IRS Form 5329 Instructions for Additional Tax

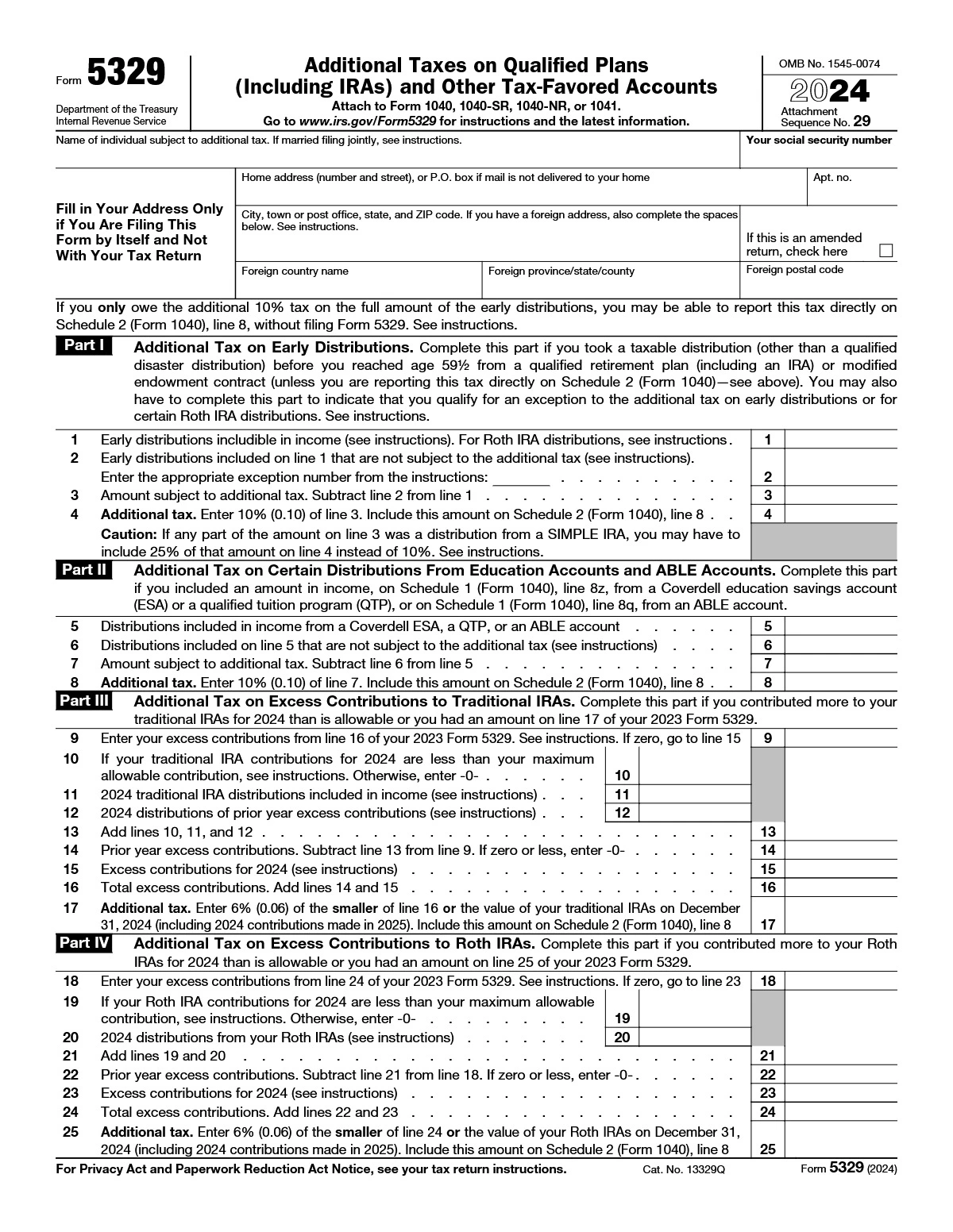

Form 5329 is needed for taxpayers to report additional taxes on IRAs, other qualified retirement plans, and other tax-favored accounts. It’s essential for individuals who have taken early distributions, have excess contributions, or didn’t take required minimum distributions. Filling out Form 5329 helps avoid potential penalties by accurately reporting these activities to the IRS.

Form 5329 used for?

Form 5329 is essential for addressing specific tax situations related to retirement plans and savings accounts. Here’s what it’s used for:

- To report additional taxes on IRAs, other qualified retirement plans, and other tax-favored accounts.

- To correct excess contributions to these accounts.

- To report certain distributions from education savings accounts or Coverdell ESAs.

How to fill out a 5329 form?

- Start by entering your personal information, including your name, address, and Social Security Number at the top of Form 5329.

- For each section that applies to you, fill out the necessary lines. This might include taxes on early distributions, excess contributions, etc.

- Calculate the tax owed by following the instructions for each part that you filled out.

- Sign and date the form if it requires your signature. If an electronic signature is accepted, you can create one to complete the form.

- Review the form thoroughly to ensure all information is accurate and complete before submitting.