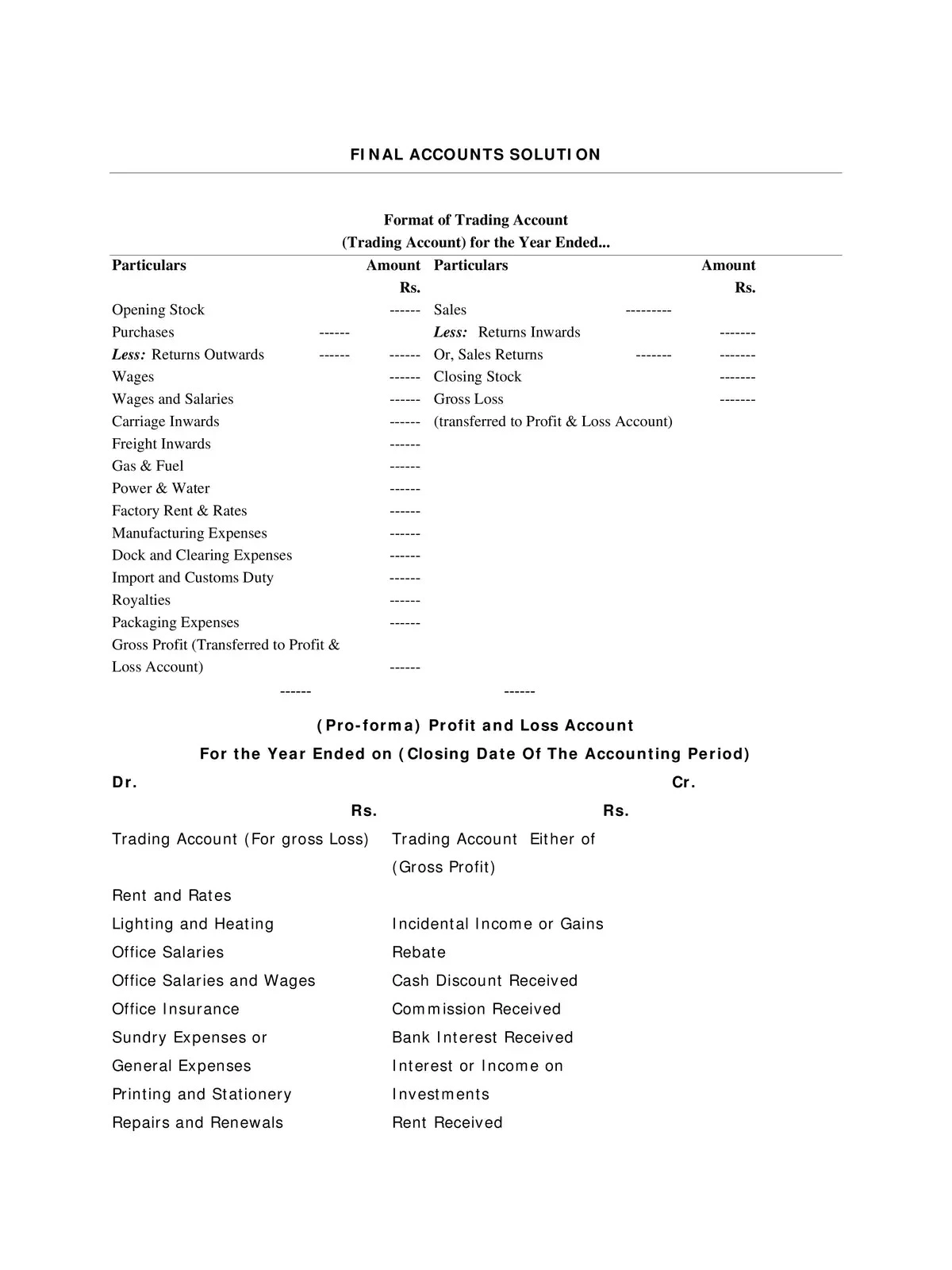

Performa of Final Accounts

Final Accounts are the accounts, which are prepared at the end of a fiscal year. It gives a precise idea of the financial position of the business/organization to the owners, management, or other interested parties. Financial statements are typically prepared through a series of steps that include journal entries, transferring data to a ledger, and finally, the creation of the final accounts.

Final Accounts Format Download

Usually, a final account includes the following components −

- Trading Account

- Manufacturing Account

- Profit and Loss Account

- Balance Sheet

Trading Account

Trading accounts represent the Gross Profit/Gross Loss of the concern out of sale and purchase for the particular accounting period.

Study of the Debit Side of Trading Account

- Opening Stock − Unsold closing stock of the last financial year appears on the debit side of the Trading Account as “To Opening Stock“ of the current financial year.

- Purchases − Total purchases (net of purchase return) including cash purchase and credit purchase of traded goods during the current financial year appeared as “To Purchases” in the debit side of the Trading Account.

- Direct Expenses − Expenses incurred to bring traded goods to business premises/warehouses are called direct expenses. Freight charges, cartage or carriage charges, custom and import duty in case of import, gas, electricity fuel, water, packing material, wages, and any other expenses incurred in this regard come under the debit side of the Trading Account and appeared as “To Particular Name of the Expenses”.

- Sales Account − Total Sales of the traded goods including cash and credit sales will appear in the outer column of the credit side of the Trading Account as “By Sales.” Sales should be on net releasable value excluding Central Sales Tax, VAT, Customs, and Excise Duty.

- Closing Stock − The total Value of the unsold stock of the current financial year is called closing stock and will appear on the credit side of the Trading Account.

- Closing Stock = Opening Stock + Net Purchases – Net Sale

- Gross Profit − Gross profit is the difference between revenue and the cost of providing services or making products. However, it is calculated before deducting payroll, taxation, overhead, and other interest payments. Gross Margin is used in US English and carries the same meaning as the Gross Profit.

- Gross Profit = Sales – Cost of Goods Sold

- Operating Profit − Operating profit is the difference in revenue and the costs generated by ordinary operations. However, it is calculated before deducting taxes, interest payments, investment gains/losses, and any other non-recurring items.

- Operating Profit = Gross Profit – Total Operating Expenses

- Net Profit − Net profit is the difference in total revenue and the total expenses of the company. It is also known as net income or net earnings.

It is a part of the final accounts of the entity. In other words, the trading account gives details of total sales, total purchases, and direct expenses relating to purchases and sales. The trading account format for the year contains Particulars, Amount, Dr., Cr., Purchases, Sales, etc.