Axis Bank RTGS Form 2025

Axis Bank RTGS Form: Money transferring has become a lot easier with technology becoming a major part of our day to day lives. Real-time gross settlement systems (RTGS) is a funds transfer system where money transfer takes place from one bank to another on a “real time” basis and “gross” basis.

Axis Bank RTGS Form – Overview

| Type of Form | Axis Bank RTGS/NEFT Application Form |

| Name of Bank | Axis Bank |

| Official Website | https://www.axisbank.com/ |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | The minimum limit is Rs. 2 lakhs for RTGS, No minimum limit for NEFT |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

| Form Language | English, Hindi |

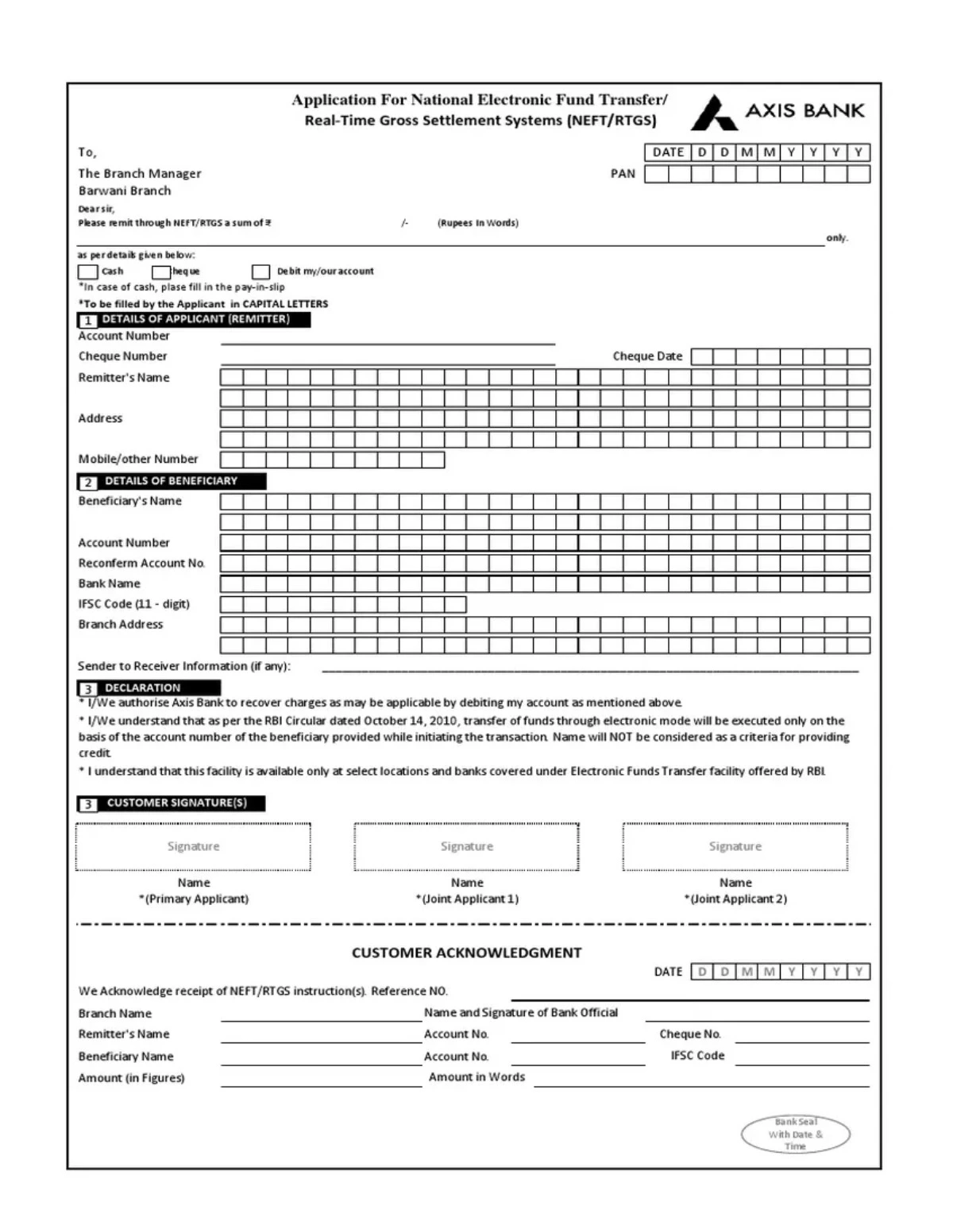

Details to be Mentioned in Axis Bank RTGS Form

- Sender Details: This section requires you to fill in your personal details such as your name, address, contact number, and account number from which the funds will be debited.

- Recipient Details: Here, you’ll provide details about the recipient, including their name, address, contact number, and account number to which the funds will be credited. You’ll also need to provide the IFSC (Indian Financial System Code) of the recipient’s bank branch.

- Amount to be Transferred: Specify the amount you wish to transfer in figures and words.

- Purpose of Remittance: You might be asked to mention the reason for the transfer, such as payment for goods/services, loan repayment, etc.

- Date of Transfer: You’ll indicate the date on which you want the transfer to take place. For RTGS transactions, funds are transferred in real-time, so the date specified is usually the current date.

- Charges: RTGS transactions typically involve charges, which could be borne either by the sender, the recipient, or shared. This section clarifies who will bear the charges.

- Authorization: Signatures of the sender are usually required to authorize the transaction.

- Declaration: You may need to declare that the information provided is accurate and that you understand the terms and conditions of the RTGS transaction.

Axis Bank NEFT/RTGS Charges

The charges for Axis Bank’s NEFT and RTGS services are shown below in the Table,

| NEFT Outward | Outward Up to Rs. 10,000/- | Rs.2.50/- per transaction |

| Rs. 10001 to Rs 1 Lakh | Rs. 5/- per transaction | |

| Rs 1 Lakh to Rs 2 lakh | Rs. 15/- per transaction | |

| Above Rs.2 Lakh | Rs.25/- per transaction | |

| RTGS Outward | Outward Rs.2 Lakh to Rs.5 Lakh | Rs.25/- per transaction |

| Rs.5 Lakh & Above | Rs.50/- per transaction |