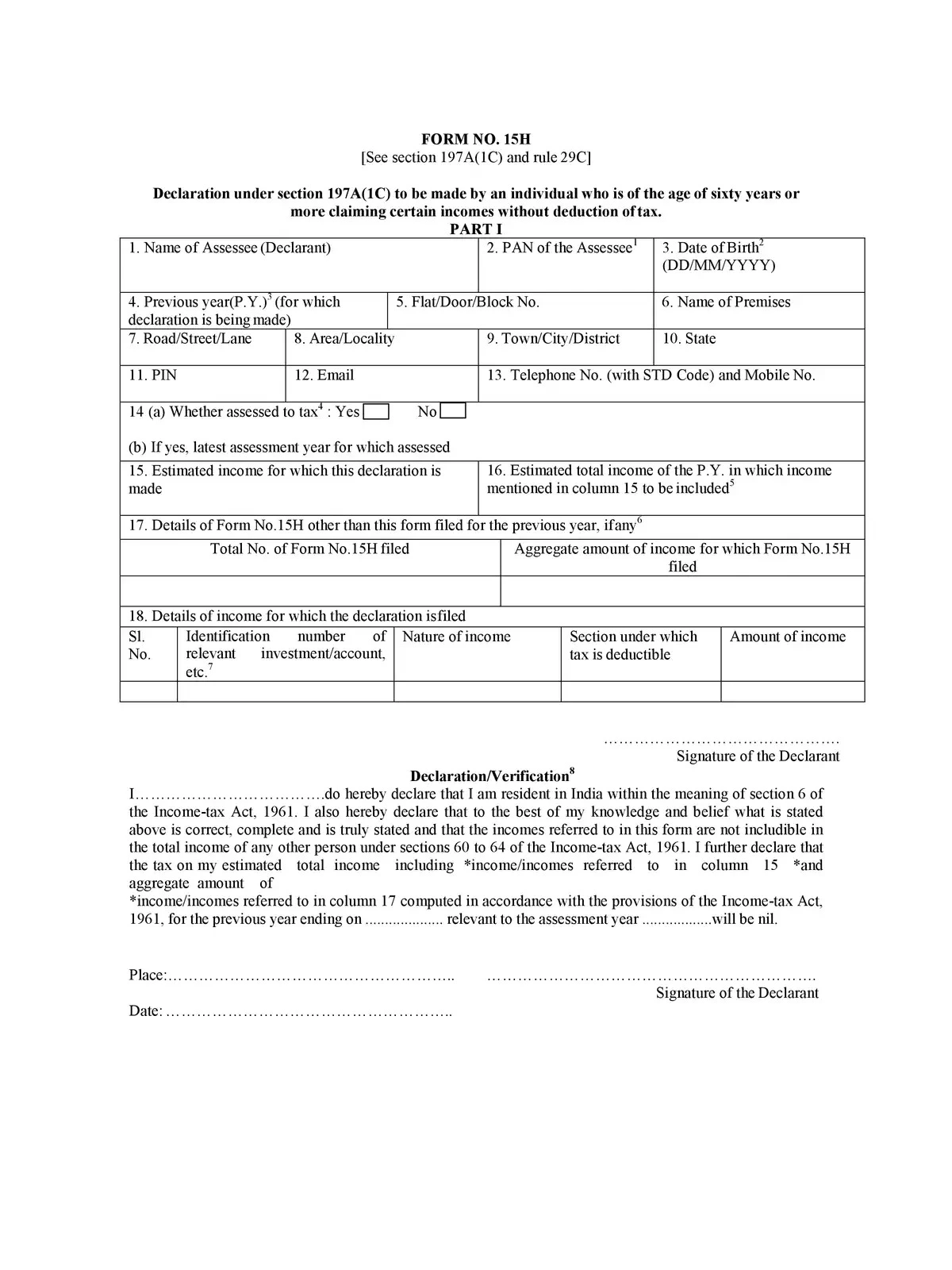

Bank of Baroda 15H Form

Form 15H is a self-declaration form that assists individuals over 60 years of age in saving Tax Deducted at Source (TDS) on the interest income earned from their fixed deposits. By submitting this form to their bank, the assessee can request no deduction or a lower deduction of TDS on their fixed deposits.

Essential Information for Bank of Baroda 15H Form

This form requires several mandatory details that must be filled accurately to ensure a smooth process.

Mandatory Details for Bank of Baroda 15H Form

- Name of Assessee (Declarant)

- PAN of the Assessee

- Date of Birth

- Previous year (P.Y.) for which declaration is being made

- Flat/Door/Block No.

- Name of Premises

- Road/Street/Lane

- Area/Locality

- Town/City/District

- State

- PIN

- Telephone No. (with STD Code) and Mobile No.

- Estimated income for which this declaration is made

- Estimated total income of the P.Y. in which the income mentioned in column 15 is to be included

- Details of any other Form No. 15H filed for the previous year

- Details of income for which the declaration is submitted

- Signature of the Declarant

You can easily download the Bank of Baroda 15H Form in PDF format using the link provided below. This will help you complete your tax-saving plans conveniently! 📝