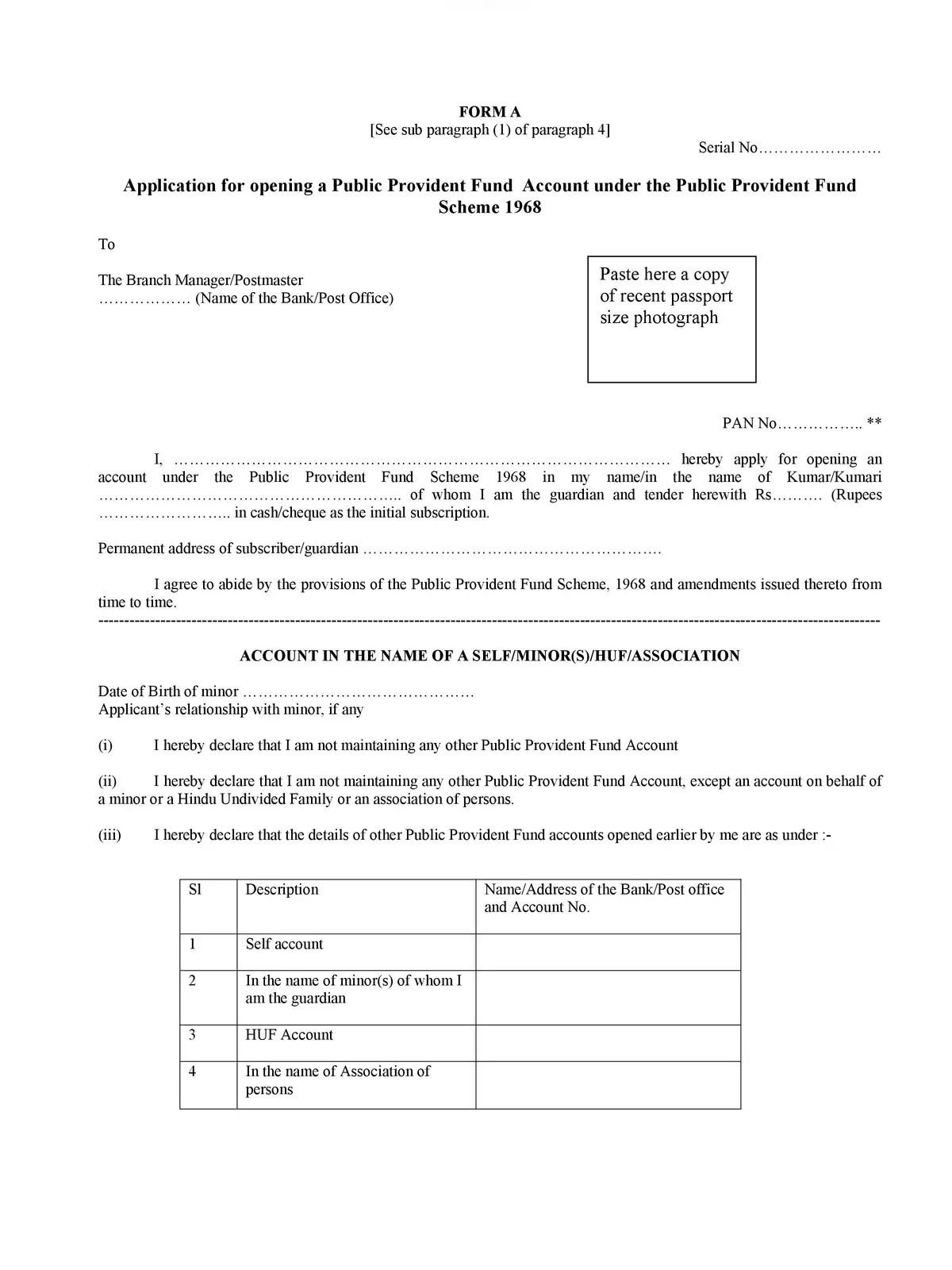

Bank of Baroda PPF Deposit Form

Public Provident Fund (PPF) deposit form is essential for anyone looking to save through this popular long-term investment scheme backed by the Government of India. The PPF scheme not only offers safety but also provides attractive interest rates and returns that are completely tax-exempt. Bank of Baroda facilitates the Public Provident Fund scheme across all its branches in India, making it convenient for investors everywhere.

Key Benefits of PPF

- An individual can open an account or an individual can open it on behalf of a minor or a person of unsound mind for whom they are the guardian. However, only one account can be opened in the name of a minor or a person of unsound mind by any guardian.

- Joint accounts are not permitted under this scheme.

- The minimum deposit is Rs. 500 per financial year, with a maximum limit of Rs. 1,50,000, which can be contributed in multiples of Rs. 50.

- Deposits can be made in a lump sum or in installments throughout the year.

- No income tax is charged on interest income earned.

- PPF accounts can be transferred to and from any Bank/Branch or Post Office.

- A loan facility against the PPF account is available after one year has passed from the end of the year in which the initial subscription was made.

- Partial withdrawals of up to 50% can be made any time after the account has been active for 5 years.

- Nomination facility is available for account holders.

- You can extend your account for more blocks of 5 years after maturity.

- Tax rebate is available under Section 80C.

Eligibility

Anyone who is an adult can open a PPF account in their name or on behalf of a minor or a person of unsound mind for whom they serve as the guardian. However, HUF and NRIs are not eligible to open a PPF account.

Minimum Deposit

A minimum deposit of Rs. 500 per annum is required. If no deposits are made for any reason, the account is treated as discontinued and cannot be closed before maturity. To reactivate a discontinued account, you need to pay the minimum deposit of Rs. 500 along with a default fee of Rs. 50 for each year of default.

Maximum Deposit

The maximum deposit allowed is Rs. 1.5 Lacs per annum. Deposits can be made either in one lump sum or in installments.

Maturity Period

The total maturity period for a PPF account is 15 years. After this period, the account can be extended for another 5 years at a time.

Interest Rate

- The interest rate is decided by the Government and is reviewed from time to time.

- The interest rate for the period from 01.01.2021 to 31.03.2021 was 7.1% per annum.

- Interest is compounded annually.

- Monthly interest is calculated on the minimum balance from the 5th of the month to the end of that month.

- If a cheque is drawn on another bank, the deposit date is considered the date of cheque realization.

You can easily download the Bank of Baroda PPF Deposit Form in PDF format using the link below.