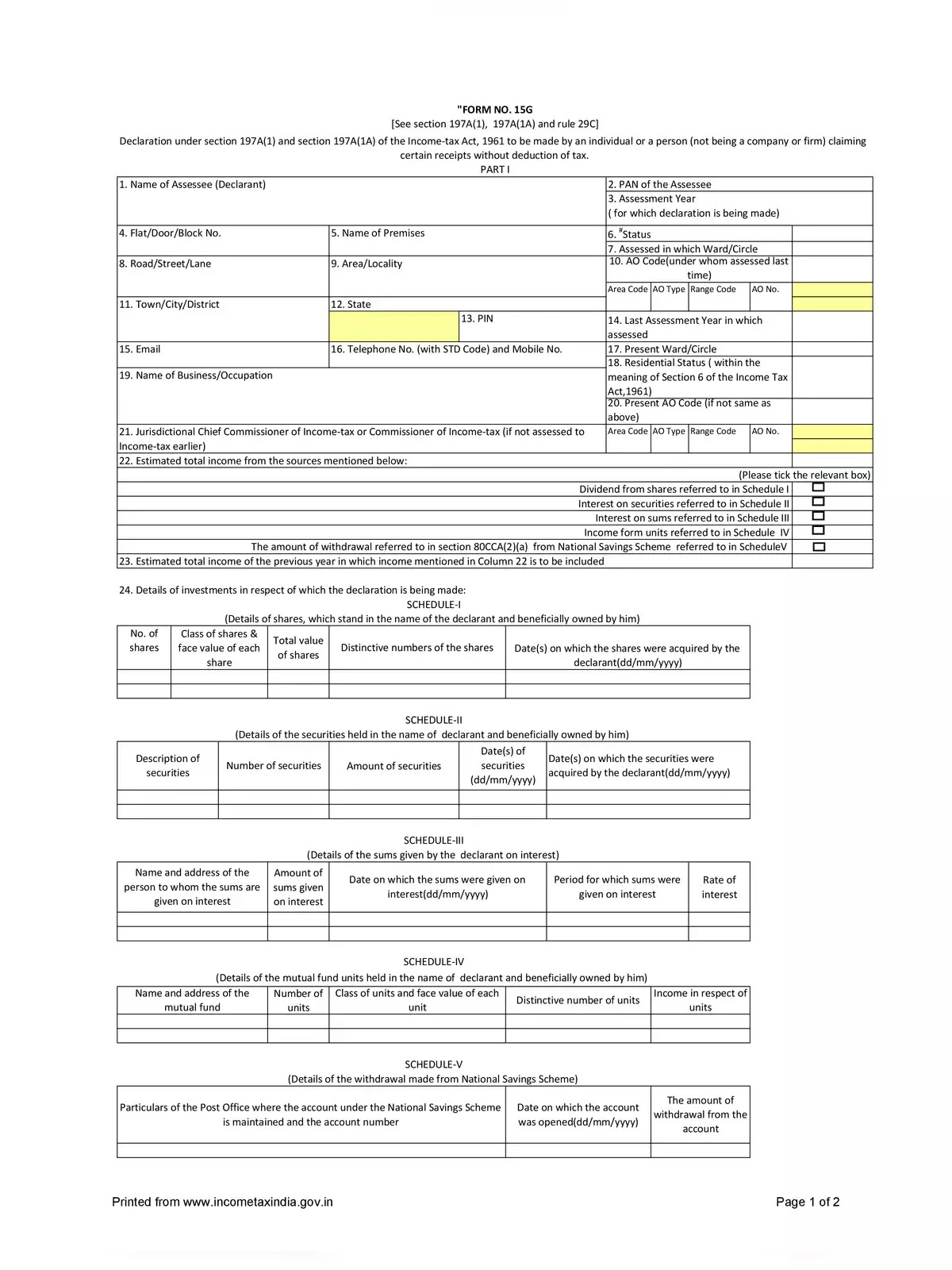

Bank of Baroda 15G Form

Form 15G is an important declaration that can be filled out by individuals under 60 years of age and Hindu Undivided Families (HUF) who hold bank fixed deposits. This form helps ensure that no TDS (tax deduction at source) is deducted from their interest income for the financial year.

Form No. 15G or 15H are self-declaration forms that individuals can use to state that their income is below the taxable limit, meaning no TDS should be deducted from it.

Essential Fields for Bank of Baroda 15G Form

- Name of Assessee (Declarant)

- PAN of the Assessee

- Assessment Year (for which declaration is being made)

- Flat/Door/Block No.

- Name of Premises

- Status

- Assessed in which Ward/Circle

- Road/Street/Lane

- Area/Locality

- AO Code (under whom assessed last time)

- Town/City/District

- State

- PIN

- Last Assessment Year in which assessed

- Name of Business/Occupation

- Telephone No. (with STD Code) and Mobile No

- Present Ward/Circle

- Present AO Code (if not same as above)

- Residential Status (within the meaning of Section 6 of the Income Tax Act, 1961)

- Jurisdictional Chief Commissioner of Income‐tax or Commissioner of Income‐tax (if not assessed to Income‐tax earlier)

- Estimated total income from the sources mentioned

- Estimated total income of the previous year in which income mentioned in Column 22 is to be included

- Details of investments in respect of which the declaration is being made

- Signature of the Declarant

You can easily download the Bank of Baroda 15G Form in PDF format from the link provided below. Make sure to complete the form and submit it to avoid TDS deductions. 🌟