GST Rate List

For all regular taxpayers, the primary GST slabs are now set at 0% (nil-rated), 5%, 12%, 18%, and 28%. A couple of the less popular GST rates include 3% and 0.25%.

Additionally, the composition taxable individuals are required to pay GST at nominal or lower rates, such as 1.5%, 5%, or 6% of their sales. Under the GST, there is also the idea of TDS and TCS, with rates of 2% and 1%, respectively.

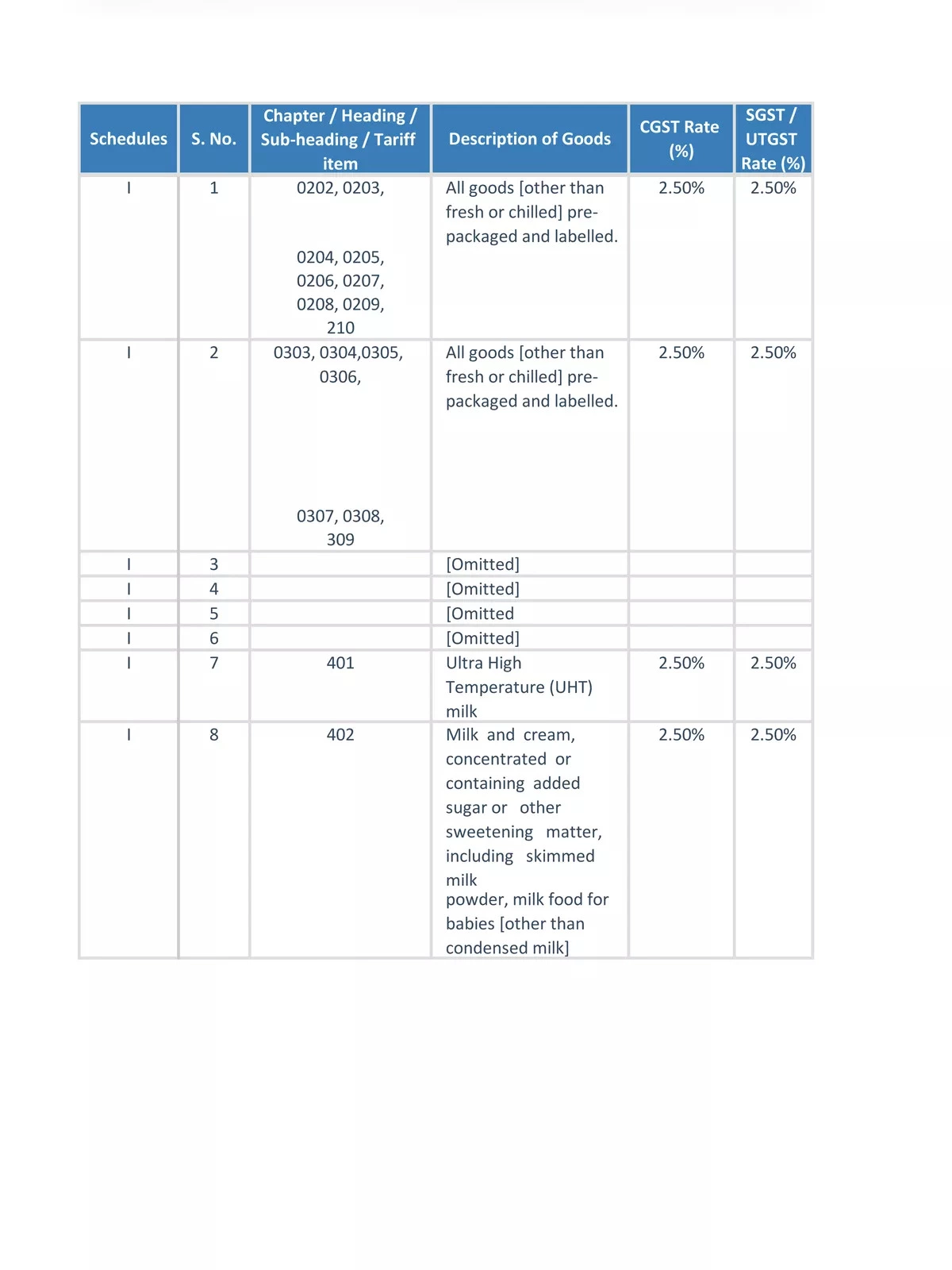

GST Rate List in India – Goods and Service Tax Rates, Slab & Revision

| Tax Rates | Products | |

|---|---|---|

| 0% | Milk | Kajal |

| 0% | Eggs | Educations Services |

| 0% | Curd | Health Services |

| 0% | Lassi | Children’s Drawing & Colouring Books |

| 0% | Unpacked Foodgrains | Unbranded Atta |

| 0% | Unpacked Paneer | Unbranded Maida |

| 0% | Gur | Besan |

| 0% | Unbranded Natural Honey | Prasad |

| 0% | Fresh Vegetables | Palmyra Jaggery |

| 0% | Salt | Phool Bhari Jhadoo |

| 5% | Sugar | Packed Paneer |

| 5% | Tea | Coal |

| 5% | Edible Oils | Raisin |

| 5% | Domestic LPG | Roasted Coffee Beans |

| 5% | PDS Kerosene | Skimmed Milk Powder |

| 5% | Cashew Nuts | Footwear (< Rs.500) |

| 5% | Milk Food for Babies | Apparels (< Rs.1000) |

| 5% | Fabric | Coir Mats, Matting & Floor Covering |

| 5% | Spices | Agarbatti |

| 5% | Coal | Mishti/Mithai (Indian Sweets) |

| 5% | Life-saving drugs | Coffee (except instant) |

| 12% | Butter | Computers |

| 12% | Ghee | Processed food |

| 12% | Almonds | Mobiles |

| 12% | Fruit Juice | Preparations of Vegetables, Fruits, Nuts or other parts of Plants including Pickle Murabba, Chutney, Jam, Jelly |

| 12% | Packed Coconut Water | Umbrella |

| 18% | Hair Oil | Capital goods |

| 18% | Toothpaste | Industrial Intermediaries |

| 18% | Soap | Ice-cream |

| 18% | Pasta | Toiletries |

| 18% | Corn Flakes | Computers |

| 18% | Soups | Printers |

| 28% | Small cars (+1% or 3% cess) | High-end motorcycles (+15% cess) |

| 28% | Consumer durables such as AC and fridge | Beedis are NOT included here |

| 28% | Luxury & sin items like BMWs, cigarettes and aerated drinks (+15% cess) | |

GST Rate Changes at 53rd GST Council Meeting

Particulars | New GST Rate/Exemption |

| Extra Neutral Alcohol used for the manufacture of alcoholic liquor for human consumption | Exempt |

| Imports of parts, components, testing equipment, tools, and tool-kits of aircraft, irrespective of their HS classification, are used to boost the MRO activities subject to specified conditions. | 5% IGST |

| Parts of Poultry keeping Machinery | 12% |

| All milk cans (different materials), irrespective of use | 12% |

| All carton boxes and cases of both corrugated and non-corrugated paper board | 12% |

| All types of sprinklers, including fire water sprinklers | 12% |

| All solar cookers, whether or not single or dual energy source | 12% |

| Services provided by Indian Railways to common man for sale of platform tickets, cloak rooms, and battery operated car services are exempted, including intra railway supplies | Exempt |

| Service by way of hostel accommodation is currently not exempted if outside educational institution upon satisfying the conditions that the rent limit is up to Rs. 20,000 per person per month, and the service is rendered for a continuous period of 90 days | Exempt |

| Corporate guarantee if in case it is for services or goods where whole ITC is available | Exempt |

| Services provided by Special Purpose Vehicles (SPV) to Indian Railway by way of allowing Indian Railway to use infrastructure built & owned by SPV during the concession period and maintenance services supplied by Indian Railways to SPV | Exempt |

| Imports of specified items for defence forces | IGST is exempt for five years till 30th June 2029 |

| Imports of research equipment/buoys imported under the Research Moored Array for African-Asian-Australian Monsoon Analysis and Prediction (RAMA) programme subject to specified conditions | IGST is exempt |

| Imports in SEZ by SEZ Unit/developers for authorised operations with effect from 1st July 2017 | Compensation Cess is exempt |

| Supply of aerated beverages and energy drinks to authorised customers by Unit Run Canteens under the Ministry of Defence | Compensation Cess is exempt |

| Import of technical documentation for AK-203 rifle kits imported for the Indian Defence forces. | Ad hoc IGST exemption provided |