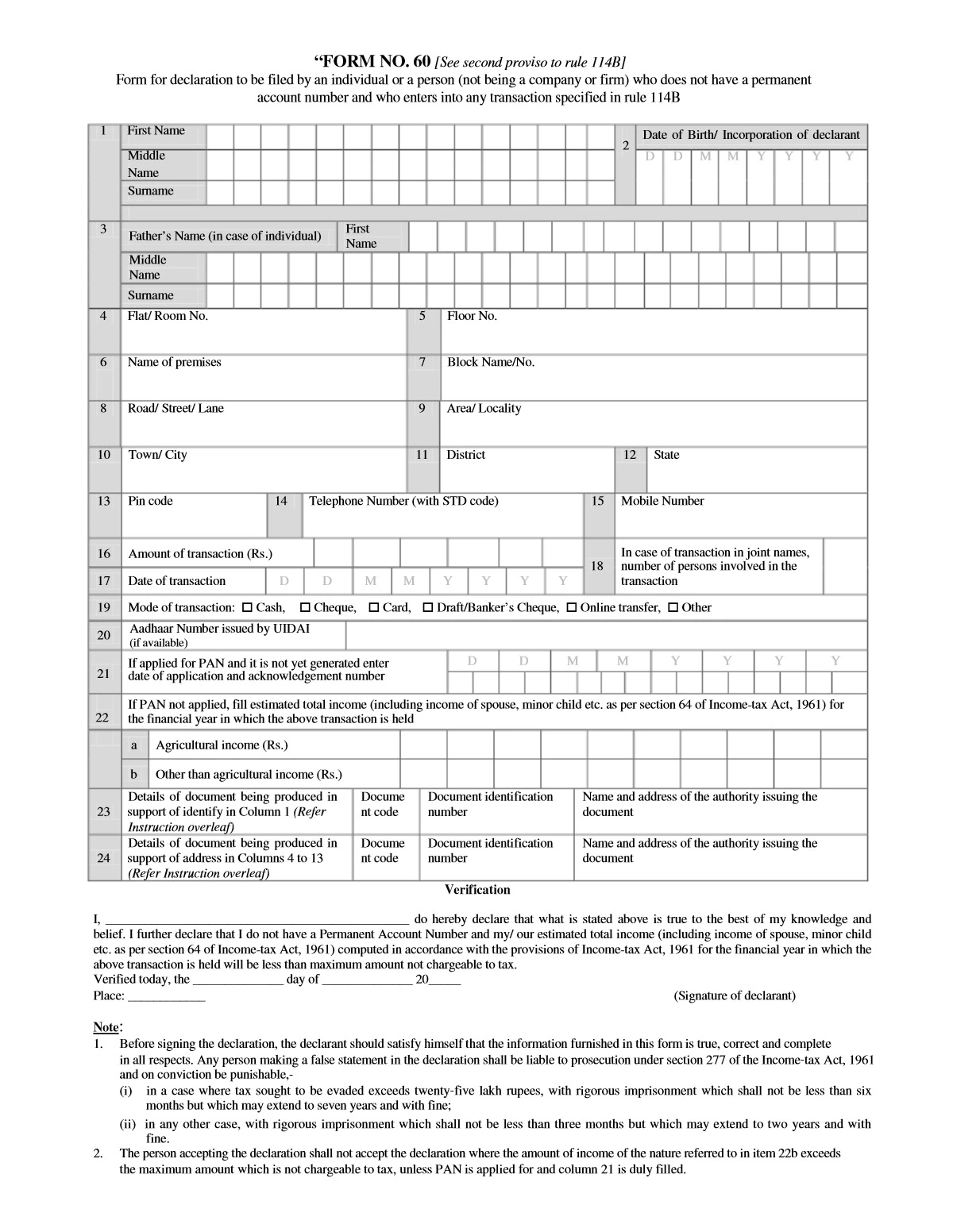

Form 60

Form 60 is used in India for declaring financial transactions by individuals who do not have a Permanent Account Number (PAN). The form is used as a declaration to comply with income tax regulations for specified transactions.

Uses of Form 60:

| Use Case | Description |

|---|---|

| Opening Bank Accounts | Required when opening a new bank account if the individual does not have a PAN card. |

| Depositing Cash | Needed for cash deposits exceeding Rs. 50,000 in a single day at banks if PAN is not available. |

| Buying or Selling Immovable Property | Required for transactions involving the purchase or sale of immovable property valued at Rs. 10 lakh or more. |

| Purchase of Vehicle | Necessary when purchasing a motor vehicle other than a two-wheeler if PAN is not available. |

| Fixed Deposit Creation | Used for creating fixed deposits exceeding Rs. 50,000 with banks or post offices if PAN is not available. |

| Mutual Fund Investments | Needed for investments in mutual funds exceeding Rs. 50,000 if PAN is not available. |

| Purchasing Bonds or Debentures | Required for purchasing bonds or debentures worth more than Rs. 50,000 if PAN is not available. |

| Applying for Credit or Debit Card | Necessary when applying for a credit or debit card if PAN is not available. |

| Telecom Services | Required for acquiring a new mobile or internet connection if PAN is not available. |

| Foreign Exchange Transactions | Needed for transactions related to foreign exchange if PAN is not available. |

| Payment for Hotel/Restaurant Bills | Used for payments exceeding Rs. 50,000 at hotels or restaurants if PAN is not available. |

| Travel Related Payments | Required for payment related to travel expenses exceeding Rs. 50,000 if PAN is not available. |