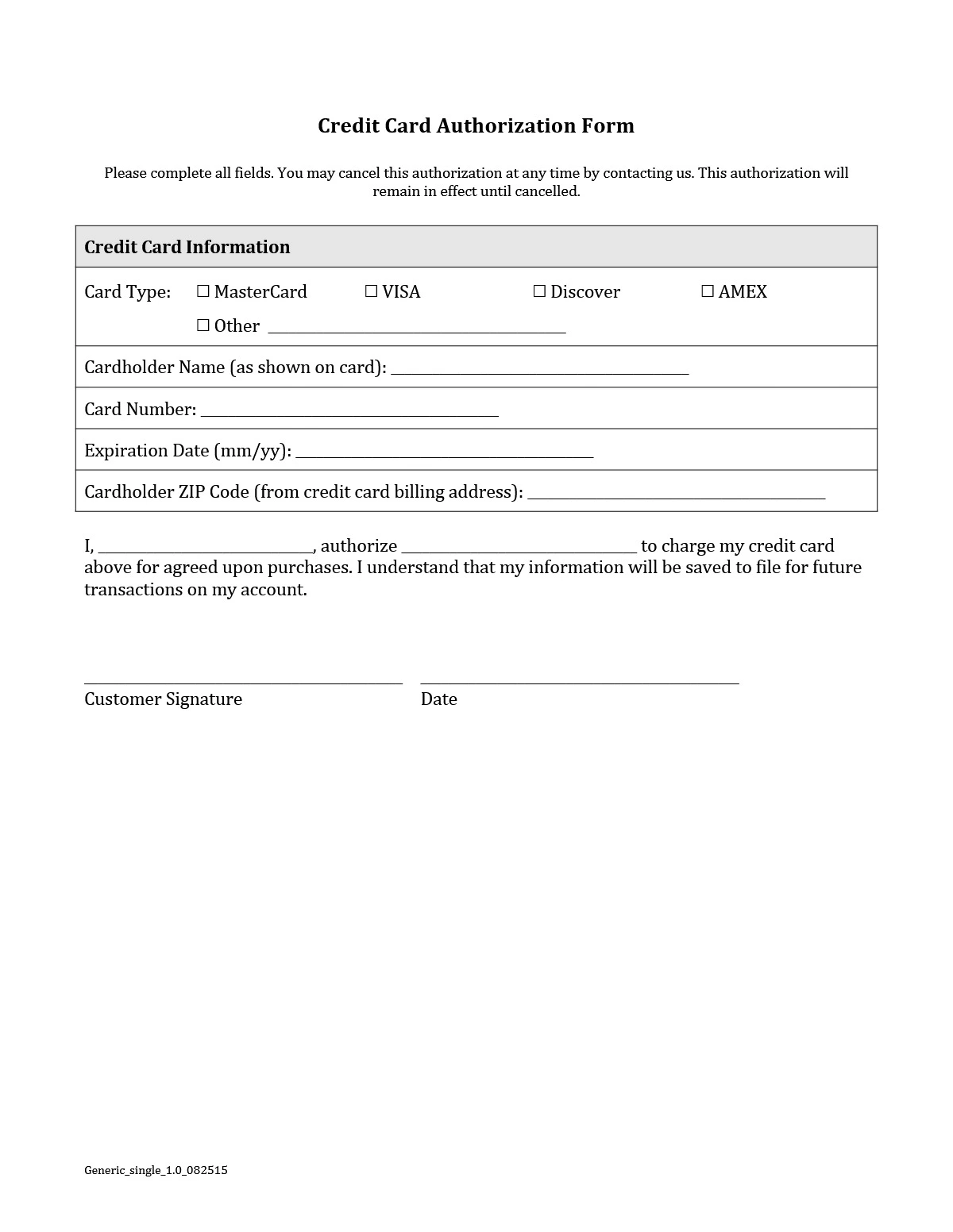

Credit Card Authorization Form

A credit card authorization form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for recurring payments during a period of time as written in that document. The form is often used to give businesses the ongoing authority to charge the cardholder on a recurring basis — whether that’s monthly, quarterly, or more sporadically.

Do credit card authorization forms help prevent chargeback abuse?

Chargebacks protect consumers from unauthorized transactions. They occur when a customer disputes a charge from your business and asks the card issuer to reverse it.

But chargebacks can cause major issues for businesses, in large part because disputed funds are held from the business until the card issuer decides what to do. Chargebacks are also time consuming for businesses and involve a lot of paperwork.

A credit card authorization form is one way to protect yourself against chargebacks. If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated.