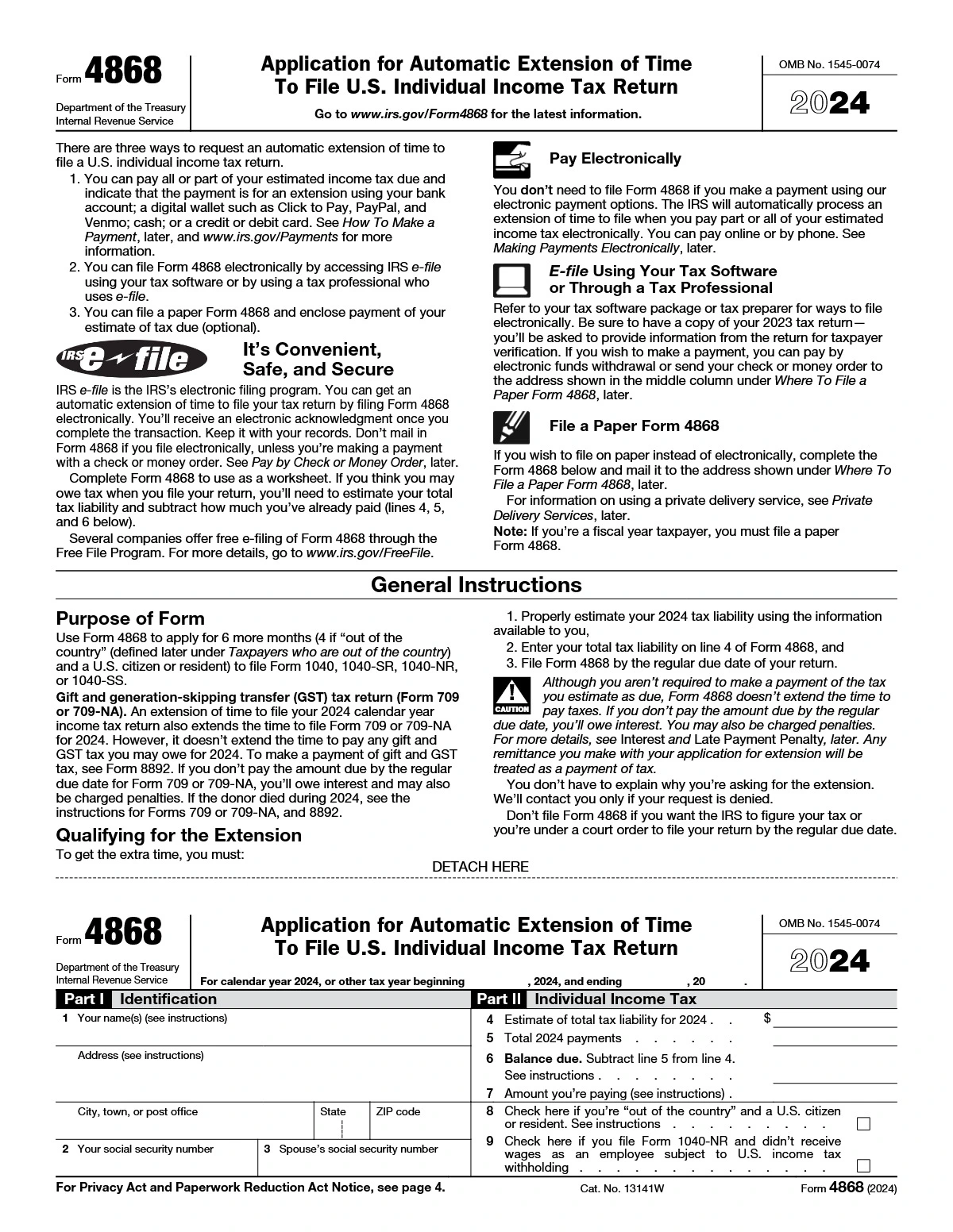

Form 4868

Purpose of Form

Use Form 4868 to apply for 6 more months (4 if “out of the country” (defined later under Taxpayers who are out of the country) and a U.S. citizen or resident) to file Form 1040, 1040-SR, 1040-NR, or 1040-SS. Gift and generation-skipping transfer (GST) tax return (Form 709 or 709-NA). An extension of time to file your 2024 calendar year income tax return also extends the time to file Form 709 or 709-NA for 2024. However, it doesn’t extend the time to pay any gift and GST tax you may owe for 2024. To make a payment of gift and GST tax, see Form 8892. If you don’t pay the amount due by the regular due date for Form 709 or 709-NA, you’ll owe interest and may also be charged penalties. If the donor died during 2024, see the instructions for Forms 709 or 709-NA, and 8892

When To File Form 4868

File Form 4868 by April 15, 2025. Fiscal year taxpayers file Form 4868 by the original due date of the fiscal year return.

Taxpayers who are out of the country. If, on the regular due date of your return, you’re out of the country (as defined below) and a U.S. citizen or resident, you’re allowed 2 extra months to file your return and pay any amount due without requesting an extension. Interest will still be charged, however, on payments made after the regular due date, without regard to the extension. If you’re out of the country and file a calendar year income tax return, you can pay the tax and file your return or this form by June 16, 2025. File this form and be sure to check the box on line 8 if you need an additional 4 months to file your return.

If you’re out of the country and a U.S. citizen or resident, you may qualify for special tax treatment if you meet the bona fide residence or physical presence test. If you don’t expect to meet either of those tests by the due date of your return, request an extension to a date after you expect to meet the tests by filing Form 2350, Application for Extension of Time To File U.S. Income Tax Return.

You’re out of the country if:

- You live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or

- You’re in military or naval service on duty outside the United States and Puerto Rico. If you qualify as being out of the country, you’ll still be eligible for the extension even if you’re physically present in the United States or Puerto Rico on the regular due date of the return. For more information on extensions for taxpayers out of the country, see Pub. 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad. Form 1040-NR filers. If you can’t file your return by the due date, you should file Form 4868. You must file Form 4868 by the regular due date of the return. If you didn’t receive wages as an employee subject to U.S. income tax withholding, and your return is due June 16, 2025, check the box on line 9. For more information on extensions for nonresident filers, see Pub. 519, U.S. Tax Guide for Aliens.