Form 3CD for AY 2025-26

Form 3CD is a significant document under the Indian Income Tax Act, specifically used in the context of income tax audits.

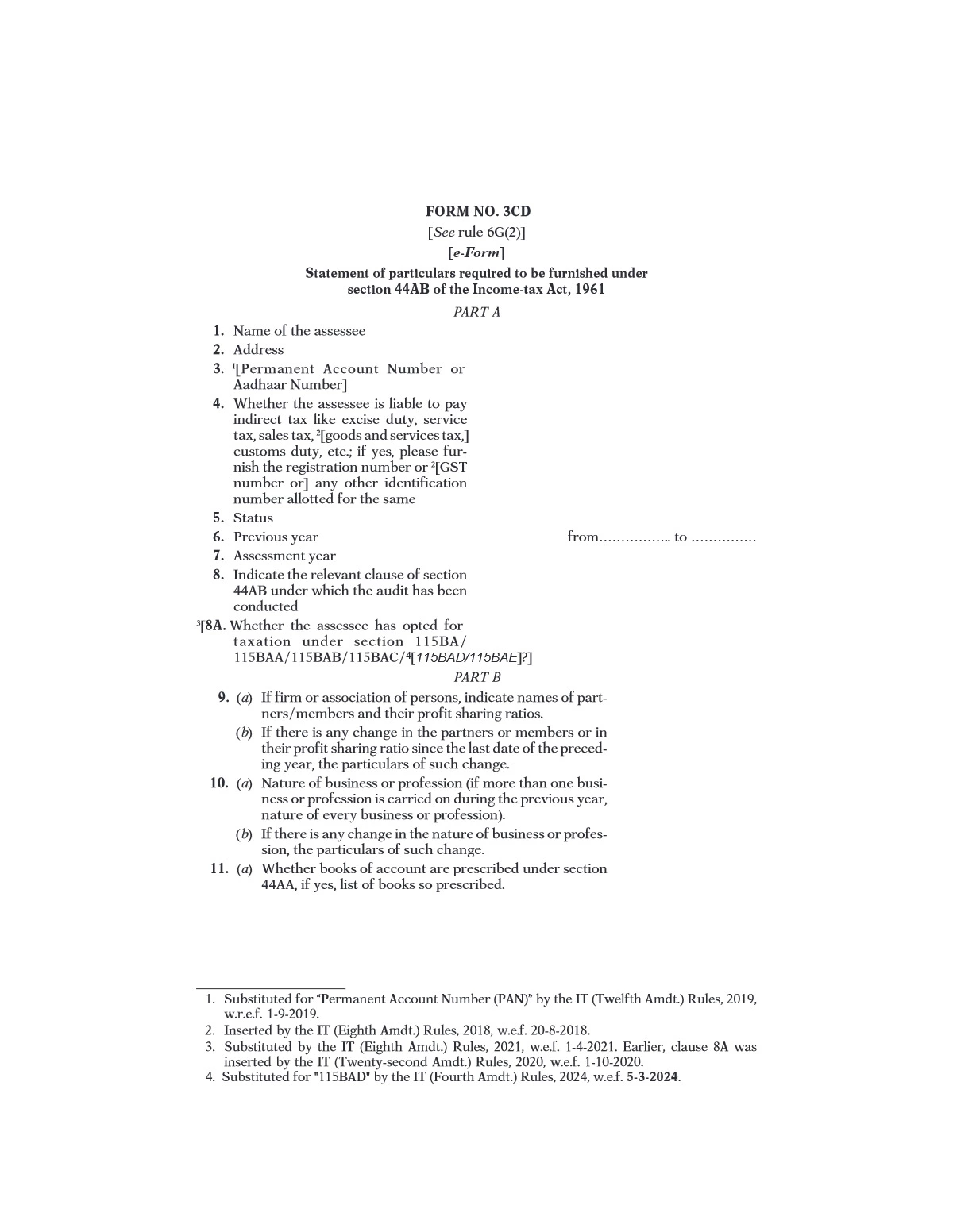

Form 3CD is a part of the Income Tax Act, 1961, and is used for reporting various details related to a taxpayer’s financial statements and audit. It is an integral part of the audit process under Section 44AB of the Income Tax Act, which mandates that certain categories of taxpayers must get their accounts audited.

Uses of Form 3CD 2026

- Income Tax Audit Compliance: Form 3CD is used to report the specifics of the audit conducted under Section 44AB. It is a declaration by the auditor regarding the accuracy and completeness of the taxpayer’s financial statements.

- Disclosure of Information: It requires the disclosure of detailed financial information, including details about income, expenses, and other financial transactions. This helps the Income Tax Department assess the tax liability of the taxpayer.

- Tax Reporting: The form provides a comprehensive report on the taxpayer’s compliance with various provisions of the Income Tax Act. This includes reporting on transactions, financial statements, and specific disclosures required under the Act.

- Preventing Tax Evasion: By mandating detailed disclosures, Form 3CD helps in ensuring transparency and preventing tax evasion. It helps in detecting discrepancies and ensuring that all income and expenses are reported accurately.

- Supporting Tax Returns: The information in Form 3CD supports the tax return filed by the taxpayer. It acts as evidence of the financial information reported and provides additional context for the tax authorities.