Direct Tax Vivad Se Vishwas Scheme 2024 Notification

In order to facilitate the various queries raised by the stakeholders following the enactment of the Direct Tax Vivad Se Vishwas (DTVSV) Scheme, 2024, the Central Board of Direct Taxes (CBDT) has today issued a Guidance Note in the form of Frequently Asked Questions (FAQs). This note is designed to provide clarity and assist taxpayers in better understanding the provisions of the Scheme.

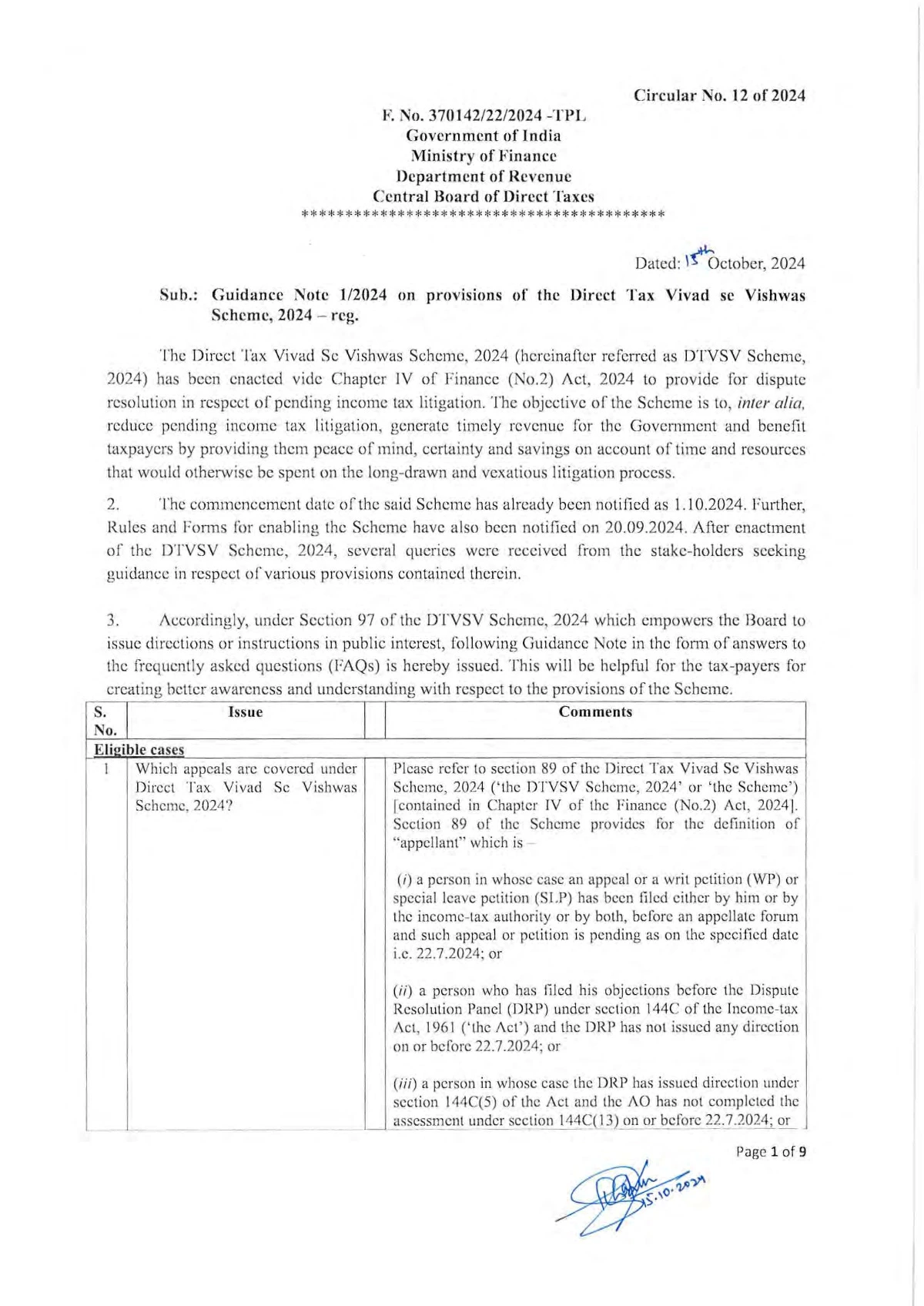

The Direct Tax Vivad Se Vishwas (DTVSV) Scheme, 2024, was announced in the Union Budget 2024-25 by the Union Finance Minister to resolve pending income tax disputes. The scheme was enacted through the Finance (No. 2) Act, 2024. Additionally, the corresponding Rules and Forms for implementing the Scheme were notified on September 20, 2024.

For detailed provisions of the DTVSV Scheme, 2024, sections 88 to 99 of the Finance (No. 2) Act, 2024, may be referred along with the Direct Tax Vivad Se Vishwas Rules, 2024.

Direct Tax Vivad se Vishwas Scheme, 2024 Overview

(DTVsV Scheme, 2024)is a scheme notified by the Government of India on 20th September, 2024 to resolve pending appeals in case of income tax disputes. The DTVsV Scheme, 2024 was enacted vide Finance (No. 2) Act, 2024. The said scheme shall come into effect from 01.10.2024. The rules and forms for enabling the scheme have been notified vide Notification No. 104/2024 dated 20.09.2024. Four separate Forms have been notified for the purposes of the Scheme. These are as follows:

- Form-1: Form for filing declaration and Undertaking by the declarant

- Form-2: Form for Certificate to be issued by Designated Authority

- Form-3: Form for Intimation of payment by the declarant

- Form-4: Order for Full and Final Settlement of tax arrears by Designated Authority