EPF Withdrawal Form (Non-Aadhar)

Download EPF Withdrawal Form (Non-Aadhar) is also in Hindi Languages. The complete withdrawal of EPF while switching employers without remaining unemployed for two months or more (i.e. during the interim period between changing jobs), is against the PF rules and regulations and therefore is not allowed.

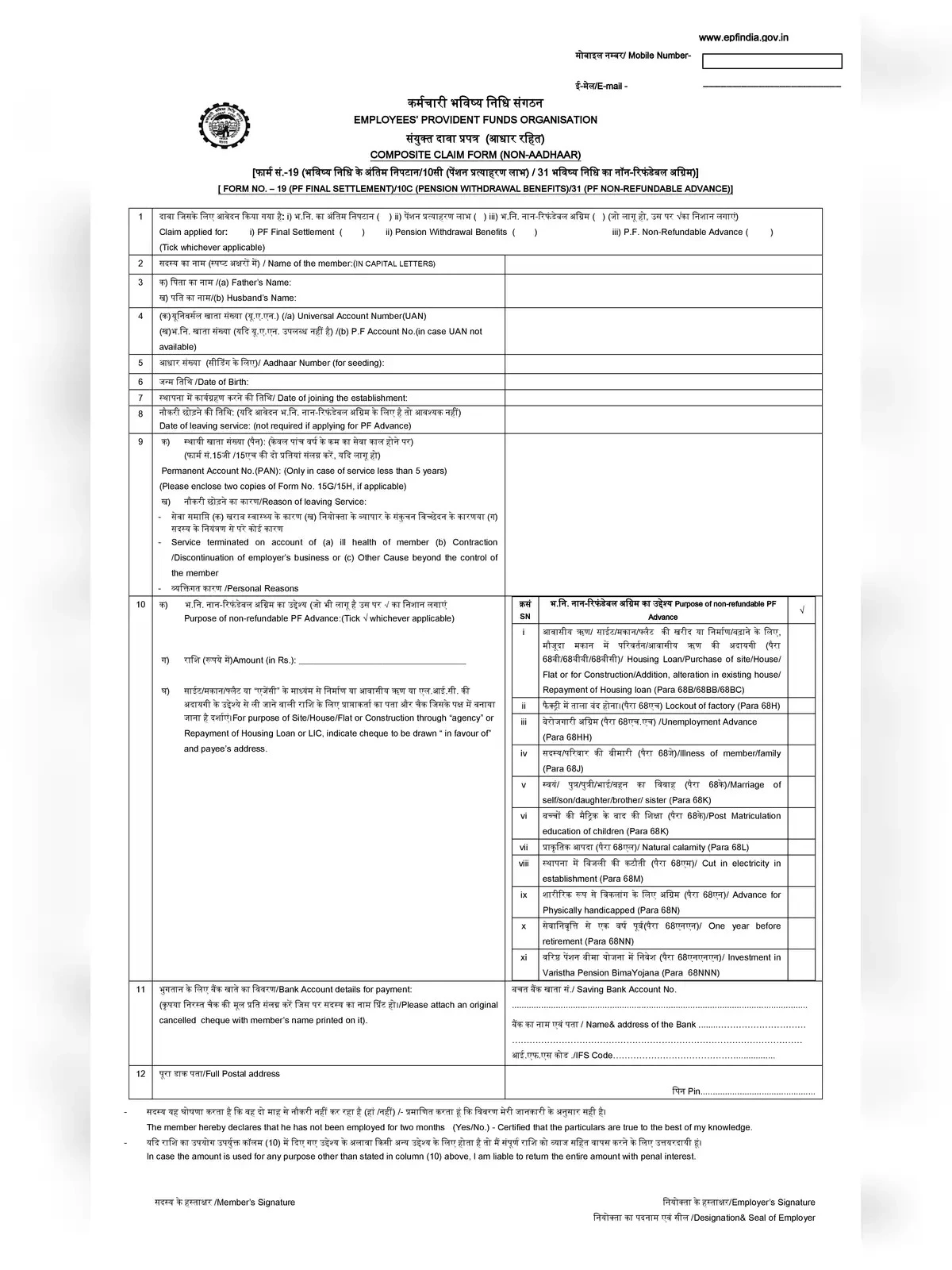

When applying for the withdrawal offline, you are required to fill out the Composite Claim Form which serves the purpose of three forms – Form 19 (For Final PF Settlement), Form 10C (For Pension Withdrawal) and Form 31 (For Part-withdrawal of PF amount).

Non Aadhar PF Form – Required Details

In this form you have to mentioned the following details:-

- Name in CAPITAL LETTERS

- Father’s Name: Kindly write clearly

- Husband’s Name: Kindly write clearly

- UAN: Kindly mention the 12-digit Universal Account Number

- PF Account Number

- Kindly mention 12 digits’ Aadhaar Number

- Date of Birth: In DD/MM/YYYY format

- Date of Joining the Establishment: In DD/MM/YYYY format.

- Date of leaving service: In DD/MM/YYYY format

- Permanent Account Number (PAN): In case of service less than 5 years

- Please submit two copies of Form 15G/15H

EPF can be completely withdrawn under any of the following circumstances:

- When an individual retires

- When an individual remains unemployed for more than two months. To make a withdrawal on this circumstance, the individuals must get an attestation of the same from a gazetted office.

Partial withdrawal of EPF can be made under certain circumstances and subject to certain prescribed conditions which have been discussed in brief below:

| Reasons | Limit | No. of years of service required |

|---|---|---|

| Medical purposes | Six times the monthly basic salary or the total employee’s share plus interest, whichever is lower | No criteria |

| Marriage | Up to 50% of employee’s share of contribution to EPF | 7 years |

| Education | Up to 50% of employee’s share of contribution to EPF | 7 years |

| Purchase of land or purchase/construction of a house | For land – Up to 24 times of monthly basic salary plus dearness allowance, For house – Up to 36 times of monthly basic salary plus dearness allowance, Above limits are restricted to the total cost | 5 years |

| Home loan repayment | Least of below:

| 10 years |

| House renovation | Least of the below: Up to 12 times the monthly wages and dearness allowance, or Employees contribution with interest, or Total cost | 5 years |

| Partial withdrawal before retirement | Up to 90% of accumulated balance with interest | Once the employee reaches 54 years and withdrawal should be within one year of retirement/superannuation |

Other conditions for EPF Withdrawal

Medical Purposes: Medical treatment of self, spouse, children, or parents

Marriage: For the marriage of self, son/daughter, and brother/sister

Education: Either for account holder’s education or child’s education (post matriculation)

Purchase of land or purchase / construction of a house:

i. The asset, i.e. land or the house should be in the name of the employee or jointly with the spouse.

ii. It can be withdrawn just once for this purpose during the entire service.

iii. The construction should begin within 6 months and must be completed within 12 months from the last withdrawn instalment.

Home loan repayment:

i. The property should be registered in the name of the employee or spouse or jointly with the spouse.

ii. Withdrawal permitted subject to furnishing of requisite documents as stated by the EPFO relating to the housing loan availed.

iii. The accumulation in the member’s PF account (or together with the spouse), including the interest, has to be more than Rs 20,000.

House renovation:

i. The property should be registered in the name of the employee or spouse or jointly held with the spouse.

ii. The facility can be availed twice:

a. After 5 years of the completion of the house

b. After the 10 years of the completion of the house