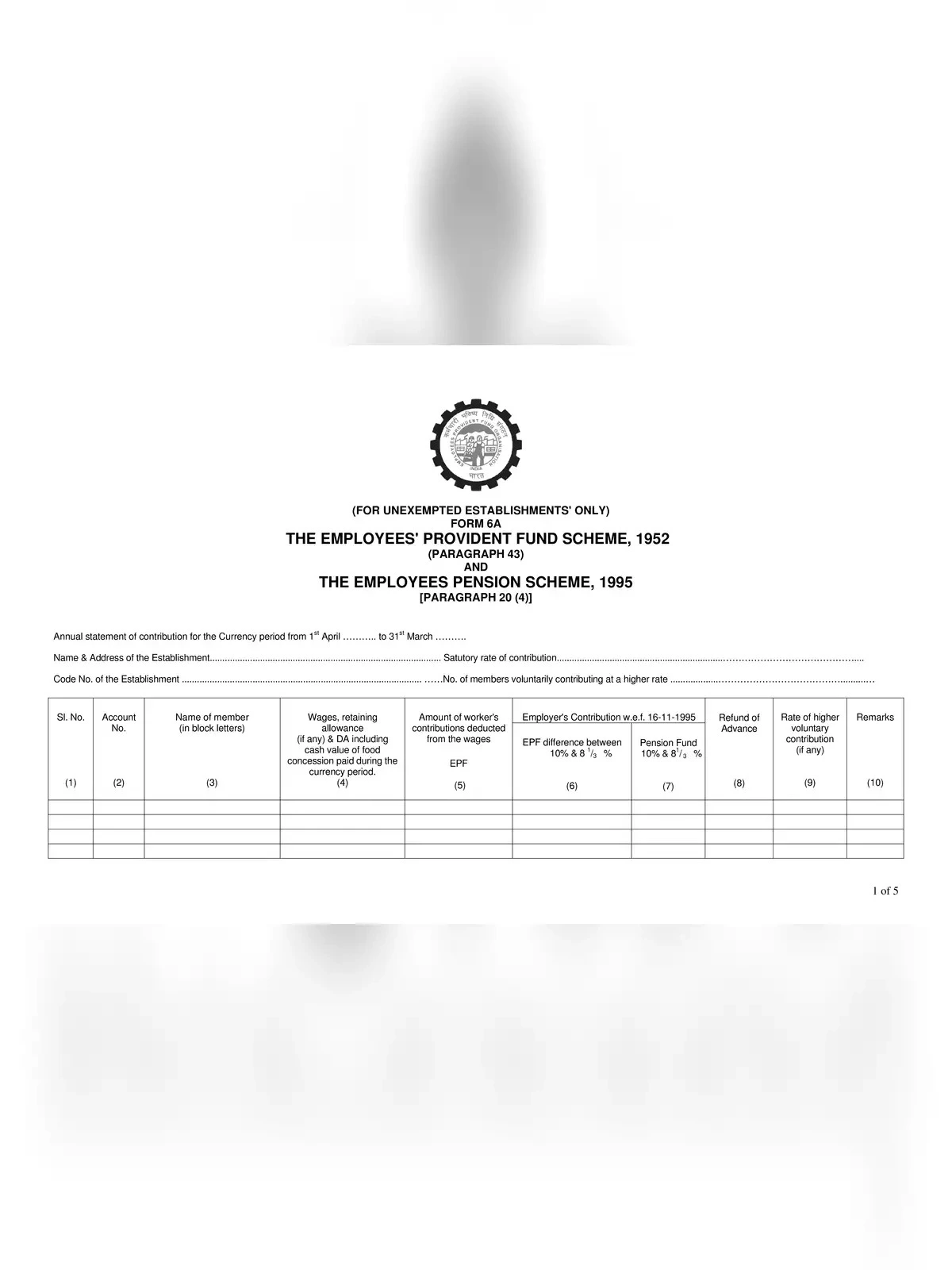

EPF Return Form 3A/6A

EPF Form 6A is a return form used by employers to provide details of the employees’ contributions to the Employees’ Provident Fund (EPF). The EPF is a social security scheme in India that aims to provide financial security and retirement benefits to eligible employees.

Consolidated Annual Contribution Statement: This form provides the annual contributions of each member of the establishment. A vital form for compiling the annual Provident Fund statement of a subscriber. To be submitted by 30th April.

EPF Return Form 6A (Required Details)

- Name & Address of the Establishment

- Statutory rate of contribution

- Code No. of the Establishment

- No. of members voluntarily contributing at a higher rate

- Signature of Employer

- Sl. No.

- Account No

- Name of member

- Wages, retaining allowance (if any) & DA including cash value of food concession paid during the currency period.

- Amount of worker’s contributions deducted from the wages EPF

- Refund of Advance

- Rate of higher voluntary contribution (if any)

- Remarks