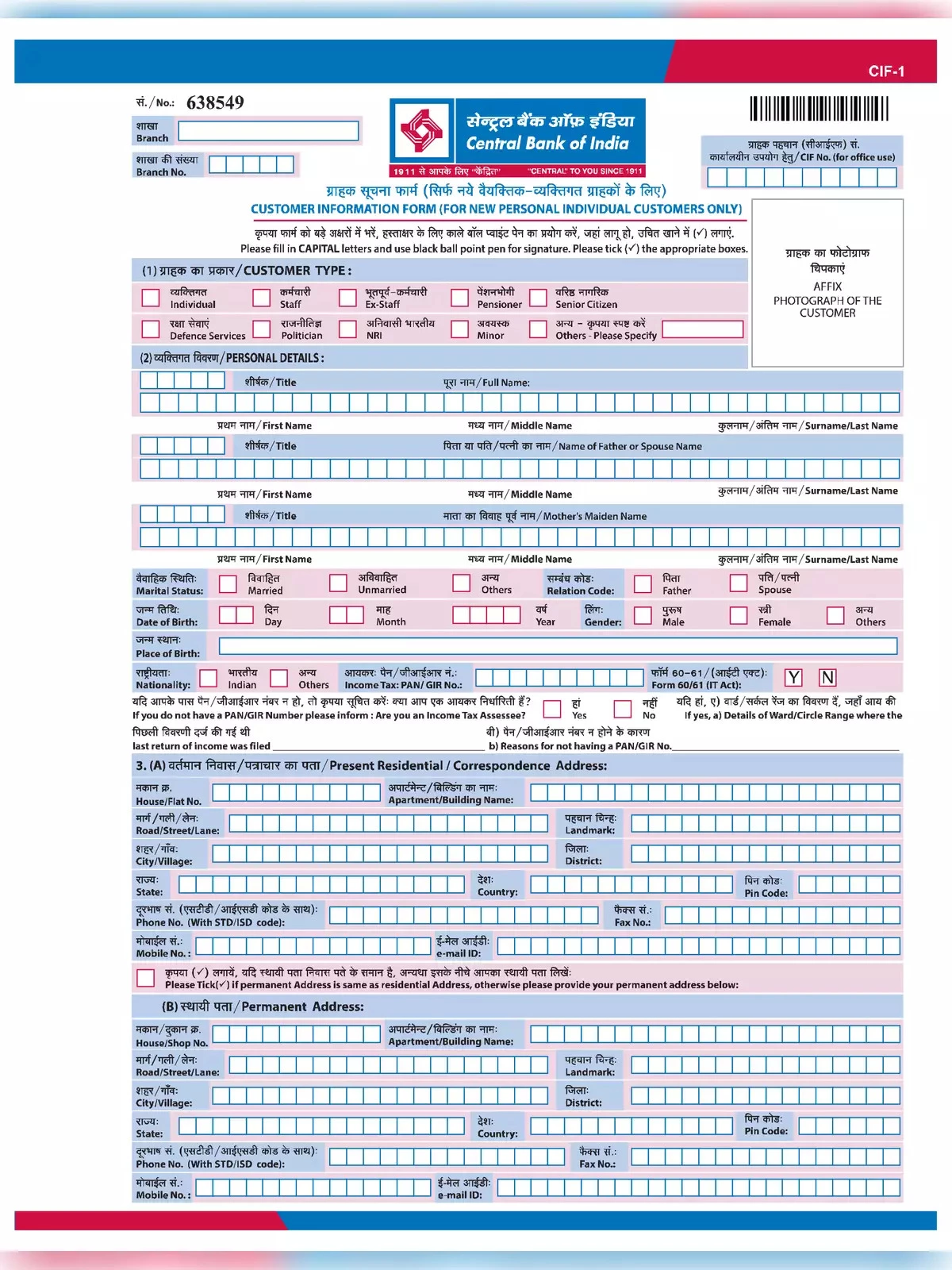

Central Bank of India Account Opening Form 2026

For people who want to open a savings account in the Central Bank of India (CBI), this form can be used by properly filing the form and submit to the nearest branch of CBI along with the necessary documents.

How to Open a Bank Account in the Central Bank of India (CBI)

- Visit a Central Bank of India branch: Locate the nearest branch of Central Bank of India and visit during working hours.

- Collect the account opening form: Approach one of the bank officials and request an account opening form. They will provide you with the necessary form to fill out.

- Fill out the form: Carefully fill out the account opening form with accurate information. Here are some common details you’ll need to provide:

- Personal details: Full name, date of birth, gender, occupation, marital status, etc.

- Contact information: Residential address, email address, mobile number, etc.

- Identification details: Aadhaar card number, PAN card number, passport number, voter ID, etc.

- Nominee details: Name, relationship, address, etc. (if applicable)

- Account type: Savings account, current account, fixed deposit, etc.

- Attach required documents: Along with the filled-out form, you’ll need to submit certain documents as proof of identity, address, and other relevant information. Here’s a list of commonly required documents:

- Proof of identity (anyone): Aadhaar card, PAN card, passport, voter ID, driving license, etc.

- Proof of address (anyone): Aadhaar card, passport, utility bills (electricity bill, water bill, gas bill), rental agreement, bank statement, etc.

- Passport-size photographs: You may need to affix passport-size photographs on the account opening form.

- PAN card: It is mandatory to provide a PAN card or submit Form 60/61 if you don’t have a PAN card.

- Additional documents: Depending on the type of account and specific requirements, additional documents may be needed.

- Submit the form and documents: Once you have filled out the form and attached the required documents, submit them to the bank official at the branch.

- Verification and processing: The bank will verify the information provided and process your account opening request. This may take a few days, depending on the bank’s procedures.

- Receive account details: Once your account is opened successfully, you will receive your account details, including the account number, through SMS or email. You may also receive a passbook or cheque book, if applicable.

Documents Required for Opening Bank Account in CBI Bank

- Proof of identity (anyone): Aadhaar card, PAN card, passport, voter ID, driving license, etc.

- Proof of address (anyone): Aadhaar card, passport, utility bills (electricity bill, water bill, gas bill), rental agreement, bank statement, etc.

- Passport-size photographs: You may need to affix passport-size photographs on the account opening form.

- PAN card: It is mandatory to provide a PAN card or submit Form 60/61 if you don’t have a PAN card.

Minimum Balance in CBI Savings Account

The account holder is expected to maintain a minimum quarterly balance of

- Rs. 2,000 in metro/urban branches,

- Rs. 1,000 in semi-urban branches, and

- Rs. 500 in rural branches.