Form 9465

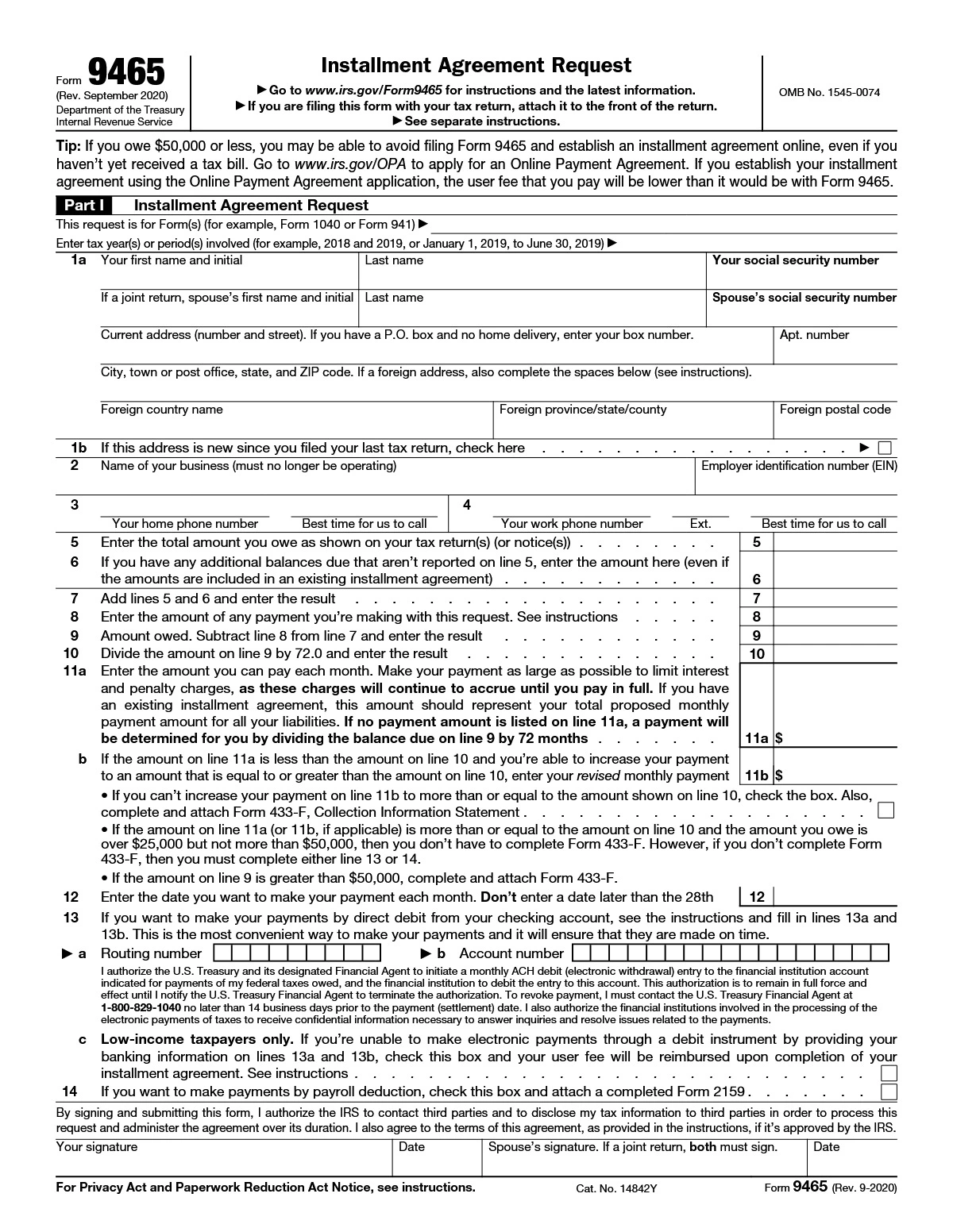

Use Form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. See Streamlined installment agreement, later, for more information. In certain circumstances, you can have longer to pay or you can establish an agreement for an amount that is less than the amount of tax you owe.

However, before requesting a payment plan, you should consider other alternatives, such as getting a bank loan or using available credit, which may be less costly. If you have any questions about this request, call 800-829-1040.

Who should use this form?

Use Form 9465 if you’re an individual:

- Who owes income tax on Form 1040 or 1040-SR;

- Who is or may be responsible for a trust fund recovery penalty;

- Who owes employment taxes (for example, as reported on Forms 941, 943, or 940) related to a sole proprietor business that is no longer in operation; or

- Who owes an individual shared responsibility payment under the Affordable Care Act (this payment isn’t assessed for months beginning after December 31, 2018). See section 5000A.

Who should not use this form?

Don’t use Form 9465 if:

- You can pay the full amount you owe within 180 days (if you plan to pay the taxes, interest, and penalties due in full within 180 days, you can save the cost of the user fee—see Can you pay in full within 180 days? next);

- You want to request a payment plan online, including an installment agreement (see Applying online for an installment agreement and other payment plans, later); or

- Your business is still operating and owes employment or unemployment taxes. Instead, call the telephone number on your most recent notice to request an installment agreement.

Can you pay in full within 180 days?

If you can pay the full amount you owe within 180 days, you can avoid paying the fee to set up an installment agreement by calling the IRS at 800-829-1040. If you owe $100,000 or less, you can apply for a short-term payment plan, if you can pay in full within 180 days, by using the OPA application at IRS.gov/OPA.