Income Tax Computation Format

Income tax is computed based on the applicable tax slab rates. Your taxable income is determined after applying relevant deductions and accounting for other taxes such as Advance Tax and the tax deducted at source (TDS). The resulting taxable income will then be taxed according to the slab rate that applies to you.

Understanding Income Tax Computation

When calculating your income tax, it’s important to consider several factors, such as your total taxable income, current tax rates, eligible deductions, and exemptions. This guide provides a simple overview of the process. You can easily download the Income Tax Computation Format for AY 2024-25 in PDF format using the link below.

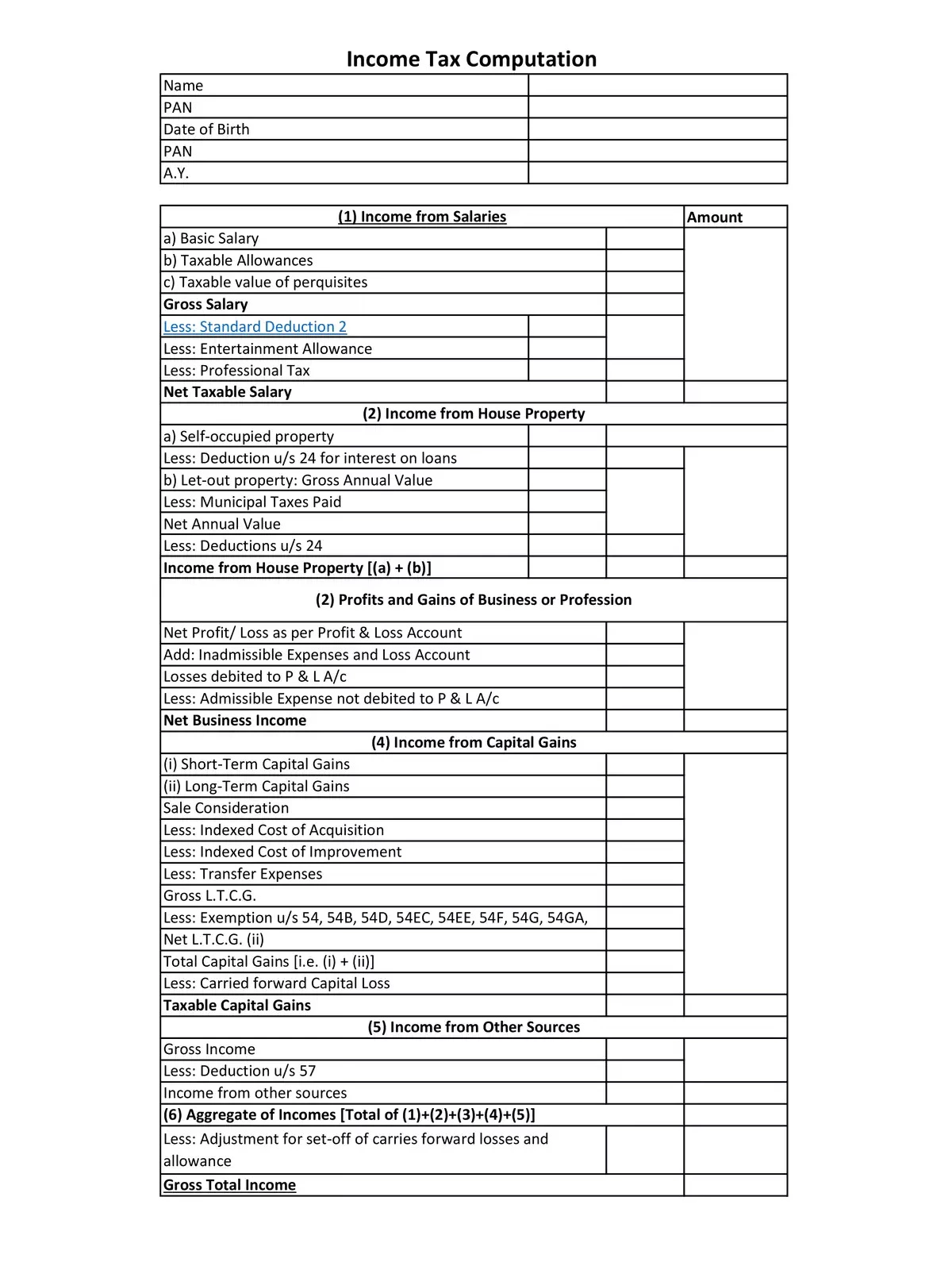

Income Tax Computation Format for AY 2024-25

- Name

- PAN

- Date of Birth

- A.Y.

- Basic Salary

- Taxable Allowances

- Taxable value of perquisites

- Gross Salary

- Less: Standard Deduction

- Less: Entertainment Allowance

- Less: Professional Tax

- Net Taxable Salary

To make your tax calculation easier, download the Income Tax Computation Format in PDF format from the link provided below.