Axis Bank DD Form – How to Fill Up

A Demand Draft or DD is a prepaid instrument in which the mentioned amount is offered by the financial institution instead of the distinct drawer’s account. It is drawn on in the name of the bank by a person who wishes to make transfer payment form one bank account to another bank account. Individuals who do not have a bank account can also get a DD made by giving cash.

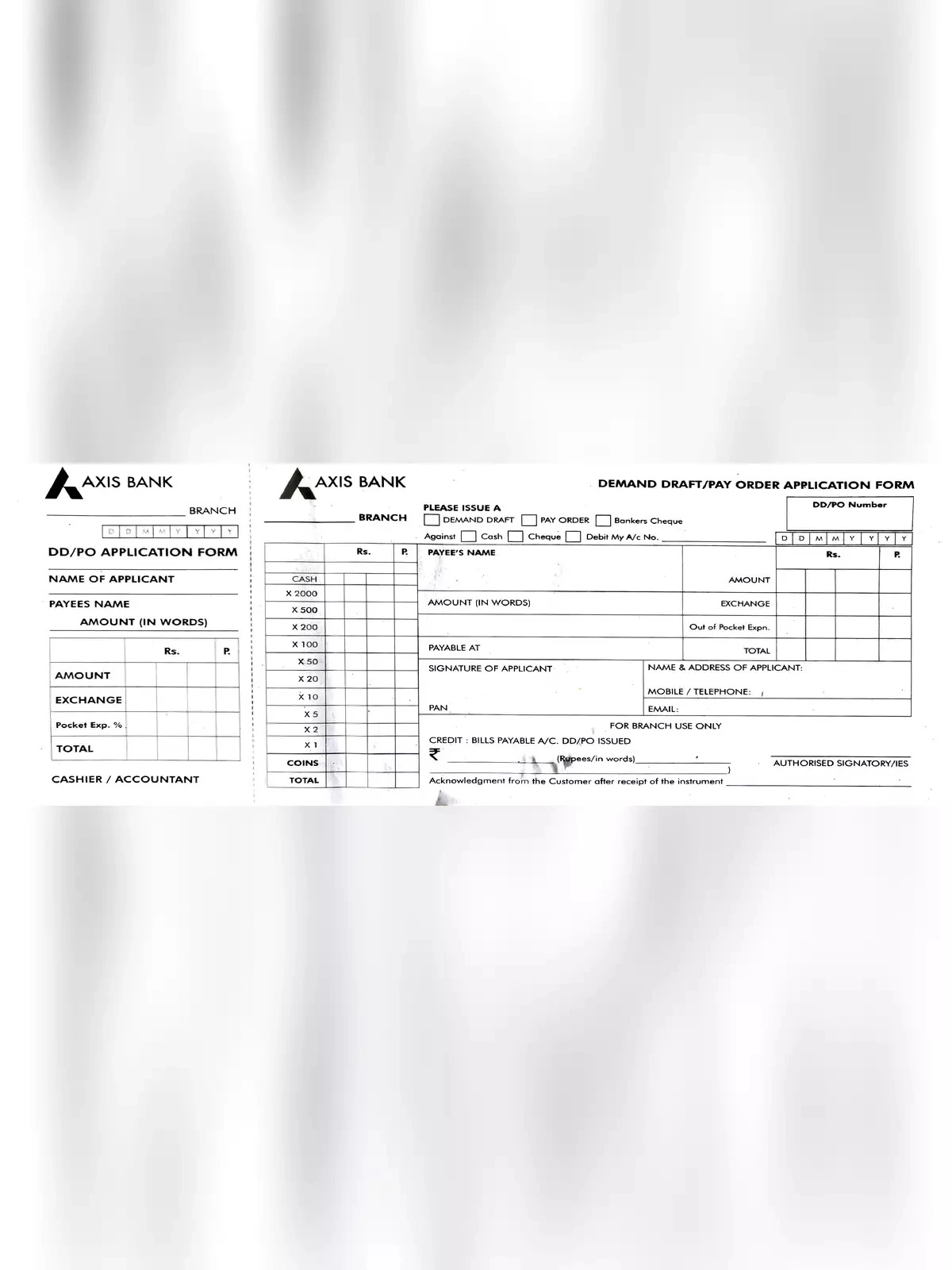

Axis Bank DD Form (Required Details)

- Payee’s Name

- Branch Name

- Payable Location

- Amount

- Cash details in case when DD are made on cash

- Cheque details in case when DD are made on cheque

- And any other details

It is important to know that, both cheque and DD are considered to make payments. However, a cheque can be termed as a “Bill of Exchange” issued on a definite banker and not mentioned to be payable elsewhere if not demanded. On the other hand, Demand Draft can be called as a prepaid “Traversable Tool”, where the drawee bank behaves as a guarantor for making the complete payment whenever the tool is presented.

Demand Draft Types

There are two prominent types of Demand Drafts which are usually preferred by customers. These are:

- Sight Demand Draft: This version of demand draft is considered payable right after the presentation of certain documents. In case, the receiver isn’t successful in providing the specified documents, then he/she won’t be allowed to take out the

- Time Demand Draft– This type of demand draft is billed right after a specified time. Always remember that, before this duration the Demand Draft isn’t allowed to be billed from the bank.