GST State Wise Code List

Every taxpayer under Goods and Services Tax Identification Number (GSTIN) must take note of correct GST State codes for each State and Union Territory as it is used widely in various GST compliance and adjudication. The Goods and Services Tax Identification Number (GSTIN) is a 15-digit alphanumeric unique identification number provided to a taxpayer who registered under the GST.

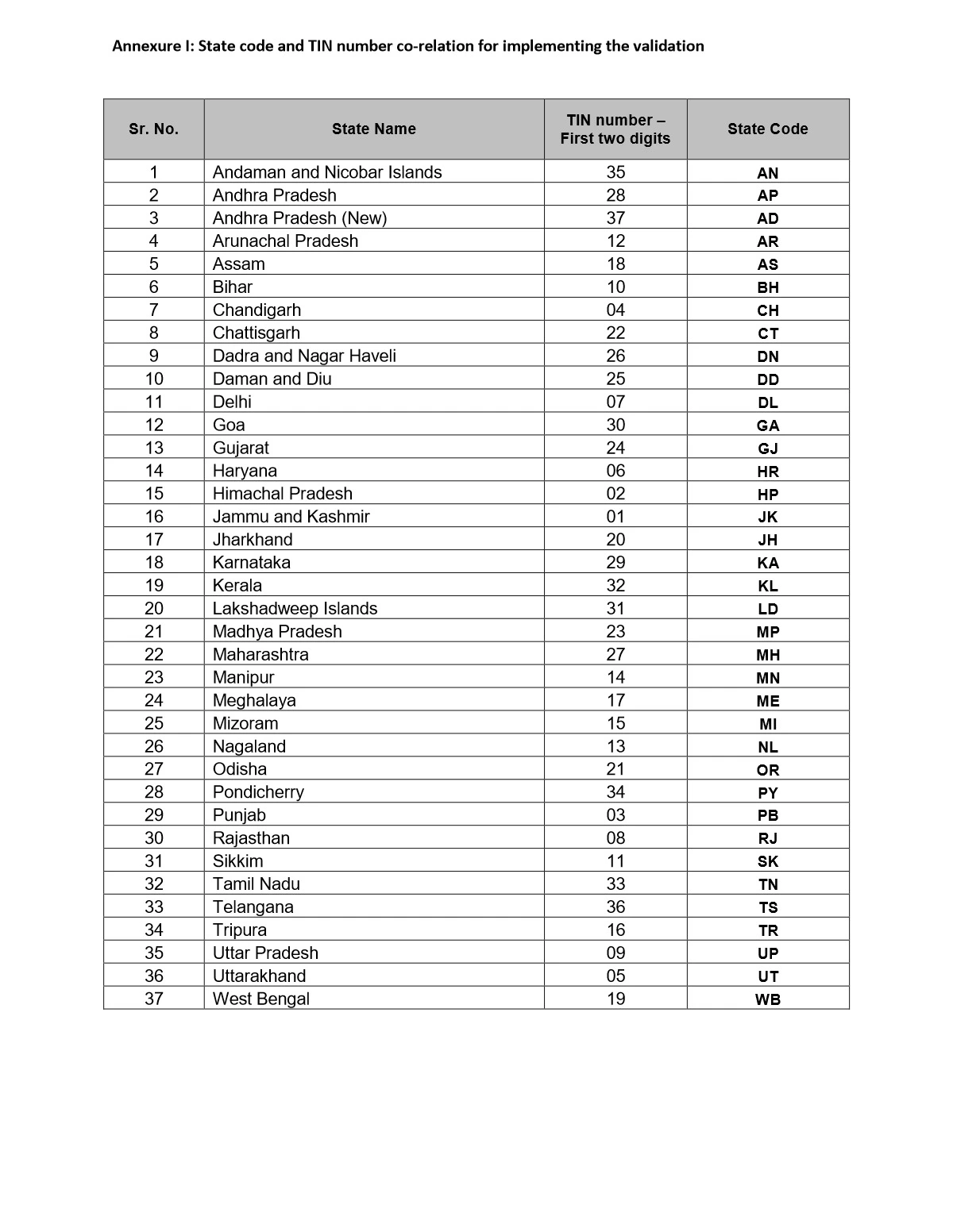

The first two digits of any GSTIN represent the GST state code. The GST state code list is used by a taxpayer while registering for GST and entering invoice details in GST Returns in the form of GSTIN.

GST State Code List and Jurisdiction

| State Name | State Code | Alphabetical Code |

|---|---|---|

| Jammu and Kashmir | 01 | JK |

| Himachal Pradesh | 02 | HP |

| Punjab | 03 | PB |

| Chandigarh | 04 | CH |

| Uttarakhand | 05 | UT |

| Haryana | 06 | HR |

| Delhi | 07 | DL |

| Rajasthan | 08 | RJ |

| Uttar Pradesh | 09 | UP |

| Bihar | 10 | BH |

| Sikkim | 11 | SK |

| Arunachal Pradesh | 12 | AR |

| Nagaland | 13 | NL |

| Manipur | 14 | MN |

| Mizoram | 15 | MI |

| Tripura | 16 | TR |

| Meghalaya | 17 | ME |

| Assam | 18 | AS |

| West Bengal | 19 | WB |

| Jharkhand | 20 | JH |

| Odisha | 21 | OR |

| Chattisgarh | 22 | CT |

| Madhya Pradesh | 23 | MP |

| Gujarat | 24 | GJ |

| Daman and Diu | 25 | DD |

| Dadra and Nagar Haveli | 26 | DN |

| Maharashtra | 27 | MH |

| Andhra Pradesh | 28 | AP |

| Karnataka | 29 | KA |

| Goa | 30 | GA |

| Lakshadweep Islands | 31 | LD |

| Kerala | 32 | KL |

| Tamil Nadu | 33 | TN |

| Pondicherry | 34 | PY |

| Andaman and Nicobar Islands | 35 | AN |

| Telangana | 36 | TS |

| Andhra Pradesh (New) | 37 | AD |

| Ladakh (New) | 38 | LA |

GST (GSTIN) Format

The GSTIN is an alphanumeric number consisting of 15 digits. It is a PAN-based number and is state-specific. The GSTIN can be decoded as follows:

- First Two Digits – Represent the State Code

- Next Ten Digits – Indicate PAN or TAN

- Thirteenth Digit – Represents the number of registration under a single PAN

- The fourteenth Digit – Indicates the nature of business (this is kept as ‘Z’ by default. It is kept blank for future use)

- Fifteenth Digit – Alphanumeric character that indicates the check code