Business Loan Documents List

While every loan program has specific forms you need to fill out and documents you need to submit, you will likely need to submit much of the same information for different loan packages. Before you start applying for loans, you should get some basic documentation together.

Business Loan Documents Checklist

| Document | Description |

|---|---|

| Business Plan | A detailed plan outlining your business goals, strategies, and financial projections. |

| Financial Statements | Income statements, balance sheets, and cash flow statements for the past few years. |

| Business Tax Returns | Copies of your business tax returns for the past few years. |

| Personal Tax Returns | Copies of personal tax returns for the business owner(s) for the past few years. |

| Bank Statements | Recent bank statements for your business accounts. |

| Legal Documents | Business licenses, registrations, contracts, and any other legal documents related to your business. |

| Collateral Documentation | Documents related to any collateral you are offering to secure the loan. |

| Business Debt Schedule | A list of all outstanding debts your business currently owes. |

| Personal Identification | Government-issued IDs for the business owner(s). |

तुम्हाला हे माहित असणे आवश्यक आहे

आपल्या व्यवसाय वाढीच्या कर्ज अर्जासह पुढील कागदपत्रे आवश्यक आहेत:

- पॅन कार्ड – कंपनी / फर्म / वैयक्तिक साठी

- ओळख पुरावा म्हणून खालीलपैकी कोणत्याही कागदपत्रांची प्रत:

- आधार कार्ड

- पासपोर्ट

- मतदार ओळखपत्र

- पॅन कार्ड

- चालक परवाना

- पत्त्याचा पुरावा म्हणून खालीलपैकी कोणत्याही कागदपत्रांची प्रत:

- आधार कार्ड

- पासपोर्ट

- मतदार ओळखपत्र

- चालक परवाना

- मागील 6 महिन्यांचे बँक स्टेटमेंट

- CA सर्टिफाइड / ऑडिट झाल्यानंतर मागील 2 वर्षांच्या उत्पन्नाची गणना, बॅलन्स शीट आणि नफा व तोटा खाते यांच्यासह नवीनतम आयटीआर

- सुरू ठेवल्याचा पुरावा (आयटीआर / व्यापार परवाना / स्थापना / विक्री कर प्रमाणपत्र)

- इतर अनिवार्य कागदपत्रे [एकमेव मालकी, भागीदारी कराराची घोषणा किंवा प्रमाणित प्रत, ‘मेमोरँडम अँड आर्टिकल्स ऑफ असोसिएशन’ ची प्रमाणित खरी प्रत (संचालकांद्वारे प्रमाणित) आणि बोर्ड ठराव (मूळप्रत)]

Home Loan Documens List SBI

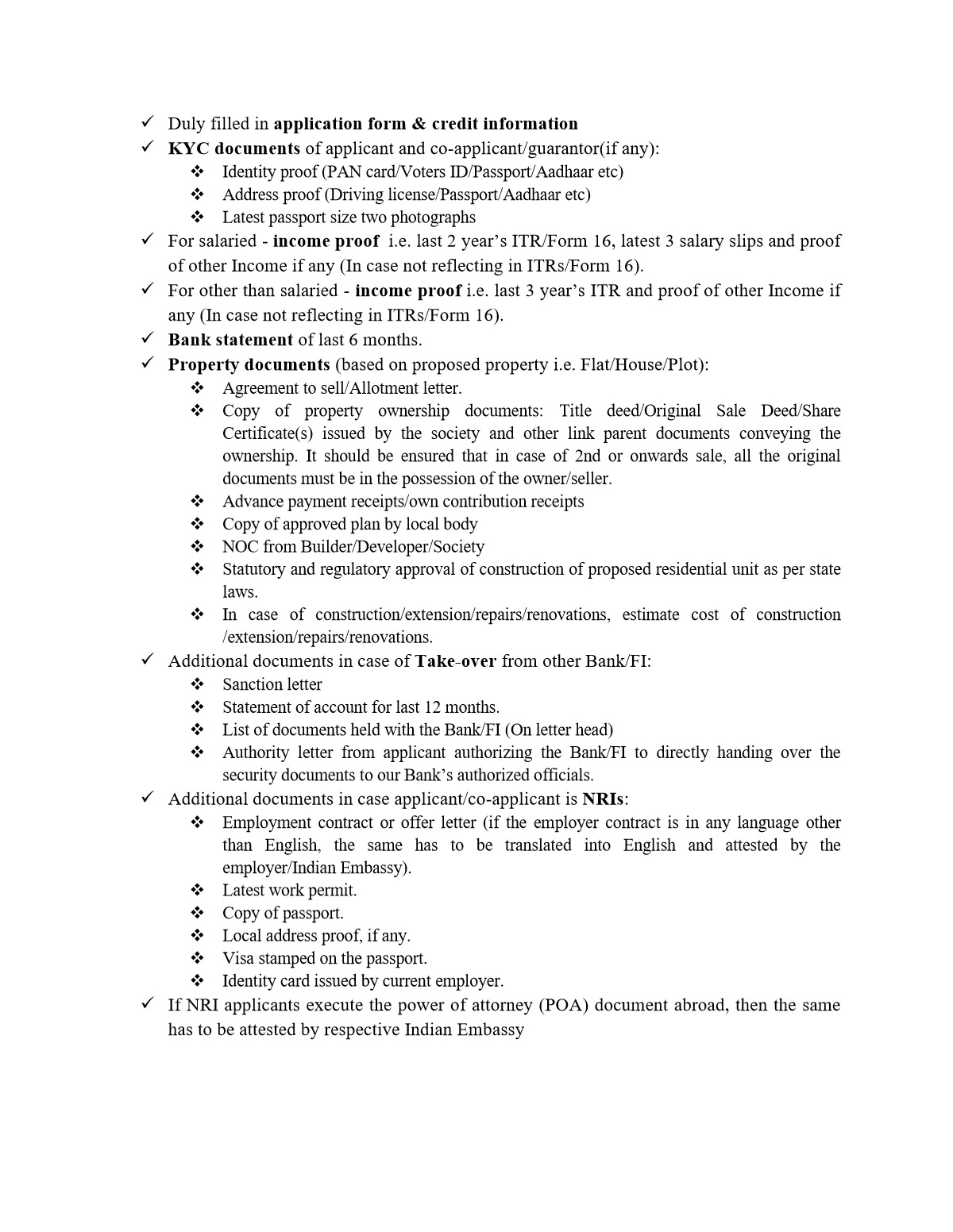

List of papers/ documents applicable to all applicants:

- Employer Identity Card

- Loan Application: Completed loan application form duly filled in affixed with 3 Passport size photographs

- Proof of Identity (Any one): PAN/ Passport/ Driver’s License/ Voter ID card

- Proof of Residence/ Address (Any one): Recent copy of Telephone Bill/ Electricity Bill/Water Bill/ Piped Gas Bill or copy of Passport/ Driving License/ Aadhar Card

Property Papers:

- Permission for construction (where applicable)

- Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for Sale

- Occupancy Certificate (in case of ready to move property)

- Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, Property Tax Receipt

- Approved Plan copy (Xerox Blueprint) & Registered Development Agreement of the builder, Conveyance Deed (For New Property)

- Payment Receipts or bank A/C statement showing all the payments made to Builder/Seller

Account Statement:

- Last 6 months Bank Account Statements for all Bank Accounts held by the applicant/s

- If any previous loan from other Banks/Lenders, then Loan A/C statement for last 1 year

Income Proof for Salaried Applicant/ Co-applicant/ Guarantor:

- Salary Slip or Salary Certificate of last 3 months

- Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years, acknowledged by IT Dept.

Income Proof for Non-Salaried Applicant/ Co-applicant/ Guarantor:

- Business address proof

- IT returns for last 3 years

- Balance Sheet & Profit & Loss A/c for last 3 years

- Business License Details(or equivalent)

- TDS Certificate (Form 16A, if applicable)

- Certificate of qualification (for C.A./ Doctor and other professionals)