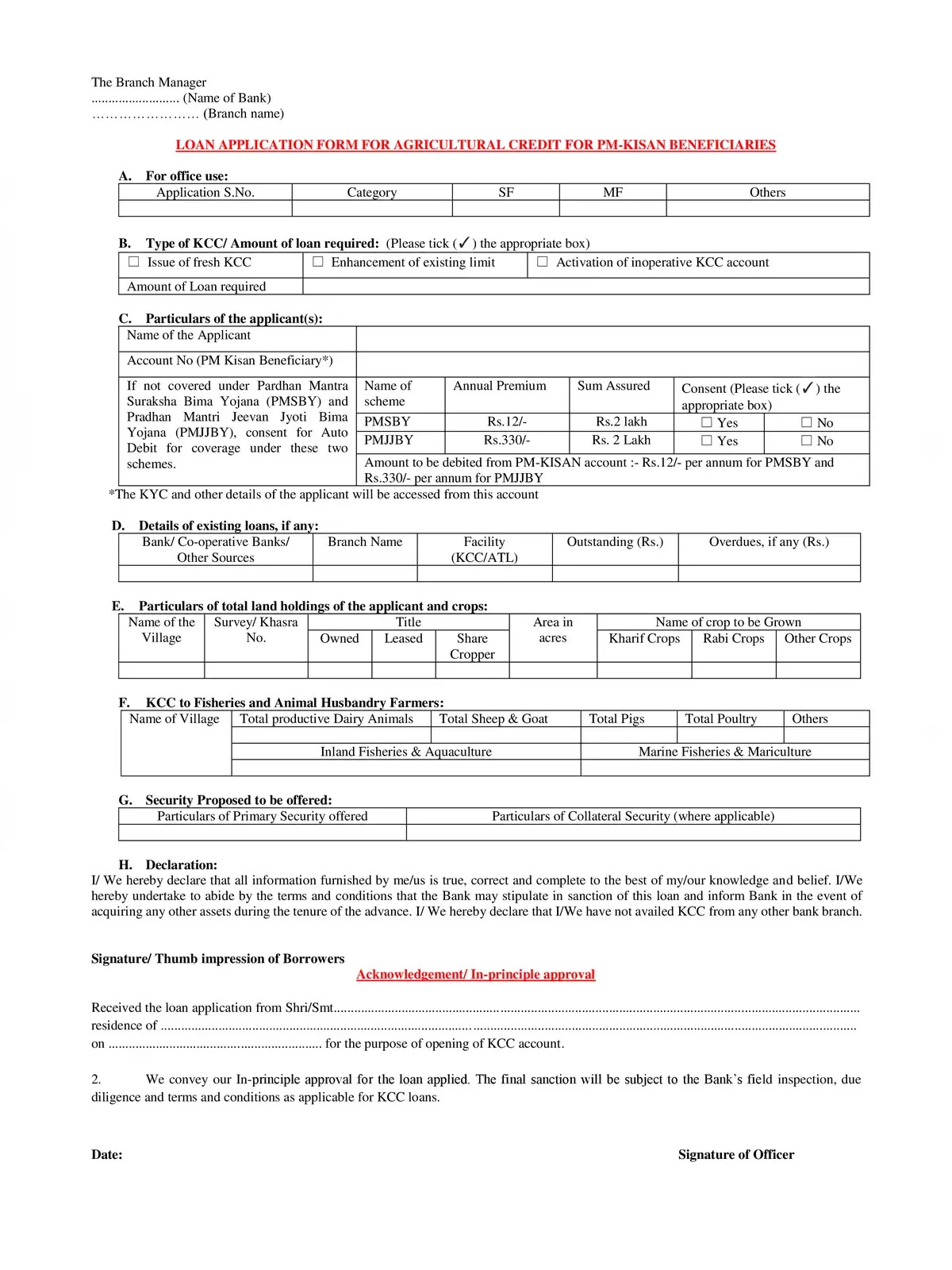

SBI Kisan Credit Card Application Form

Kisan Credit Card Yojana is a scheme that offers short-term, revolving credit to farmers across India. It was launched in August 1998 with an aim to mitigate any financial shortcomings experienced by farmers during crop cultivation, harvesting, and maintenance of their produce.

It is a cash credit facility that is sanctioned to a farmer for farming. When crop season starts, the farmer can avail the credit up to the sanctioned limit for purchase of seeds, manures, pesticides, payment of labour, and for sowing work in the field.

SBI KCC Loan Application Form (Features and Benefits)

- Get interest at saving bank rate on credit balance in KCC account.

- Free ATM cum debit card (State Bank Kisan Card) for all KCC borrowers.

- Interest subvention @2% p.a is available for loan amount upto Rs. 3 Lacs.

- Additional interest subvention @3% p.a for prompt repayments.

- Notified crops / notified areas are covered under crop insurance for all KCC loans.

- Quantum of loan for 1st year will be assessed on the basis of Cost of cultivation, post-harvest expenses and farm maintenance cost.

- For subsequent 5 year loan will be sanction on the basis of increase in scale of finance.

- Collateral security is waived for KCC limit upto Rs. 1.60 lac.

- Sanctioned KCC limit will be considered for the purpose of fixing collateral security requirement.

- Simple interest @7% p.a will be charged for one year or upto the repayment due date, which ever is earlier.

- In case of non-repayment within the due dates interest is applied at card rate.

- Beyond due date interest will be compounded half yearly.

- The repayment period may be fixed as per the anticipated harvesting and marketing period for the crops for which a loan has been granted.

You can download the SBI Kisan Credit Card Application Form PDF using the link given below.