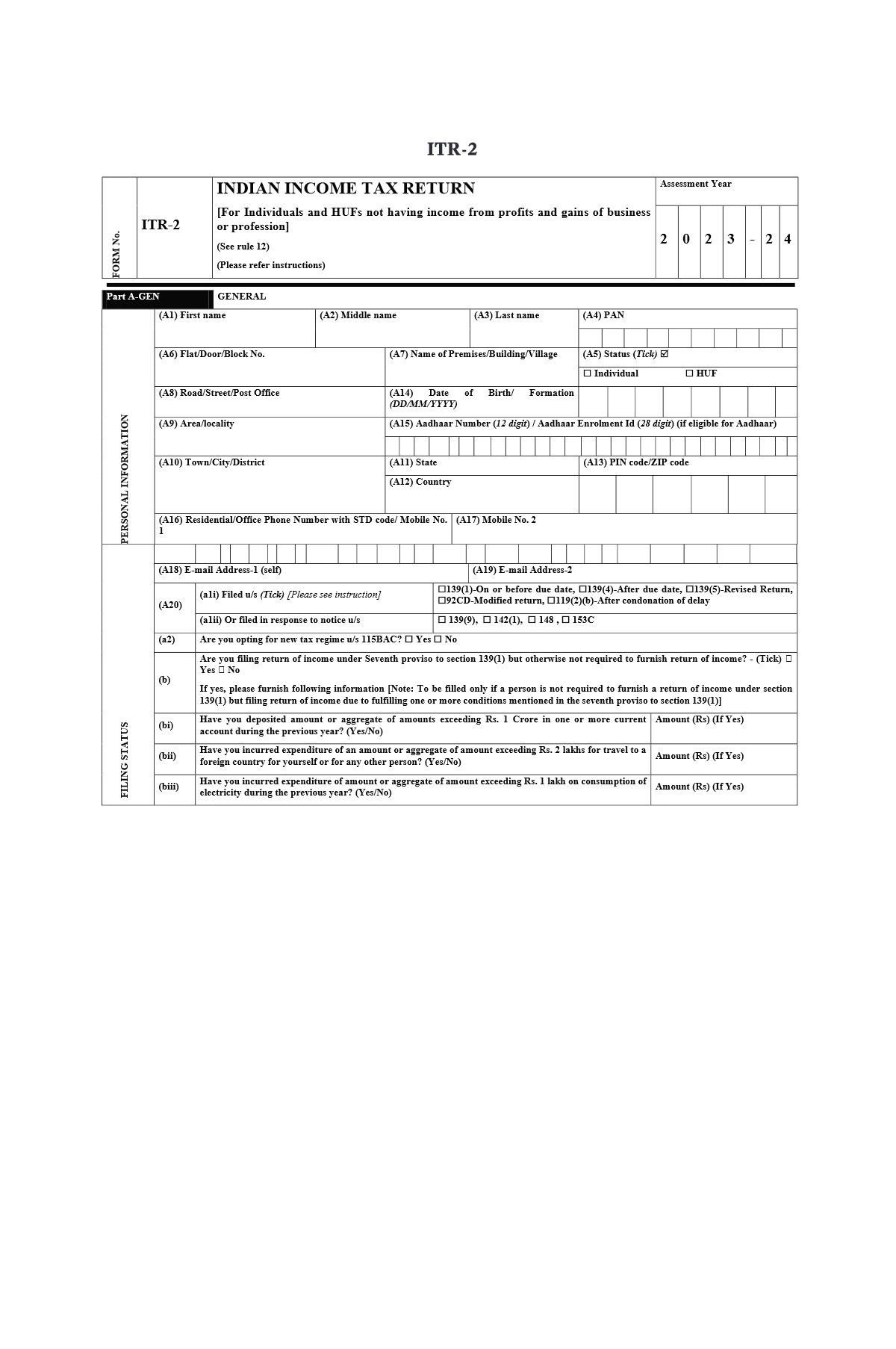

ITR-2 Filled Form Example for AY 2024-25

The pre-filling and filing of ITR-2 service is available to registered users on the e-Filing portal. This service enables individual taxpayers and HUFs to file ITR-2 through the e-Filing portal. This user manual covers the process for filing ITR-2 through online mode.

| General |

|

| Others |

|

ITR-2 has the following sections that you need to fill before submitting the form, a summary section where you review your tax computation and pay tax and finally submit the return for verification:

- 3.1 Part A General

- 3.2 Schedule Salary

- 3.3 Schedule House Property

- 3.4 Schedule Capital Gains

- 3.5 Schedule 112A and Schedule-115AD(1)(iii) proviso

- 3.6 Schedule Other Sources

- 3.7 Schedule CYLA

- 3.8 Schedule BFLA

- 3.9 Schedule CFL

- 3.10 Schedule VI-A

- 3.11 Schedule 80G and Schedule 80GGA

- 3.12 Schedule AMT

- 3.13 Schedule AMTC

- 3.14 Schedule SPI

- 3.15 Schedule SI

- 3.16 Schedule EI

- 3.17 Schedule PTI

- 3.18 Schedule FSI

- 3.19 Schedule TR

- 3.20 Schedule FA

- 3.21 Schedule 5A

- 3.22 Schedule AL

- 3.23 Part B – Total Income (TI)

- 3.24 Tax Paid

- 3.25 Part B-TTI

3.1 Part A General

In the Part A General section of the ITR, you need to verify the pre-filled data from your e-Filing profile. You will not be able to edit some of your data directly in the form. However, can make the necessary changes by going to your e-Filing profile. You can edit your contact details, filing status, residential status and bank details in the form itself.