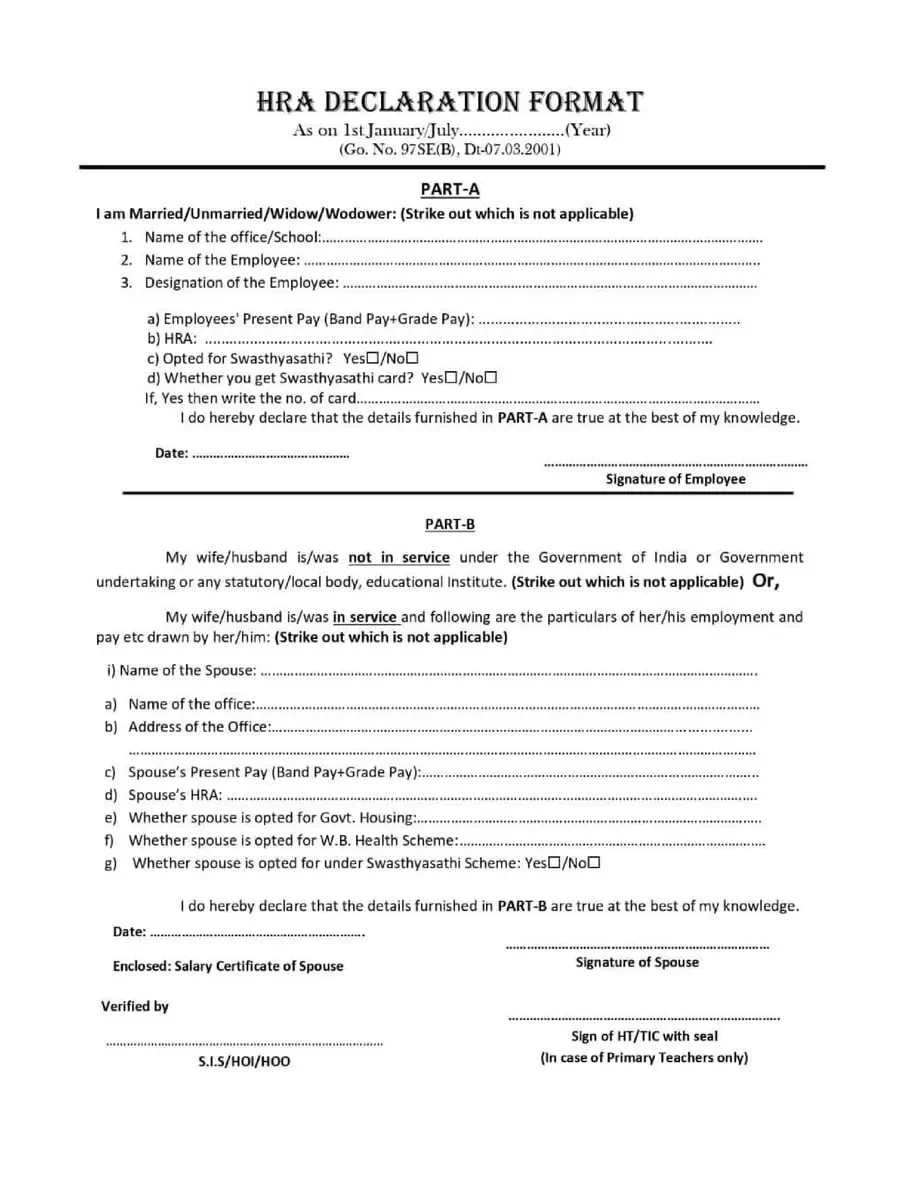

HRA Declaration Form for School Teachers 2026

House Rent Allowance, or commonly known as HRA, is an amount that is paid by employers to employees as a part of their salaries. This is basically done as it helps provide employees with tax benefits towards the payment for accommodations every year. The decision of how much HRA needs to be paid to the employee is made by the employer on the basis of a number of different criteria such as the salary and the city of residence.

n order to calculate the HRA, the salary is defined as the sum of the basic salary, dearness allowances, and any other commissions. If an employee does not receive a commission or a dearness allowance, then the HRA will be around 40% – 50% of his/her basic salary.

- The actual HRA offered, in all probability, will be the lowest of the following three provisions:

- The actual rent that is paid should be less than 10% of the basic salary.

- In case you’re staying in a metro, 50% of the basic salary and 40% if you live in a non-metro city.

- The actual amount received as the HRA from the employer.

Download the HRA Declaration Form for School Teachers 2023 in PDF format online form the link given below or alternative link.