IRS Form 8332

What is IRS Form 8332?

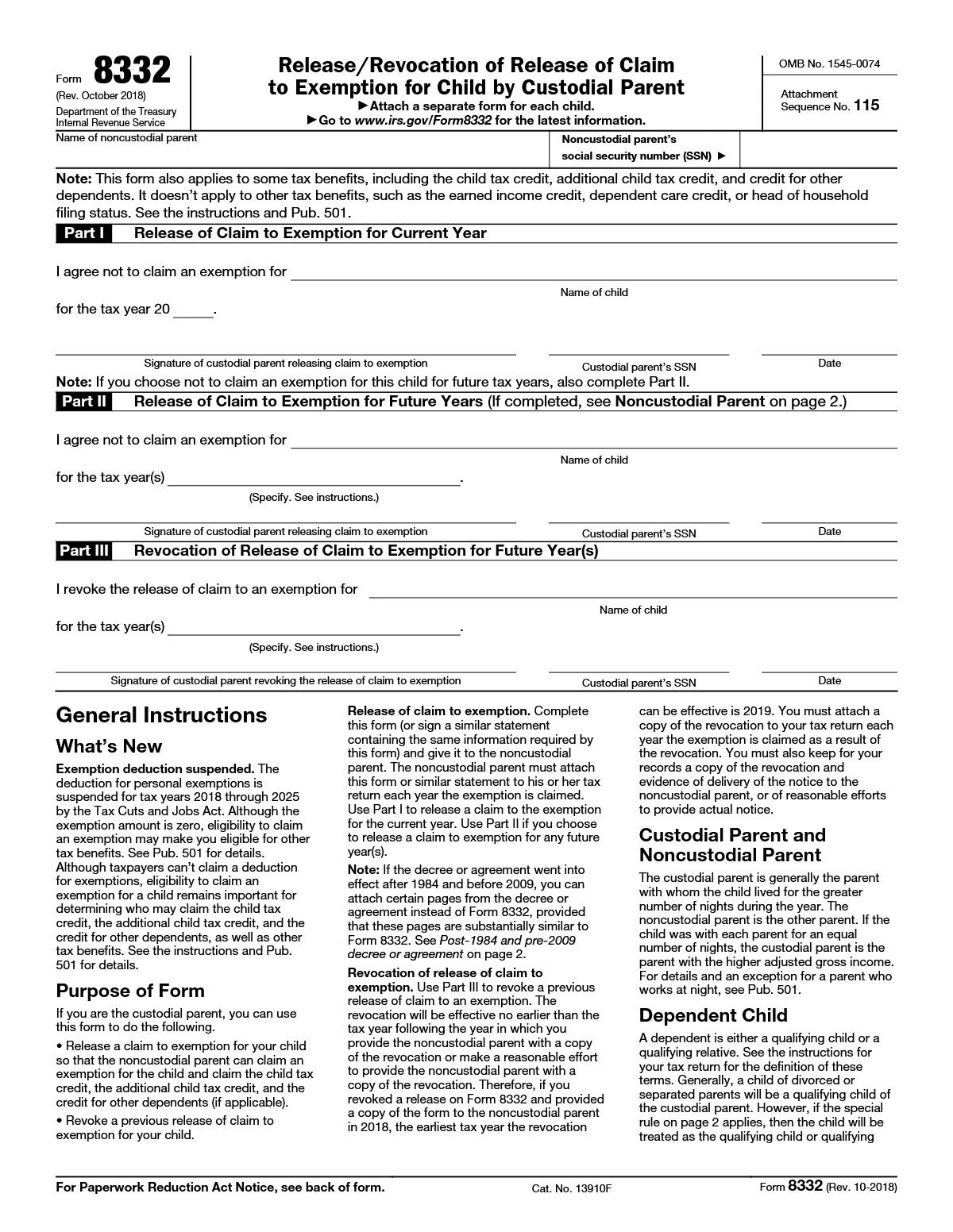

IRS Form 8332, Release/Revocation of Claim to Exemption for Child by Custodial Parent, is used by a custodial parent to release their claim to a child’s tax exemption, allowing the noncustodial parent to claim the child as a dependent.

When is Form 8332 Needed?

When divorced or separated parents share custody and the noncustodial parent wants to claim the child as a dependent.

The custodial parent must sign and submit the form to release or revoke the exemption.

Key Sections of Form 8332

- Release of Claim – The custodial parent agrees to allow the noncustodial parent to claim the child for one or multiple tax years.

- Revocation of Release – The custodial parent can revoke the release for future years by submitting the form again.