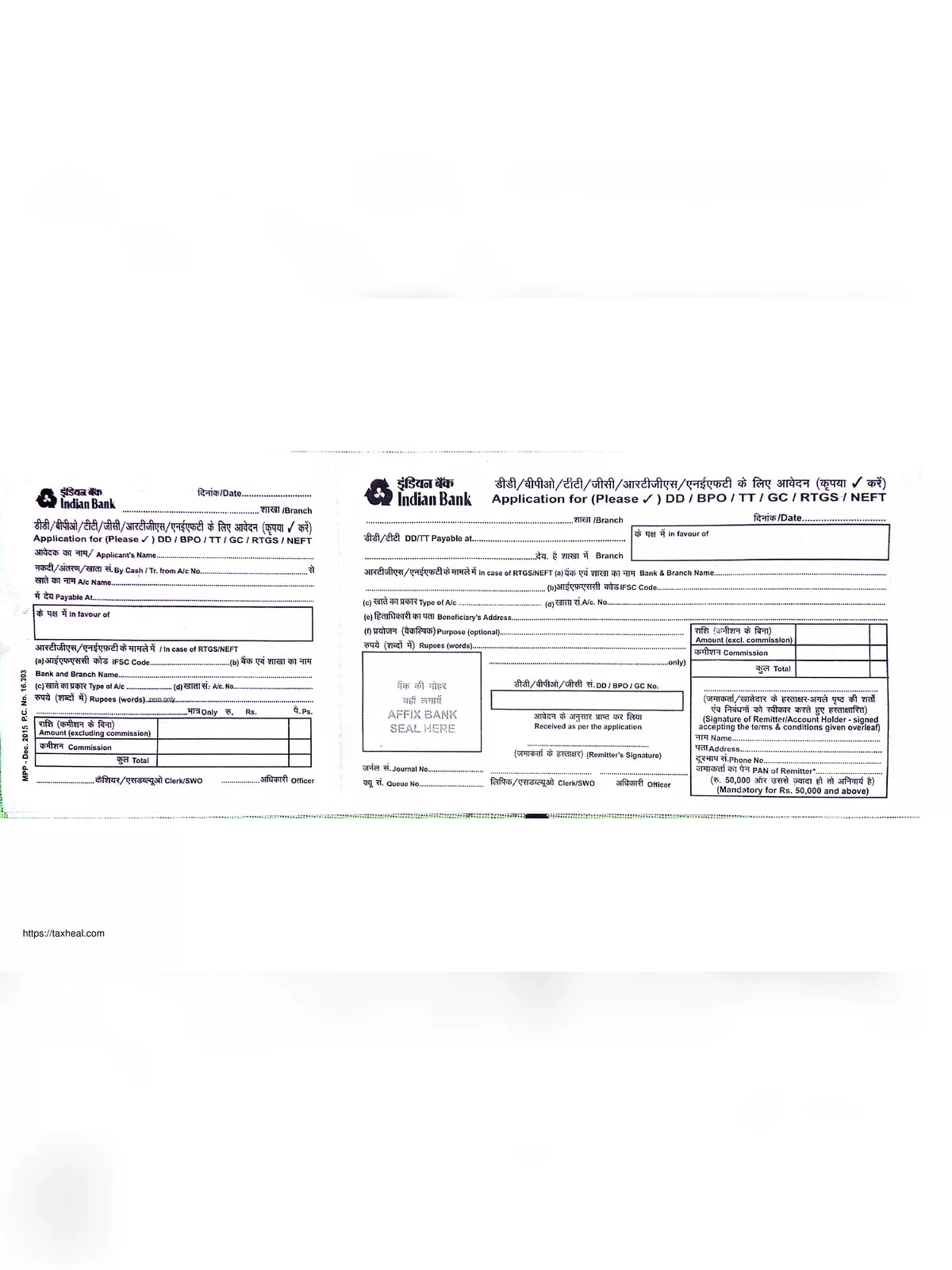

Indian Bank RTGS/NEFT/DD Form – For Money Transfer

Indian Bank RTGS payment method is a way of fund transfer that allows the money sent by the remitter to immediately reach the beneficiary/payee as and when the request is received.

The customer fills out an application form providing details of the beneficiary (like name, bank, branch name, IFSC, account type, and account number) and the amount to be remitted. Then Submit to the nearest branch of Indian Bank

Indian Bank RTGS Form – Overview

| File Name | Indian Bank RTGS and NEFT Form |

| Form Type | |

| Beneficiary | Indian Bank Account Holders |

| Language | English |

| Uses | Online Fund Transfer |

| Official Site | indianbank.net.in |

Indian Bank RTGS Charges

- Rs. 25+Applicable Taxes for Sum between INR 2 lakh to INR 5 lakh

- Rs. 50+Applicable Taxes for Sum between INR 5 lakh to INR 10 lakh

Indian Bank NEFT Charges

| Transaction Charges | NEFT |

|---|---|

| Cash up to ₹ 10,000 | ₹ 2.50 + Applied Taxes |

| Sum between ₹ 10,000 and ₹ 1 lakh | ₹ 5 + Applied Taxes |

| Sum between ₹ 1 lakh and ₹ 2 lakh | ₹ 15 + Applied Taxes |

| Sum between ₹ 2 lakh and ₹ 5 lakh | ₹ 25 + Applied Taxes |

| Sum between ₹ 5 lakh and ₹ 10 lakh | ₹ 25 + Applied Taxes |