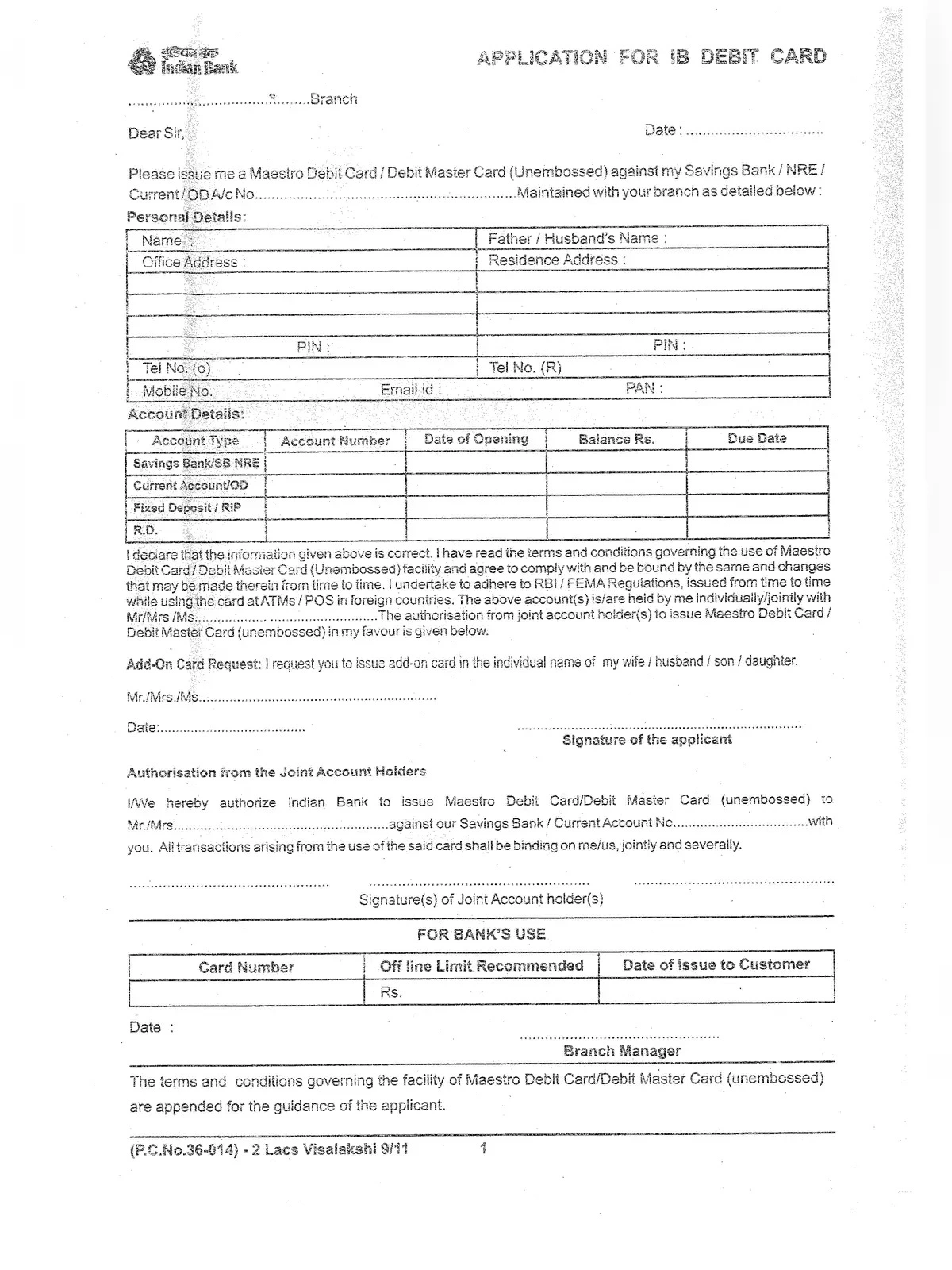

Indian Bank ATM Card Form

An Indian Bank ATM Card is a convenient and secure way to access your bank account, allowing you to perform a variety of financial transactions with ease. Here is how to fill application form for losing the Indian Bank ATM Card.

- Fill out the application form with all the details that are asked in the form.

- Cross-check to verify that there are no errors or mistakes I can make in the application form.

- Once you have filled the form successfully make your signature on it.

- Apply to the bank officials and you are done with it! You will get a new Indian Bank ATM card soon.

Indian Bank ATM Card Application Form (Required Details)

- Customer Account Details

- Applicant Name

- Father/Mother Name

- Permanent Address

- Mobile Number

- Type of Account

- Signature of the Applicant

- And any other details

Documents Required for Indian Bank ATM Card Form

- Application Form: The bank’s specific ATM card application form needs to be filled out accurately and completely.

- Identity Proof: This could be any government-issued photo identification document such as:

- Passport

- Driver’s License

- Voter ID Card

- Aadhaar Card (in India)

- National ID Card

- Address Proof: Documents that establish your current address, which can include:

- Utility bills (electricity, water, gas) issued within the last three months

- Bank account statements

- Rental agreement

- Property tax bill

- Aadhaar Card (if address is mentioned)

- Photographs: Usually passport-sized photographs are required, though the number may vary depending on the bank.

- Signature Proof: Some banks may require a signature verification document or a copy of your signature.

- Income Proof: In some cases, especially for premium accounts or credit-linked ATM cards, banks may require income proof documents such as salary slips, Income Tax Returns (ITR), or Form 16.

- Existing Bank Account Details: If you are applying for an ATM card linked to an existing bank account, you may need to provide details of that account.

- Reference Letter: Some banks might require a reference letter from an existing account holder or a person of standing in the community.