial year.

| Types of goods | Examples |

|---|---|

| Live animals | Asses, cows, sheep, goats, poultry, etc. |

| Meat | Fresh and frozen meat of sheep, cows, goats, pigs, horses, etc. |

| Fish | Fresh or frozen fish |

| Natural products | Honey, fresh and pasteurized milk, cheese, eggs, etc. |

| Live trees and plants | Bulbs, roots, flowers, foliage, etc. |

| Vegetables | Tomatoes, potatoes, onions, etc. |

| Fruits | Bananas, grapes, apples, etc. |

| Dry fruits | Cashew nuts, walnuts, etc. |

| Tea, coffee and spices | Coffee beans, tea leaves, turmeric, ginger, etc. |

| Grains | Wheat, rice, oats, barley, etc. |

| Products of the milling industry | Flours of different types |

| Seeds | Flower seeds, oil seeds, cereal husks, etc. |

| Sugar | Sugar, jaggery, etc. |

| Water | Mineral water, tender coconut water, etc. |

| Baked goods | Bread, pizza base, puffed rice, etc. |

| Fossil fuels | Electrical energy |

| Drugs and pharmaceuticals | Human blood, contraceptives, etc. |

| Fertilizers | Goods and organic manure |

| Beauty products | Bindi, kajal, kumkum, etc. |

| Waste | Sewage sludge, municipal waste, etc. |

| Ornaments | Plastic and glass bangles, etc. |

| Newsprint | Judicial stamp paper, envelopes, rupee notes, etc. |

| Printed items | Printed books, newspapers, maps, etc. |

| Fabrics | Raw silk, silkworm cocoon, khadi, etc. |

| Hand tools | Spade, hammer, etc. |

| Pottery | Earthen pots, clay lamps, etc. |

List of GST Exemption on Services

The threshold limit of aggregate turnover for exemption from registration and payment of GST for suppliers of services has been fixed at ₹ 20 Lakh.

| Types of services | Examples |

|---|---|

| Agricultural services | Cultivation, supplying farm labor, harvesting, warehouse-related activities, renting or leading agricultural machinery, services provided by a commission agent or the Agricultural Produce Marketing Committee or Board for buying or selling agriculture produce, etc. |

| Government services | Postal service, transportation of people or goods, services by a foreign diplomat in India, services offered by the Reserve Bank of India, services offered to diplomats, etc. |

| Transportation services | Transportation of goods by road, rail, water, etc., payment of toll, transportation of passengers by air, transportation of goods where the cost of transport is less than INR 1500, etc. |

| Judicial services | Services offered by the arbitral tribunal, partnership firm of advocates, senior advocates to an individual or business entity whose aggregate turnover is up to INR 40 lakhs |

| Educational services | Transportation of faculty or students, mid-day meal scheme, examination services, services offered by IIMs, etc. |

| Medical services | Services offered by ambulances, charities, veterinary doctors, medical professionals, etc. does not include hair transplant or cosmetic or plastic surgery. |

| Organizational services | Services offered by exhibition organizers for international business exhibitions, tour operators for foreign tourists, etc. |

| Other services | Services offered by GSTN to the Central or State Government or Union Territories, admission fee payable to theatres, circuses, sports events, etc. which charge a fee up to INR 250 |